Get the free Conestoga Bank SBA Loan Application

Show details

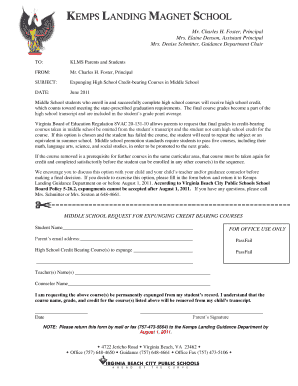

Conestoga Bank SBA Loan Application COMPANY INFORMATION Company name Address City State Zip Principal in charge Phone Fax Secondary contact person Phone Fax (HOUSE CONTROLLER OR BOOKKEEPER) Type of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign conestoga bank sba loan

Edit your conestoga bank sba loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your conestoga bank sba loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit conestoga bank sba loan online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit conestoga bank sba loan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out conestoga bank sba loan

How to fill out Conestoga Bank SBA Loan:

01

Visit Conestoga Bank's website or branch: Start by accessing the Conestoga Bank website or visit one of their branches to obtain the necessary loan application forms and documents.

02

Gather required documents: Before filling out the SBA loan application, gather all the necessary documents such as financial statements, tax returns, business plans, and personal identification documents.

03

Understand the loan requirements: Familiarize yourself with the specific requirements of the Conestoga Bank SBA loan. This may include having a well-established business, meeting a minimum credit score, providing collateral, and demonstrating the ability to repay the loan.

04

Complete the application form: Fill out the SBA loan application form provided by Conestoga Bank. Pay attention to details and provide accurate information about your business, financial history, and loan purpose.

05

Attach supporting documents: Attach the required supporting documents to the loan application as specified by Conestoga Bank. This can include financial statements, tax returns, credit reports, business plans, and legal documents.

06

Review and double-check: Before submitting your application, thoroughly review all the information provided to ensure accuracy and completeness.

07

Submit the application: Once all the necessary documents are completed and attached, submit your application either online or in person at a Conestoga Bank branch.

08

Wait for review and approval: After submission, Conestoga Bank will review your application. This process may take some time, so be patient. Undergo any necessary follow-ups or interviews as requested by the bank.

09

Receive the loan decision: Conestoga Bank will inform you of their loan decision. If approved, carefully review the terms and conditions of the loan offer.

10

Sign the loan agreement: If you agree to the terms and conditions, sign the loan agreement provided by Conestoga Bank. Make sure you understand all the obligations, repayment schedules, and interest rates associated with the loan.

Who needs Conestoga Bank SBA Loan:

01

Small business owners: Conestoga Bank SBA loan is designed to assist small business owners who require financial support for various purposes, such as expanding their business, purchasing equipment, or meeting working capital needs.

02

Entrepreneurs seeking funding: Individuals looking to start a new business venture can also benefit from the Conestoga Bank SBA loan. It provides a stable source of funding to turn their business idea into a reality.

03

Businesses with limited collateral: Conestoga Bank SBA loan serves businesses that may have limited collateral to offer. This makes it an attractive funding option as it provides access to capital while minimizing collateral requirements.

04

Business owners with long-term goals: If you have long-term business goals that require substantial investment, the Conestoga Bank SBA loan can be an appropriate choice. It enables you to secure funds for business expansion, purchase real estate, or acquire other companies.

05

Companies looking for favorable loan terms: The Conestoga Bank SBA loan offers advantageous terms and competitive interest rates, providing small businesses with access to affordable financing compared to traditional loans.

Remember, it is always recommended to consult with a Conestoga Bank representative or your financial advisor for specific guidance tailored to your unique circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send conestoga bank sba loan to be eSigned by others?

Once you are ready to share your conestoga bank sba loan, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find conestoga bank sba loan?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific conestoga bank sba loan and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in conestoga bank sba loan?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your conestoga bank sba loan and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is conestoga bank sba loan?

Conestoga Bank SBA loan is a loan program offered by Conestoga Bank that is guaranteed by the Small Business Administration.

Who is required to file conestoga bank sba loan?

Small business owners who are looking to obtain financing for their business may be required to file for Conestoga Bank SBA loan.

How to fill out conestoga bank sba loan?

To fill out Conestoga Bank SBA loan, applicants need to provide information about their business, financial statements, business plan, and other relevant documents.

What is the purpose of conestoga bank sba loan?

The purpose of Conestoga Bank SBA loan is to provide small business owners with access to capital to start or grow their business.

What information must be reported on conestoga bank sba loan?

Information such as business financials, personal financial information, collateral details, and business plan must be reported on Conestoga Bank SBA loan.

Fill out your conestoga bank sba loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Conestoga Bank Sba Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.