Get the free SEPA B2B Direct Debit Mandate Without right of contestation For companies only - pos...

Show details

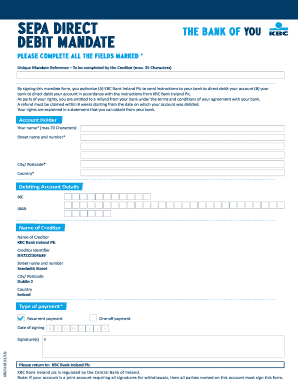

SEPA B2B Direct Debit Mandate (Without right of contestation. For companies only) Creditor identifier Mandate reference* *To be completed by the creditor Debtor By signing this mandate form, you authorize

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sepa b2b direct debit

Edit your sepa b2b direct debit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sepa b2b direct debit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sepa b2b direct debit online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sepa b2b direct debit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sepa b2b direct debit

How to fill out a SEPA B2B direct debit:

01

Make sure you have the necessary information: Before filling out the SEPA B2B direct debit form, gather the required details such as the creditor's name and address, the debtor's details, and the applicable payment amounts.

02

Complete the creditor information: Provide your business's name, address, and other relevant information in the designated section of the form. This will identify you as the entity that will receive the direct debit payment.

03

Fill in the debtor information: Enter the details of the customer or client who has authorized the direct debit. Include their name, address, and any other required information to accurately identify them.

04

Specify the payment details: Indicate the payment amounts, due dates, and the frequency of the direct debit. This should align with the agreement made between you and the debtor.

05

Include the mandate reference: Include the unique mandate reference number assigned to the direct debit authorization. This reference number is crucial for tracking and reconciling direct debit transactions.

06

Validate the form: Before submitting the form, carefully review all the entered information to ensure its accuracy and completeness. Any errors or missing details can cause payment delays or complications.

Who needs SEPA B2B direct debit?

01

Businesses with recurring payments: Companies that have regular recurring payments from their customers, such as subscriptions or service fees, can benefit from using SEPA B2B direct debit. This method provides a convenient and efficient way to collect payments automatically.

02

Organizations engaged in cross-border transactions: SEPA B2B direct debit enables businesses operating across European borders to collect payments from customers in different countries. It simplifies the payment process by adhering to the SEPA (Single Euro Payments Area) standards.

03

Companies seeking cost-effective payment solutions: Compared to other payment methods, SEPA B2B direct debit offers competitive pricing, making it an attractive option for businesses looking to optimize their payment collection processes and reduce transaction costs.

Fill

form

: Try Risk Free

People Also Ask about

What is SEPA B2B direct debit?

The. SEPA Direct Debit Business-to-Business. scheme gives both the billers and the business payers efficiency gains thanks to the automation of payment processing, and an improved liquidity, as the bills are automatically paid when they are due.

What is SEPA direct debit mandate?

A SEPA Direct Debit Mandate is the authorisation given by your customer allowing you to collect future payments from them at any time on their Euro-denominated bank account (subject to advance notice). Each mandate must include certain mandatory legal wording and mandatory information (as specified here).

What is the SEPA business to business direct debit mandate?

SEPA business to business direct debit is a mandate for transactions between companies and is exclusive to corporate customers. The same as core direct debit, the mandate must be valid for the transaction to be successful. The idea is that no incorrect bookings may occur between businesses.

What is SEPA B2B direct debit?

The SEPA business-to-business direct debit, also known as SEPA B2B or SDD B2B, is intended for professionals. It enables a single or regular euro invoice to be paid in euros, with no upper limit on the amount, to a creditor within the SEPA zone, and to set up a payment schedule if necessary.

What does SEPA direct debit mandate mean?

The mandate is at the centre of a SEPA Direct Debit (SDD) payment. It is the document a payer must sign and send to the biller in order to authorise the biller (via its payment service provider or. ) to collect the funds directly from the account of the payer.

What are the mandatory requirements for a SEPA payment?

Under SEPA, all bank accounts must be identified by an International Bank Account Number (IBAN) and a Bank Identifier Code (BIC). To make a payment, the International Bank Account Number (IBAN) must be used. The Bank Identifier Code (BIC) is optional. There are 33 countries in the SEPA area.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sepa b2b direct debit without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like sepa b2b direct debit, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I fill out sepa b2b direct debit on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your sepa b2b direct debit. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I fill out sepa b2b direct debit on an Android device?

On Android, use the pdfFiller mobile app to finish your sepa b2b direct debit. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is sepa b2b direct debit?

SEPA B2B Direct Debit is a payment method that allows businesses to collect Euro-denominated payments from other businesses within the SEPA zone, using a single authorization for recurring payments.

Who is required to file sepa b2b direct debit?

Businesses that intend to collect payments from other businesses within the SEPA zone using the B2B Direct Debit scheme are required to file SEPA B2B Direct Debit.

How to fill out sepa b2b direct debit?

To fill out a SEPA B2B Direct Debit, you need to provide information such as the debtor's bank account details, the amount to be debited, the currency, and the associated mandate reference.

What is the purpose of sepa b2b direct debit?

The purpose of SEPA B2B Direct Debit is to facilitate efficient and secure payment collections between businesses within the SEPA area, streamlining cash flow management.

What information must be reported on sepa b2b direct debit?

The information that must be reported includes the debtor's IBAN, the creditor's details, the mandate reference, the amount, the collection date, and any associated remittance information.

Fill out your sepa b2b direct debit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sepa b2b Direct Debit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.