Get the free Credit Card Application - Tennessee Employees Credit Union

Show details

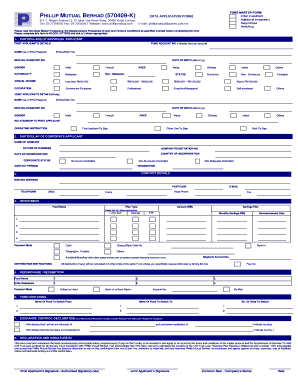

Credit Card Application A table that includes required credit card disclosures is provided with this Application. To obtain any change in the required information since it was printed, (800) 2350403

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card application

Edit your credit card application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit card application online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit card application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card application

How to fill out a credit card application:

01

Gather necessary information: Before starting the application, make sure you have all the required information at hand. This typically includes personal details such as name, address, social security number, employment information, and financial information.

02

Choose the right credit card: Research different credit card options and choose the one that suits your needs and financial situation. Consider factors like interest rates, rewards programs, and annual fees.

03

Read the terms and conditions: It's essential to understand the terms and conditions of the credit card before filling out the application. Read through the document carefully, paying attention to the APR, credit limit, payment terms, and any other fees or penalties associated with the card.

04

Start the application: Begin the credit card application by providing your personal information as requested. This may include your name, address, phone number, email address, date of birth, and social security number.

05

Employment information: Provide accurate details about your employment, including your current occupation, employer's name and address, and your income. You may also need to provide information about your expenses and monthly housing payments.

06

Financial information: This section requires you to disclose your financial information, such as your annual income, existing debts, and assets. Be honest and accurate in reporting your financial situation.

07

Review your application: Before submitting the application, carefully go through all the provided information to ensure its accuracy. Correct any errors or omissions you come across.

08

Submitting the application: Once you are satisfied with the information provided, submit the completed credit card application. Some credit card issuers allow you to apply online, while others require a mailed form. Follow the instructions provided by the card issuer.

09

Follow up: After submitting the application, you may have to wait for a response from the credit card issuer. This can take a few days to a few weeks. If you haven't received a response within a reasonable time frame, consider contacting the card issuer to check on the status of your application.

Who needs a credit card application?

01

Individuals seeking financial flexibility: Credit cards can provide a convenient way to make purchases and cover unexpected expenses. Those who want the ability to pay for goods or services over time rather than upfront may need a credit card.

02

Travelers: Credit cards often offer travel-related benefits, including rewards, travel insurance, and access to airport lounges. If you frequently travel for business or pleasure, having a credit card can enhance your travel experience and provide added security.

03

Individuals building credit: Having a credit card and using it responsibly is an effective way to establish and build your credit history. This can be particularly beneficial for young adults or those with limited credit history who want to improve their credit score for future financial endeavors, such as applying for loans or mortgages.

04

Online shoppers: With the increase in online shopping, having a credit card can make transactions more secure and convenient. Most online merchants accept credit cards as a form of payment, and credit cards often offer protection against fraud or unauthorized transactions.

05

Emergency preparedness: A credit card can serve as a financial safety net during emergencies. Having access to a line of credit can help cover unexpected medical expenses, car repairs, or other emergencies when funds may not be readily available.

In conclusion, anyone who needs financial flexibility, travel benefits, credit-building opportunities, enhanced online shopping security, or emergency preparedness can benefit from filling out a credit card application. Remember to choose a credit card that aligns with your needs and financial situation, and always use credit responsibly.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card application directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your credit card application and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit credit card application in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing credit card application and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit credit card application on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share credit card application from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is credit card application?

Credit card application is a form that individuals fill out to apply for a credit card with a financial institution.

Who is required to file credit card application?

Anyone who wants to apply for a credit card with a financial institution is required to file a credit card application.

How to fill out credit card application?

To fill out a credit card application, individuals need to provide personal information, financial details, and authorization for credit checks.

What is the purpose of credit card application?

The purpose of a credit card application is to apply for a credit card and establish a borrowing relationship with a financial institution.

What information must be reported on credit card application?

On a credit card application, individuals must report personal information, financial details, and consent to credit checks.

Fill out your credit card application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.