IRS 1040 - Schedule SE 2012 free printable template

Show details

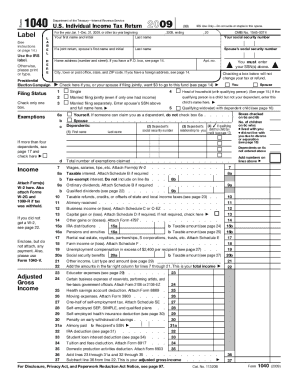

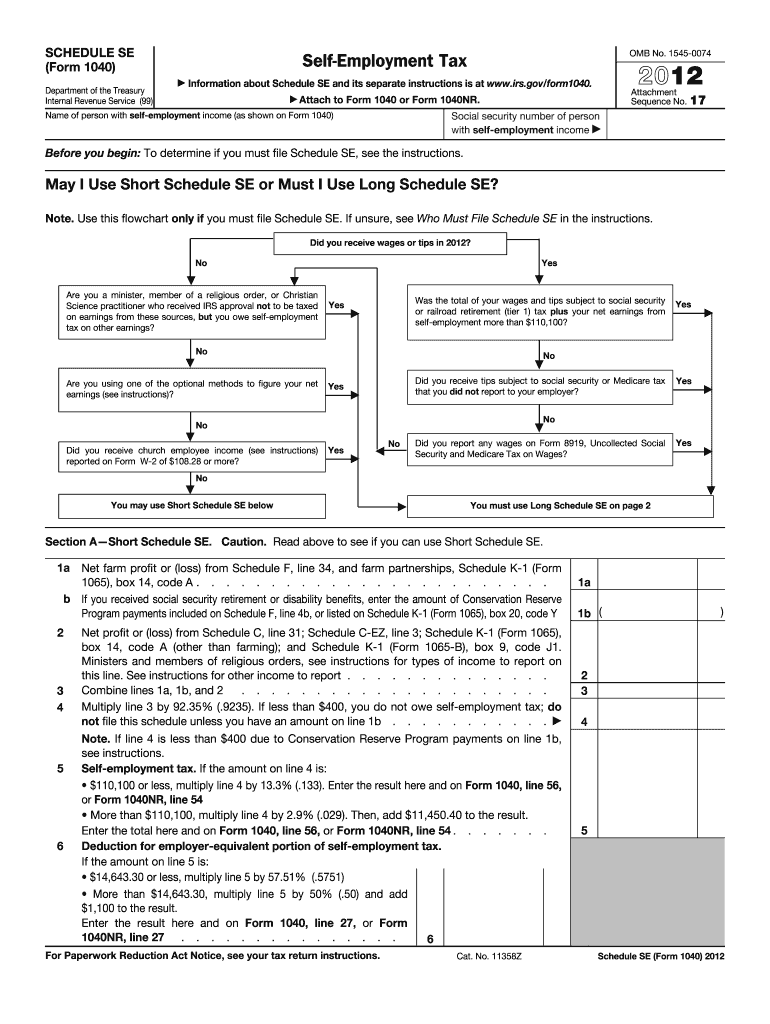

For Paperwork Reduction Act Notice see your tax return instructions. Cat. No. 11358Z 1b Schedule SE Form 1040 2012 Page 2 Attachment Sequence No. 17 Section B Long Schedule SE Part I Note. May I Use Short Schedule SE or Must I Use Long Schedule SE Note. Use this flowchart only if you must file Schedule SE. If unsure see Who Must File Schedule SE in the instructions. Did you receive wages or tips in 2012 No Yes Are you a minister member of a religious order or Christian Science practitioner who...received IRS approval not to be taxed on earnings from these sources but you owe self-employment tax on other earnings Was the total of your wages and tips subject to social security or railroad retirement tier 1 tax plus your net earnings from that you did not report to your employer reported on Form W-2 of 108. Did you receive wages or tips in 2012 No Yes Are you a minister member of a religious order or Christian Science practitioner who received IRS approval not to be taxed on earnings from...these sources but you owe self-employment tax on other earnings Was the total of your wages and tips subject to social security or railroad retirement tier 1 tax plus your net earnings from that you did not report to your employer reported on Form W-2 of 108. 28 or more Are you using one of the optional methods to figure your net earnings see instructions Did you report any wages on Form 8919 Uncollected Social Security and Medicare Tax on Wages You may use Short Schedule SE below You must use...Long Schedule SE on page 2 Section A Short Schedule SE. Caution. Read above to see if you can use Short Schedule SE. 1a Net farm profit or loss from Schedule F line 34 and farm partnerships Schedule K-1 Form 1065 box 14 code A. SCHEDULE SE Form 1040 Department of the Treasury Internal Revenue Service 99 OMB No* 1545-0074 Self-Employment Tax Information about Schedule SE and its separate instructions is at www*irs*gov/form1040. Attach Attachment Sequence No* 17 to Form 1040 or Form 1040NR* Name...of person with self-employment income as shown on Form 1040 Social security number of person with self-employment income Before you begin To determine if you must file Schedule SE see the instructions. May I Use Short Schedule SE or Must I Use Long Schedule SE Note. Use this flowchart only if you must file Schedule SE* If unsure see Who Must File Schedule SE in the instructions. Did you receive wages or tips in 2012 No Yes Are you a minister member of a religious order or Christian Science...practitioner who received IRS approval not to be taxed on earnings from these sources but you owe self-employment tax on other earnings Was the total of your wages and tips subject to social security or railroad retirement tier 1 tax plus your net earnings from that you did not report to your employer reported on Form W-2 of 108. 28 or more Are you using one of the optional methods to figure your net earnings see instructions Did you report any wages on Form 8919 Uncollected Social Security and...Medicare Tax on Wages You may use Short Schedule SE below You must use Long Schedule SE on page 2 Section A Short Schedule SE* Caution* Read above to see if you can use Short Schedule SE* 1a Net farm profit or loss from Schedule F line 34 and farm partnerships Schedule K-1 Form 1065 box 14 code A.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule SE

How to edit IRS 1040 - Schedule SE

How to fill out IRS 1040 - Schedule SE

Instructions and Help about IRS 1040 - Schedule SE

How to edit IRS 1040 - Schedule SE

To edit the IRS 1040 - Schedule SE form, you can use online tools like pdfFiller. Begin by uploading the document to the platform, then access the editing features to make necessary changes. Ensure all information is accurate before saving or submitting the updated form.

How to fill out IRS 1040 - Schedule SE

Filling out the IRS 1040 - Schedule SE requires some basic information about your self-employment income. Follow these steps for proper completion:

01

Start by entering your name and Social Security number at the top of the form.

02

Report your net earnings from self-employment, which is typically calculated from Schedule C or Schedule F.

03

Calculate your self-employment tax, which is based on your net earnings, and confirm the result on the form.

About IRS 1040 - Schedule SE 2012 previous version

What is IRS 1040 - Schedule SE?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule SE 2012 previous version

What is IRS 1040 - Schedule SE?

IRS 1040 - Schedule SE is a form that self-employed individuals use to calculate their self-employment tax. This tax is applicable to income earned through self-employment, including freelancers and small business owners, helping to ensure they contribute toward Social Security and Medicare funding.

What is the purpose of this form?

The purpose of IRS 1040 - Schedule SE is to report self-employment income and calculate the tax owed. This form allows the IRS to assess the correct self-employment tax based on the net earnings reported by the self-employed individual, ensuring compliance with federal tax obligations.

Who needs the form?

Self-employed individuals who earn $400 or more in net earnings from self-employment must file IRS 1040 - Schedule SE. This includes individuals who operate their own business, freelancers, and anyone earning income not subject to traditional payroll deductions.

When am I exempt from filling out this form?

You are exempt from filing IRS 1040 - Schedule SE if your net earnings from self-employment are below $400. Additionally, individuals who are considered employees of a business and do not have self-employment income do not need to use this form.

Components of the form

IRS 1040 - Schedule SE includes several key components: Part I focuses on calculating self-employment tax based on net earnings, while Part II provides a summary of the total self-employment tax owed. Make sure to carefully complete each section, providing accurate figures to ensure compliance with IRS regulations.

What are the penalties for not issuing the form?

Failing to file IRS 1040 - Schedule SE when required can result in penalties. The IRS may impose a failure-to-file penalty, which is typically a percentage of the unpaid tax amount. Additionally, interest may accrue on any unpaid taxes, increasing the overall amount owed.

What information do you need when you file the form?

When filing IRS 1040 - Schedule SE, you will need your net earnings from self-employment, which can be derived from Schedule C (for business income) or Schedule F (for farm income). Have your Social Security number, any previous year's Schedule SE (if applicable), and relevant business expense records ready as well.

Is the form accompanied by other forms?

IRS 1040 - Schedule SE is typically filed alongside Form 1040, the individual income tax return. It may also be accompanied by other schedules, such as Schedule C (Profit or Loss from Business) or Schedule F (Profit or Loss from Farming) if applicable to your situation.

Where do I send the form?

The filing location for IRS 1040 - Schedule SE depends on whether you are submitting it by mail or electronically and your state of residence. Check the IRS website for the correct mailing address based on your filing status and state. For electronic filing, ensure you use approved IRS e-file partners.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Great so far. Confused a bit as to the # of documents that I can store versus folders.

Love being able to fill out forms on computer vs printing out and handwriting in info that is sloppy and messy.

See what our users say