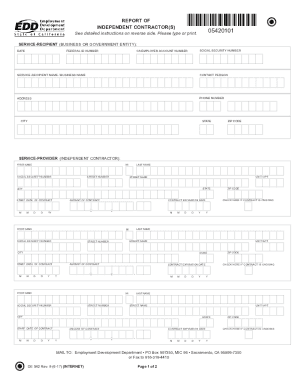

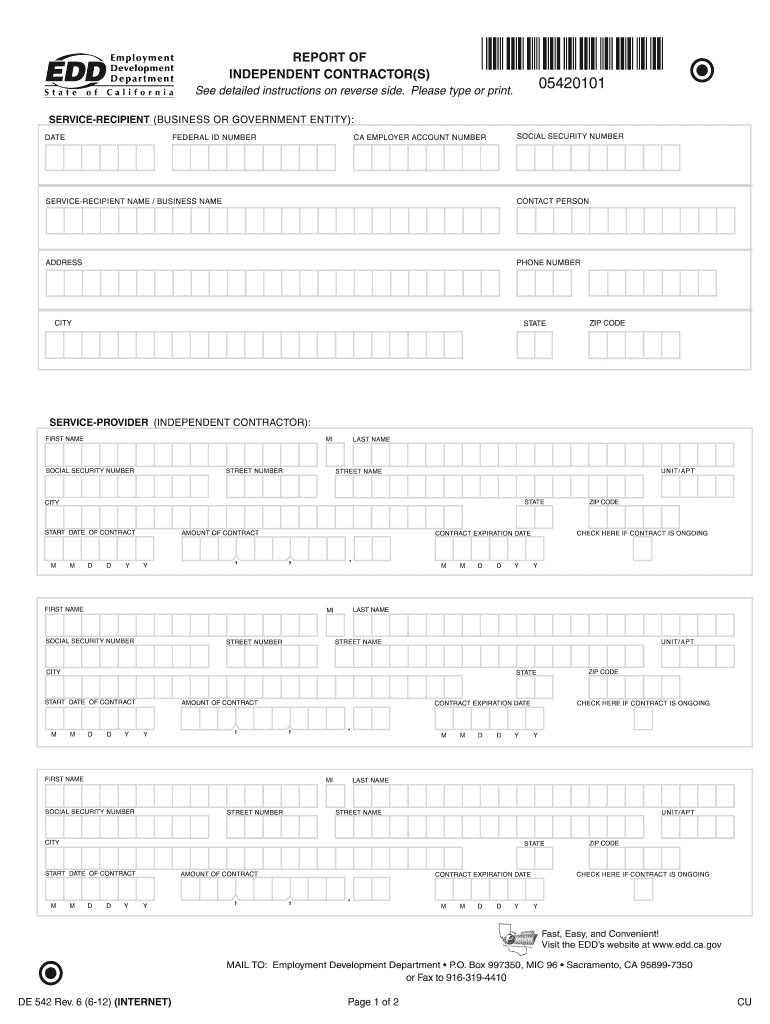

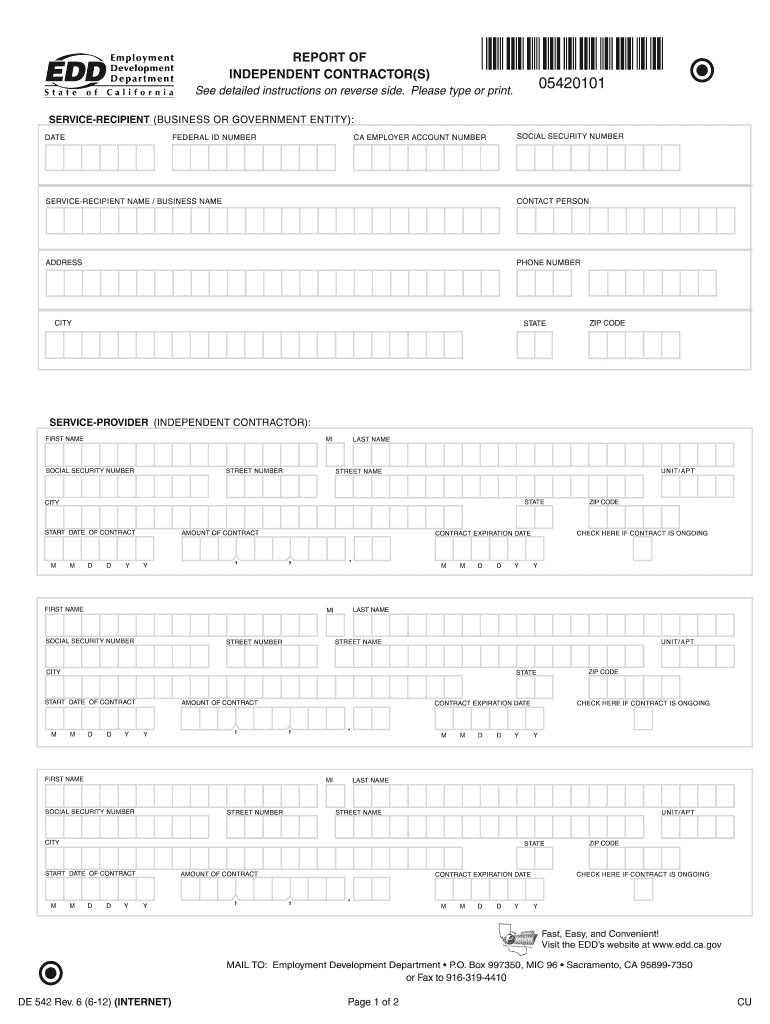

CA DE 542 2012 free printable template

Show details

Visit the website at https //eddservices. edd. ca.gov to choose the option that is best for you. To file a DE 542 form complete the information in the boxes provided on the form and fax to 916-319-4410 or mail to the following address EMPLOYMENT DEVELOPMENT DEPARTMENT P. To obtain additional DE 542 forms Visit the website at www. edd. ca.gov/Forms/ For 25 or more forms call 916-322-2835 For less than 25 forms call 916-657-0529 or call 888-745-38...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA DE 542

Edit your CA DE 542 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA DE 542 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA DE 542 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CA DE 542. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA DE 542 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA DE 542

How to fill out CA DE 542

01

Obtain the CA DE 542 form from the California Employment Development Department (EDD) website.

02

Fill in your basic information, including your name, Social Security number, and contact details.

03

Provide details about the employees for whom you are reporting wages, including their names, Social Security numbers, and gross wages paid.

04

Enter any applicable taxes withheld for each employee.

05

Double-check the accuracy of all entries to ensure there are no mistakes.

06

Sign and date the form to verify that the information is correct.

07

Submit the completed form to the EDD either online or via mail, based on the instructions provided.

Who needs CA DE 542?

01

Employers in California who need to report wages earned and taxes withheld for their employees.

02

Any business or organization that has paid wages to employees must complete CA DE 542.

Fill

form

: Try Risk Free

People Also Ask about

What is the penalty for de 542?

The EDD may assess a penalty of $24 for each failure to comply within the required time frames. Also, a penalty of $490 may be assessed for the failure to report IC information if the failure is the result of conspiracy between the service-recipient and service-provider.

Do I need to file a DE 542?

You must report to the Employment Development Department (EDD) within 20 days of EITHER making payments of $600 or more OR entering into a contract for $600 or more with an independent contractor in any calendar year, whichever is earlier.

Do independent contractors get 1099-MISC or 1099-NEC?

The 1099-NEC is now used to report independent contractor income. But the 1099-MISC form is still around, it's just used to report miscellaneous income such as rent or payments to an attorney. Although the 1099-MISC is still in use, contractor payments made in 2020 and beyond will be reported on the form 1099-NEC.

How do I know which 1099 form to use?

Some common examples when you might receive a 1099 include: If you earned $600 or more in nonemployee compensation from a person or business who isn't typically your employer, you should receive a Form 1099-NEC. If you earned $600 or more in rent or royalty payments, you should receive Form 1099-MISC.

What 1099 form do I use for independent contractors?

Complete Form 1099-NEC, Nonemployee Compensation Businesses that pay more than $600 per year to an independent contractor must complete Form 1099-NEC and provide copies to both the IRS and the freelancer by the specified annual deadline.

How do I file a DE 542?

How to Report Download a fill-in DE 542 (PDF) form. Order the DE 542 form from our Online Forms and Publications. Use the DE 542 Print Specifications (PDF) to generate an alternate form. Call the Taxpayer Assistance Center at 1-888-745-3886 to obtain a form. Create your own form with all of the required information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA DE 542 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your CA DE 542 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send CA DE 542 for eSignature?

When you're ready to share your CA DE 542, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out CA DE 542 on an Android device?

Use the pdfFiller app for Android to finish your CA DE 542. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is CA DE 542?

CA DE 542, also known as the Report of Independent Contractor(s), is a form used in California to report payments made to independent contractors for services rendered.

Who is required to file CA DE 542?

Any business or entity that pays an independent contractor $600 or more in a calendar year is required to file CA DE 542.

How to fill out CA DE 542?

To fill out CA DE 542, you need to provide the name, address, and Social Security number or Employer Identification Number (EIN) of the independent contractor, as well as the total amount paid during the year.

What is the purpose of CA DE 542?

The purpose of CA DE 542 is to ensure that income paid to independent contractors is reported for tax purposes and to help the state monitor compliance with independent contractor regulations.

What information must be reported on CA DE 542?

CA DE 542 must report the independent contractor’s name, address, taxpayer identification number, and the total amount paid to them during the reporting year.

Fill out your CA DE 542 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA DE 542 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.