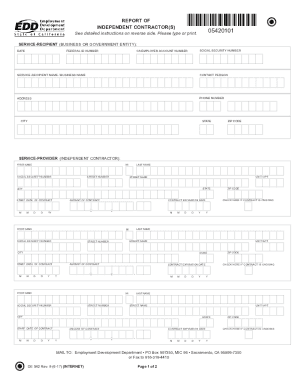

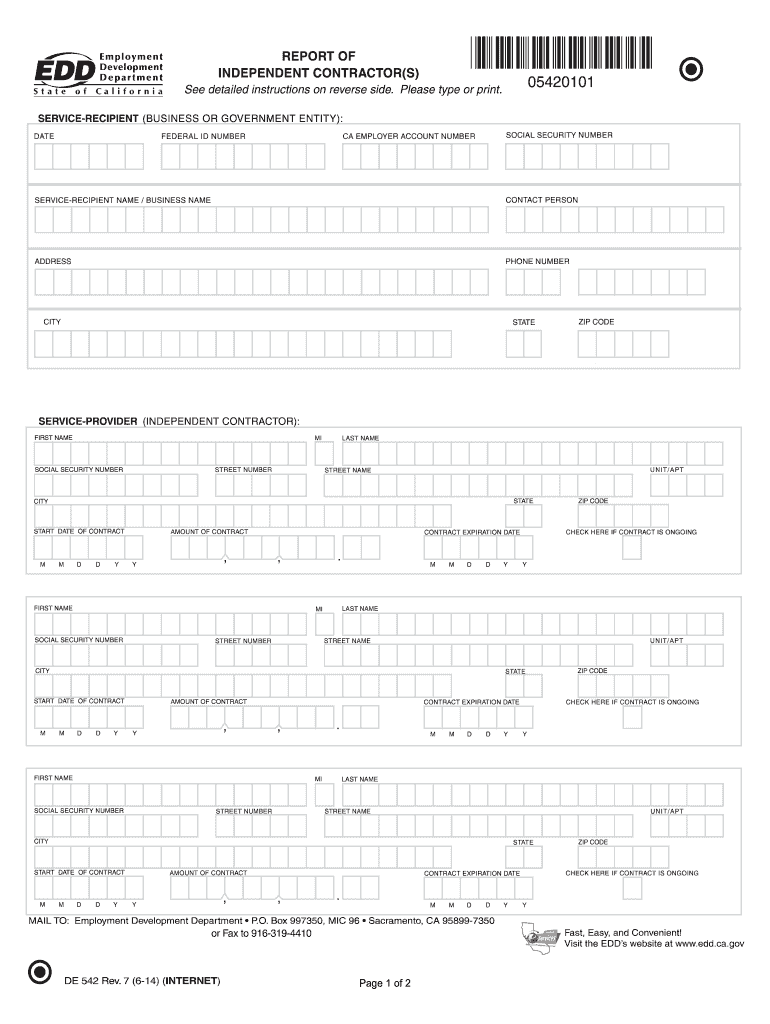

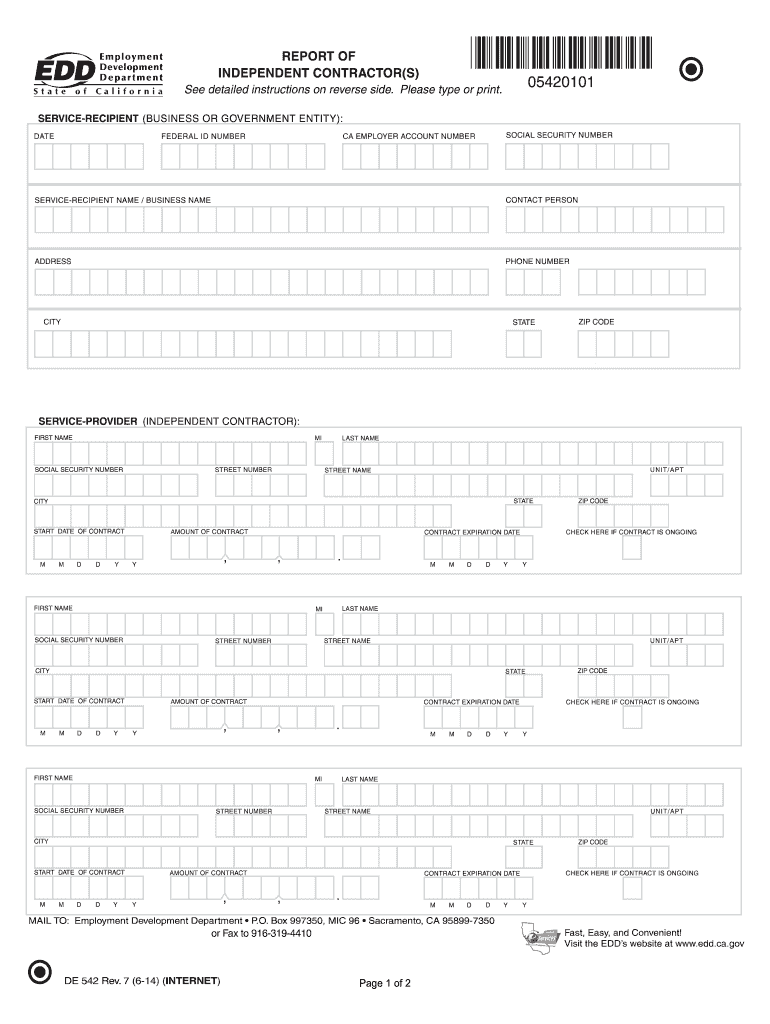

CA DE 542 2014 free printable template

Show details

To obtain additional DE 542 forms Visit the website at www. edd. ca.gov/Forms/ For 25 or more forms call 916-322-2835 For less than 25 forms call 916-657-0529 or call 888-745-3886 HOW TO REPORT For a faster easier and more convenient method of reporting your DE 542 information you are encouraged to report online using the EDD s e-Services for Business. CHECK HERE IF CONTRACT IS ONGOING MAIL TO Employment Development Department P. O. Box 997350 MIC 96 Sacramento CA 95899-7350 or Fax to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA DE 542

Edit your CA DE 542 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA DE 542 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA DE 542 online

To use the services of a skilled PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA DE 542. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA DE 542 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA DE 542

How to fill out CA DE 542

01

Start by downloading the CA DE 542 form from the California Employment Development Department website.

02

Fill in your personal information at the top of the form, including your name, Social Security number, and address.

03

Indicate the type of benefits you are claiming by marking the appropriate box.

04

Provide details regarding your employment history, including the names and addresses of your employers, dates of employment, and reason for separation.

05

Answer any questions related to your eligibility for benefits as specified on the form.

06

Review your information for accuracy and completeness.

07

Sign the form and date it.

08

Submit the completed form as instructed, either by mail or online.

Who needs CA DE 542?

01

Individuals who are applying for unemployment insurance benefits in California need to fill out CA DE 542.

02

Workers who have lost their job through no fault of their own and meet other eligibility criteria.

03

Those seeking to report their employment status or changes in their work circumstances related to benefits.

Instructions and Help about CA DE 542

Fill

form

: Try Risk Free

People Also Ask about

What is the penalty for de 542?

The EDD may assess a penalty of $24 for each failure to comply within the required time frames. Also, a penalty of $490 may be assessed for the failure to report IC information if the failure is the result of conspiracy between the service-recipient and service-provider.

What is a 542 form?

WHO MUST REPORT: Any business or government entity (defined as a “Service-Recipient”) that is required to file a federal Form 1099-MISC for service performed by an independent contractor (defined as a “Service-Provider”) must report.

Do I need to file a DE 542?

You must report to the Employment Development Department (EDD) within 20 days of EITHER making payments of $600 or more OR entering into a contract for $600 or more with an independent contractor in any calendar year, whichever is earlier.

How do I file a DE 542?

How to Report Download a fill-in DE 542 (PDF) form. Order the DE 542 form from our Online Forms and Publications. Use the DE 542 Print Specifications (PDF) to generate an alternate form. Call the Taxpayer Assistance Center at 1-888-745-3886 to obtain a form. Create your own form with all of the required information.

What is the penalty for paying EDD payroll taxes late?

You will be charged a penalty of 15 percent plus interest on late payroll tax payments.

How can an independent contractor avoid paying taxes?

Six Tips to Avoid Paying Taxes on your 1099 Set Up an Automatic Savings Plan for Taxes. Use a 1099 Tax Calculator to Estimate Taxes. Make Your Money Work for You with Micro-Investing. Create an Emergency Fund. Itemize Your Deductions. Employ a Tax Professional.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get CA DE 542?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the CA DE 542. Open it immediately and start altering it with sophisticated capabilities.

Can I sign the CA DE 542 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your CA DE 542 in minutes.

Can I create an eSignature for the CA DE 542 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your CA DE 542 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is CA DE 542?

CA DE 542 is a form used in California to report information about independent contractors that a business pays more than $600 in a calendar year.

Who is required to file CA DE 542?

Any business or entity that has paid an independent contractor $600 or more in a calendar year is required to file CA DE 542.

How to fill out CA DE 542?

To fill out CA DE 542, provide details such as the contractor's name, address, social security number or taxpayer identification number, the amount paid, and the nature of the services provided.

What is the purpose of CA DE 542?

The purpose of CA DE 542 is to inform the California Employment Development Department (EDD) of payments made to independent contractors for tax reporting and enforcement purposes.

What information must be reported on CA DE 542?

Information that must be reported includes the contractor's name, address, social security number or taxpayer identification number, total payment amount, and a description of services rendered.

Fill out your CA DE 542 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA DE 542 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.