1099 Form Independent Contractor

What is 1099 form independent contractor?

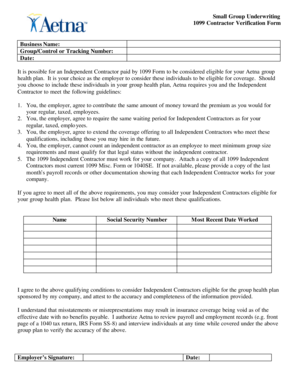

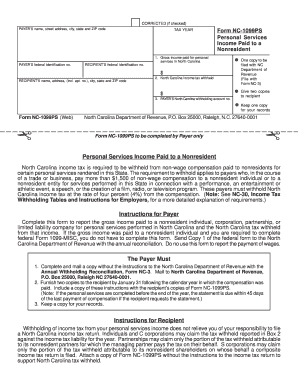

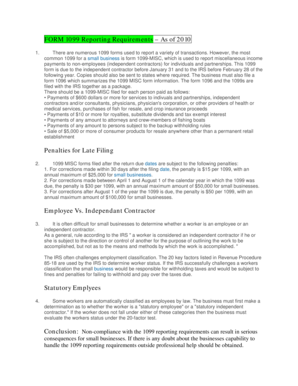

The 1099 form for independent contractors is a tax document used by businesses to report payments made to non-employees or freelancers for services rendered. It is commonly referred to as the 1099-MISC form. This form is crucial for independent contractors as it helps them accurately report their income and pay their taxes accordingly.

What are the types of 1099 form independent contractor?

There are several types of 1099 form for independent contractors, depending on the specific nature of their work and income sources. The most common types include:

How to complete 1099 form independent contractor

Completing the 1099 form as an independent contractor is essential to accurately report your income and ensure compliance with tax regulations. Here are the steps to complete the form:

pdfFiller simplifies the process of completing the 1099 form as an independent contractor. With pdfFiller's online platform, you can easily create, edit, and share your documents. They offer unlimited fillable templates and powerful editing tools, making it the only PDF editor you need to get your documents done.