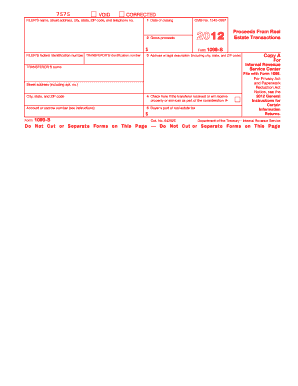

Form 1099 Instructions

What is form 1099 instructions?

Form 1099 instructions provide guidance and requirements for filing and reporting various types of income in the United States. These instructions are issued by the Internal Revenue Service (IRS) and are essential for individuals and businesses to accurately report their income and comply with tax laws.

What are the types of form 1099 instructions?

There are several types of form 1099 instructions, each pertaining to different types of income. Some common types of form 1099 instructions include: - Form 1099-MISC instructions: for reporting miscellaneous income such as freelance earnings and rental income. - Form 1099-INT instructions: for reporting interest income. - Form 1099-DIV instructions: for reporting dividend income. - Form 1099-B instructions: for reporting proceeds from broker and barter exchange transactions. These instructions provide specific guidance on what information needs to be reported and how to fill out the corresponding forms.

How to complete form 1099 instructions

To complete form 1099 instructions, follow these steps: 1. Obtain the correct form: Determine the specific form that corresponds to the type of income you need to report. 2. Gather necessary information: Collect all the required information, such as the recipient's name, address, and taxpayer identification number (TIN), as well as the amount of income received. 3. Fill out the form: Enter the information accurately and legibly, following the instructions provided. 4. Review and double-check: Carefully review the completed form for any errors or omissions. 5. Submit the form: Send the completed form to the appropriate recipients and file a copy with the IRS as instructed. By following these steps and carefully adhering to the form 1099 instructions, you can ensure that you properly report your income and fulfill your tax obligations.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.