Get the free Refund for Overpayment - lawchek

Show details

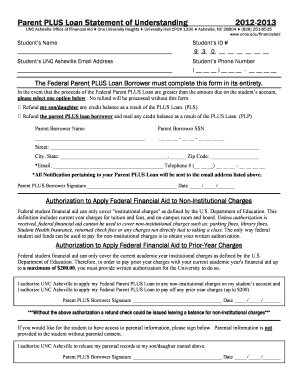

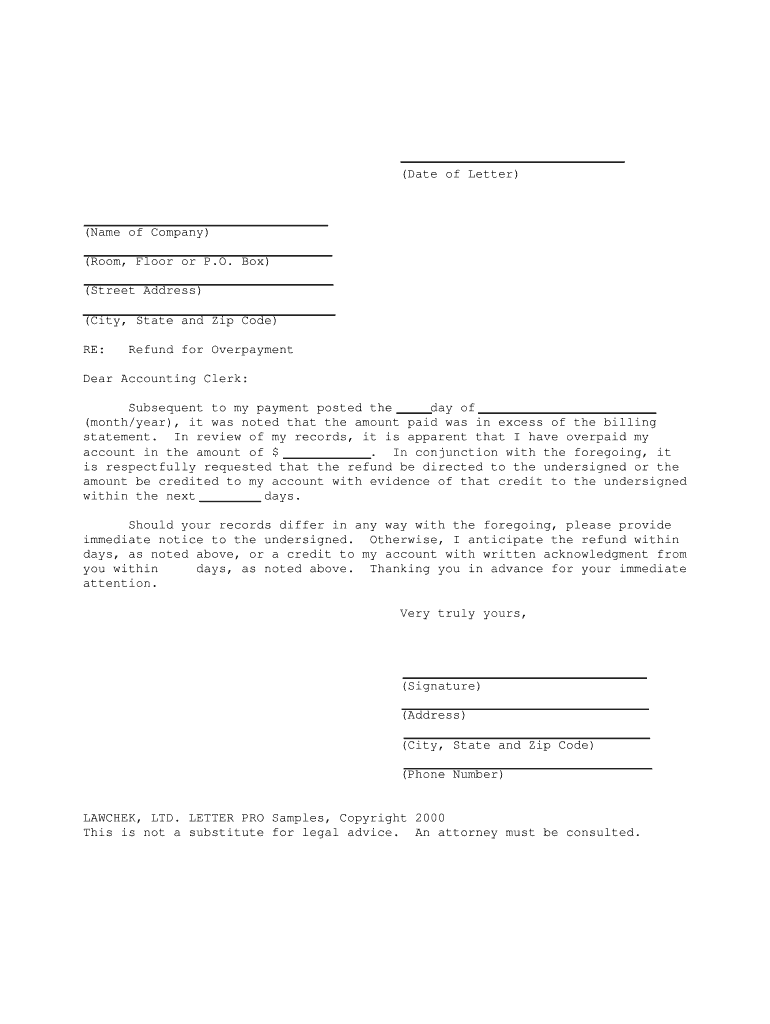

(Date of Letter) (Name of Company) (Room, Floor or P.O. Box) (Street Address) (City, State and Zip Code) RE: Refund for Overpayment Dear Accounting Clerk: After my payment posted the day of (month/year),

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign refund for overpayment

Edit your refund for overpayment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your refund for overpayment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing refund for overpayment online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit refund for overpayment. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out refund for overpayment

How to fill out a refund for overpayment:

01

Gather all relevant information: Start by collecting all the necessary documents and information related to the overpayment. This may include receipts, invoices, transaction details, and any other supporting documents.

02

Identify the reason for the overpayment: Determine the reason behind the overpayment. It could stem from a billing error, duplicate payment, or a miscalculation. Understanding the cause will help you navigate the refund process smoothly.

03

Contact the vendor or service provider: Reach out to the vendor or service provider responsible for the overpayment. Whether it's a store, utility company, or service provider, inform them about the overpayment and express your request for a refund.

04

Follow their refund process: Every vendor or service provider may have a different procedure for issuing refunds. It could involve filling out a specific form, sending an email, or speaking to a customer representative. Follow their instructions carefully for a prompt refund.

05

Provide all requested information: Comply with any requests for additional information or documentation. They may require proof of the overpayment, such as receipts or bank statements. Make sure to provide accurate and complete details to expedite the refund process.

06

Keep records of communication: Maintain a record of all communication with the vendor or service provider regarding the refund. This includes emails, letters, phone calls, and any other form of correspondence. These records will serve as evidence in case any issues or disputes arise later on.

Who needs a refund for overpayment:

01

Customers: If you made an overpayment while purchasing goods or services, you are eligible for a refund. This could occur due to pricing errors, incorrect billing, or any other error that resulted in you paying more than the actual amount owed.

02

Clients: In certain cases, businesses or individuals who have hired services may also be entitled to a refund for overpayment. This could include services like consulting, contractor work, or professional fees.

03

Insurance policyholders: Overpayments can occur in the insurance sector, where policyholders may pay premiums that are higher than the actual calculated amount. In such cases, policyholders are eligible for a refund to rectify the overpayment.

It is important to note that eligibility for a refund may vary depending on the circumstances, the terms and conditions of the vendor or service provider, and any applicable laws or regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get refund for overpayment?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the refund for overpayment in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an eSignature for the refund for overpayment in Gmail?

Create your eSignature using pdfFiller and then eSign your refund for overpayment immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit refund for overpayment on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as refund for overpayment. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is refund for overpayment?

Refund for overpayment is the return of excess payment made by a customer or taxpayer.

Who is required to file refund for overpayment?

Anyone who has made an overpayment and is entitled to a refund is required to file for a refund for overpayment.

How to fill out refund for overpayment?

To fill out a refund for overpayment, one must provide all necessary information about the overpayment and the details for the refund request.

What is the purpose of refund for overpayment?

The purpose of refund for overpayment is to return excess payment to the individual or entity who made the payment.

What information must be reported on refund for overpayment?

The refund for overpayment must include details such as the amount of the overpayment, the reason for the overpayment, and the method of payment for the refund.

What is the penalty for late filing of refund for overpayment?

The penalty for late filing of refund for overpayment may vary depending on the specific circumstances, but it could include interest charges or fines for non-compliance.

Fill out your refund for overpayment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Refund For Overpayment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.