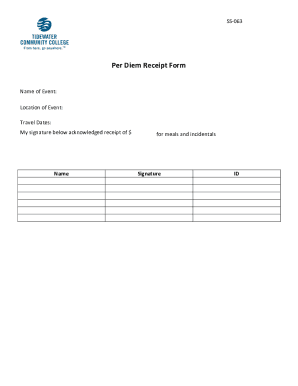

Tidewater Community College SS-063 2012 free printable template

Show details

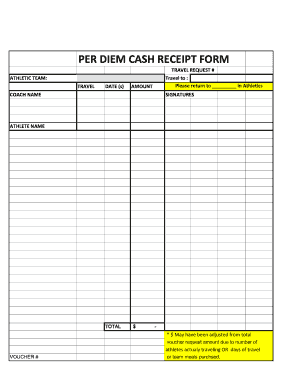

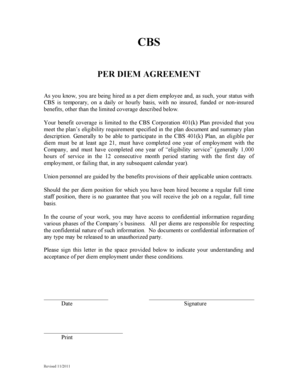

SASS SS-063 Per Diem Receipt Form Name of Event Location of Event Travel Dates / / to / / My signature below acknowledges receipt of $ for meals and incidentals. Name Signature ID.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign per diem receipt template

Edit your per diem receipt template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your per diem receipt template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit per diem receipt template online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit per diem receipt template. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Tidewater Community College SS-063 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out per diem receipt template

How to fill out a per diem receipt template?

01

Start by entering your personal information such as your name, address, and contact details.

02

Include the date of the receipt and the duration of your per diem expenses.

03

Fill in the purpose of your per diem, whether it is for business travel, medical expenses, or any other eligible category.

04

Specify the location where the per diem was incurred, including the city, state, or country.

05

Indicate the amount spent each day for meals, lodging, and incidentals, following the guidelines or limits set by your organization or the IRS.

06

Total up the daily expenses and calculate the grand total for the entire period.

07

Attach any necessary supporting documents such as receipts or invoices to validate your expenses.

08

Sign and date the per diem receipt to certify its accuracy.

09

Keep a copy of the filled-out receipt for your records and submit the original to the relevant party.

Who needs a per diem receipt template?

01

Employees who are required to travel for work purposes and need to track their per diem expenses.

02

Self-employed individuals who are eligible to claim per diem deductions on their taxes.

03

Individuals who receive per diem allowances from their employers and need to provide a record of their expenses.

04

Anyone who wants to maintain organized records of their daily expenses while on a per diem reimbursement system.

05

Organizations that provide per diem reimbursements and require employees or contractors to submit proper documentation for tracking and accounting purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum per diem allowed?

The per diem rates in lieu of the rates described in Notice 2021-52 (the meal and incidental expenses only substantiation method) are $74 for travel to any high-cost locality and $64 for travel to any other locality within CONUS. 3.

What is the high low per diem?

For many years, instead of using actual GSA per-diems, employers have been able to use a simplified “high-low” per-diem method. Under the high-low method, there is one per-diem rate for all “high-cost” areas within the continental U.S. and another per-diem rate for all other areas.

What is the usual payment per diem?

For meals and incidental expenses (M&IE), the standard GSA per diem tier rate is $55 to $76 per day, depending on where you're traveling. In some cases, the per diem rate may be higher if the city's cost of living is higher than the average. On its own, the standard rate for incidental expenses is $5 per day.

What is an example of a per diem expense?

For example, a per diem payment for an information technology (IT) consultant working for the week in another city could be $200 per day—$100 for accommodations, $50 for food, and $50 for incidental costs.

What is a reasonable per diem?

For meals and incidental expenses (M&IE), the standard GSA per diem tier rate is $55 to $76 per day, depending on where you're traveling. In some cases, the per diem rate may be higher if the city's cost of living is higher than the average. On its own, the standard rate for incidental expenses is $5 per day.

What is the difference between per diem and expense reimbursement?

Per diem is a substitute for using an actual expense reimbursement method. Instead of paying employees back the exact amount they spent on a trip (actual expense), you provide the per diem rate. You can provide per diem in advance before the employee travels for business.

Can per diem be used for anything?

Per diem is an allowance for lodging, meals, and incidental expenses.

Do I need to provide receipts for per diem?

The report must include: • The business purpose of the trip, • The date and place of the trip, and • Receipts for lodging (if using the meals-only per diem rate). The employee must file the expense report with the employer within a reasonable period of time (60 days).

How is per diem accounted for?

Per diem is taxable if an employee does not provide or leaves information out of an expense report. It is also taxable if you give the employee a flat amount. The excess is taxable if you give an employee above the maximum per diem allowance.

How much can I deduct for per diem?

The per diem rate is set by the IRS. The current rate for 2023 (last updated October 1, 2021) is $69 per full day and $51.75 per partial day in the Continental US. You may hear the amount of the deduction quoted as $55.20 per full day.

How do you document per diem?

What records should I keep if I pay per diem? You should keep the expense reports that show the time, place, and business purpose of your employees' travel. The self-employed individual should keep the same type of records.

What is the 75% per diem rule?

ing to the Federal Travel Regulation (FTR), travelers are entitled to 75% of the prescribed meals and incidental expenses for one day travel away from your official station if it is longer than 12 hours.

How is per diem written?

The Latin loan phrase per diem, literally meaning per day, is used in English to mean by the day, per day, reckoned on a daily basis, or paid by the day. It also works as a noun referring to a daily allowance, usually given by an employer or client, for expenses. In normal use, per diem does not need to be italicized.

What does $100 a day per diem mean?

The per diem amount is calculated as a daily rate. For example, if you're traveling to a state where the per diem is $100 per day, you should receive $100 for every day you stayed there on business if your company follows GSA rates. There is a separate meals and incidentals rate for the first and last days.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute per diem receipt template online?

pdfFiller makes it easy to finish and sign per diem receipt template online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in per diem receipt template without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit per diem receipt template and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I complete per diem receipt template on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your per diem receipt template. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is Tidewater Community College SS-063?

Tidewater Community College SS-063 is a specific form or document used by the college for administrative purposes, likely related to student services or financial aid.

Who is required to file Tidewater Community College SS-063?

Individuals who are applying for certain programs, services, or financial aid at Tidewater Community College may be required to file Tidewater Community College SS-063.

How to fill out Tidewater Community College SS-063?

To fill out Tidewater Community College SS-063, individuals need to provide accurate personal and relevant information as requested on the form, and submit it according to the provided instructions.

What is the purpose of Tidewater Community College SS-063?

The purpose of Tidewater Community College SS-063 is to gather necessary information from students or applicants for processing their requests or applications related to college services.

What information must be reported on Tidewater Community College SS-063?

The information reported on Tidewater Community College SS-063 typically includes personal identification details, financial information, and any other specifics required for the application or request being made.

Fill out your per diem receipt template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Per Diem Receipt Template is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.