Get the free per diem receipt template

Show details

A form used to acknowledge the receipt of funds for meals and incidentals related to an event.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign per diem invoice form

Edit your a form used to acknowledge the receipt of blackout data for discretion add comments and more msockid 1cb02e9aadf5659815763aa6acf464cd form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your per diem receipt template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing per diem receipt template online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit per diem receipt template. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out per diem receipt template

How to fill out per diem invoice template:

01

Begin by opening the per diem invoice template on your computer.

02

Fill in the header section with your name, address, and contact information.

03

Include the recipient's name, address, and contact information in the appropriate section.

04

Specify the date of the invoice and assign a unique invoice number for reference.

05

In the "Description" column, provide a detailed breakdown of the services or goods provided.

06

Enter the quantity and rate for each item or service.

07

Multiply the quantity by the rate to calculate the subtotal for each item.

08

Add up all the subtotals to determine the total amount owed.

09

Include any applicable taxes or fees, if necessary.

10

Clearly state the payment terms, such as the due date and accepted payment methods.

11

Double-check all the entered information for accuracy and completeness.

12

Save a copy of the filled-out per diem invoice template for your records.

Who needs per diem invoice template:

01

Freelancers or independent contractors who provide services on a project basis and need to bill for their time and expenses.

02

Small business owners who want to keep track of their daily expenses and accurately invoice their clients.

03

Companies that reimburse their employees for business-related expenses at a daily rate and require proper documentation for these reimbursements.

Fill

form

: Try Risk Free

People Also Ask about

How is per diem calculated?

The per diem amount is calculated as a daily rate. For example, if you're traveling to a state where the per diem is $100 per day, you should receive $100 for every day you stayed there on business if your company follows GSA rates. There is a separate meals and incidentals rate for the first and last days.

What is included in per diem?

Per diem means “for each day.” You give employees a fixed amount of money to cover daily living expenses, including lodging, meals, and incidental expenses. Per diem can also be limited to covering just meals and incidental expenses.

What is per diem and how is it calculated?

Per diem is a daily amount to cover meal and lodging expenses. You will need to calculate your per diem before the trip. The rate is set annually by the federal government and different depending on where you are traveling.

How do you calculate per diem pay?

Multiply the per diem allowance by the number of days. For example, on a three day business trip with a per diem meal expense allowance of $50, total per diem equals 3 X $50, or $150.

Is a per diem taxable UK?

Per diems are non-taxable and they are considered as reimbursement and not income but if any expenses go over HMRC limits then per diems will be considered a taxable benefit to employees. When subsistence and travel expenses exceed the maximum limit set by HMRC, they should be included legally in the employee payroll.

What is the 300 per diem rule?

The Federal Travel Regulation (FTR) 301-11.300 through 306 notes that if lodging is not available at your temporary duty location, your agency may authorize or approve the maximum per diem rate of up to 300% of per diem for the location where lodging is obtained.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify per diem receipt template without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like per diem receipt template, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send per diem receipt template to be eSigned by others?

When you're ready to share your per diem receipt template, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit per diem receipt template on an Android device?

With the pdfFiller Android app, you can edit, sign, and share per diem receipt template on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is per diem invoice template?

A per diem invoice template is a standardized form used to request reimbursement for daily expenses incurred while traveling for business. It allows employees to document the amount spent on meals, lodging, and other travel-related costs on a daily basis.

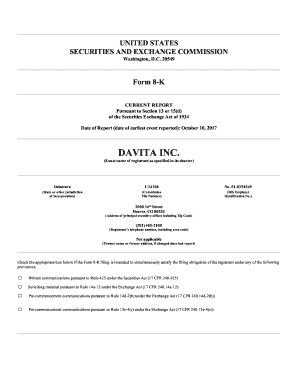

Who is required to file per diem invoice template?

Typically, employees who travel for work and incur expenses that need to be reimbursed by their employer are required to file a per diem invoice template. This includes staff, contractors, and anyone else who is on official business travel.

How to fill out per diem invoice template?

To fill out a per diem invoice template, provide the dates of travel, specify the locations, itemize the daily expenses incurred, and total the amounts. Additionally, you may need to include your personal information, such as your name, department, and any relevant project codes.

What is the purpose of per diem invoice template?

The purpose of the per diem invoice template is to simplify the reimbursement process for travel-related expenses. It ensures that employees can claim their daily expenses in a structured manner while providing employers with a clear record of the costs associated with business travel.

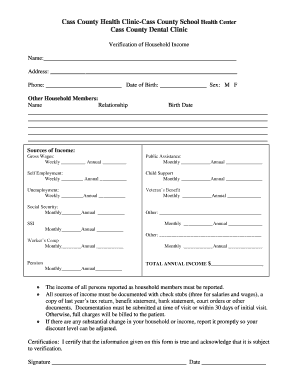

What information must be reported on per diem invoice template?

The information that must be reported on a per diem invoice template includes the employee's name, date of travel, location of travel, daily expenses for lodging, meals, and other eligible costs, as well as the total amount requested for reimbursement.

Fill out your per diem receipt template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Per Diem Receipt Template is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.