Get the free loan questionnaire example

Show details

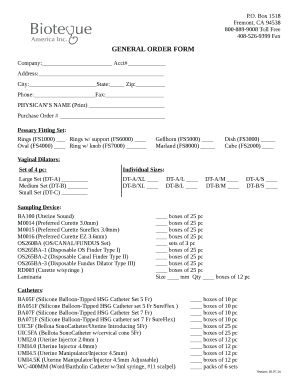

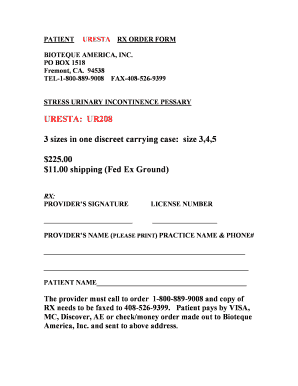

Phone 513 793-5000 Fax 513 793-9329 JOHNSON MORTGAGE SERVICES INC. 9801 Montgomery Road Cincinnati OH 45242 CHURCH LOAN QUESTIONNAIRE Name of Church Pastor Mailing Address Year Founded Telephone Fax Please complete the following questions and submit to Johnson Mortgage Services Inc. along with the last 2 years financial statements and current financial statement plus a detailed letter explaining the purpose of the loan. 1. Our congregation has 2. Regular attendance adult members representing...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan questionnaire example

Edit your loan questionnaire example form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan questionnaire example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan questionnaire example online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit loan questionnaire example. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan questionnaire example

How to fill out a loan questionnaire:

01

Start by carefully reading the instructions provided with the questionnaire. Make sure you understand the purpose of the questionnaire and what information is required.

02

Gather all the necessary documents and information before beginning to fill out the questionnaire. This may include financial statements, tax returns, identification documents, and proof of income.

03

Begin by providing the requested personal information, such as your name, address, contact details, and social security number.

04

Proceed to answer the questions related to your employment status, including your current job, employer details, and income information. Be thorough and accurate in your responses.

05

Answer any additional questions related to your financial situation, such as outstanding debts, assets, and liabilities. Disclose all relevant information to ensure a complete assessment of your loan eligibility.

06

If there are sections that you are unsure about or require further clarification, do not hesitate to reach out to the lender or a financial advisor for assistance.

07

Review the completed questionnaire before submitting it. Double-check for any errors or omissions that may affect the accuracy of your application.

08

Sign and date the questionnaire as required.

09

Keep a copy of the completed questionnaire for your records.

Who needs a loan questionnaire?

01

Individuals or businesses who are applying for a loan from a financial institution or lender.

02

People who want to access credit or financing for personal, educational, or business purposes.

03

Anyone seeking financial assistance and who must provide detailed information about their personal and financial circumstances to determine their loan eligibility.

Fill

form

: Try Risk Free

People Also Ask about

What are the five 5 important questions regarding loan requests?

Five Questions to Answer before Approaching a Bank for a Commercial Loan What is the purpose of this loan request? What dollar amount do you need for your loan request? What length of term do you need to repay the loan in monthly installments? What entity will the name of the loan be under? (

What to say when asked why you need a loan?

Common reasons for a personal loan include: Debt consolidation. Home improvements. Wedding financing. Major home purchases. Adoption expenses. Medical expenses.

How to easily get approved for a personal loan?

Review your score: One of the most effective ways to improve your chances of approval is to work on polishing your credit profile and notching up your credit score. Focus on consistently making all of your debt payments on time and paying down outstanding debts. It's also a good idea to avoid taking on any new debt.

How to fill loan form?

Though the loan application is simple to fill, there are certain things you should keep in mind before filling the form. Check the eligibility criteria. Keep your documents handy. Often the home loan application is delayed or rejected due to submission of incomplete documents. Use an EMI calculator.

How can I increase my loan approval chances?

How to Improve Your Chances of Loan Approval Understanding the Loan Approval Process. Before we get to the loan application, first it is essential to thoroughly comprehend the loan approval process. Strengthening Your Credit Score. Managing Your Debt-to-Income Ratio. Presenting a Strong Loan Application.

What is the best way to get approved for a personal loan?

Clean up your credit. Your credit score is a major consideration on a personal loan application. Rebalance your debts and income. Loan applications ask for your annual income, and you can include money earned from part-time work. Don't ask for too much cash. Consider a co-signer. Find the right lender.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my loan questionnaire example directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your loan questionnaire example and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit loan questionnaire example straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing loan questionnaire example.

How do I fill out loan questionnaire example on an Android device?

Use the pdfFiller mobile app to complete your loan questionnaire example on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is loan questionnaire example?

A loan questionnaire example is a form or document used by lenders to gather essential information from borrowers to assess their eligibility for a loan.

Who is required to file loan questionnaire example?

Individuals or businesses applying for a loan are required to file a loan questionnaire example as part of the application process.

How to fill out loan questionnaire example?

To fill out a loan questionnaire example, applicants should provide accurate personal and financial information, including income details, employment status, and the purpose of the loan.

What is the purpose of loan questionnaire example?

The purpose of a loan questionnaire example is to help lenders evaluate the creditworthiness of a borrower and make informed decisions regarding loan approval.

What information must be reported on loan questionnaire example?

Information that must be reported on a loan questionnaire example typically includes personal identification details, financial history, current debts, assets, and the amount of loan requested.

Fill out your loan questionnaire example online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Questionnaire Example is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.