Get the free BRANCH FINANCIAL STATEMENT BRANCH DISTRICT

Show details

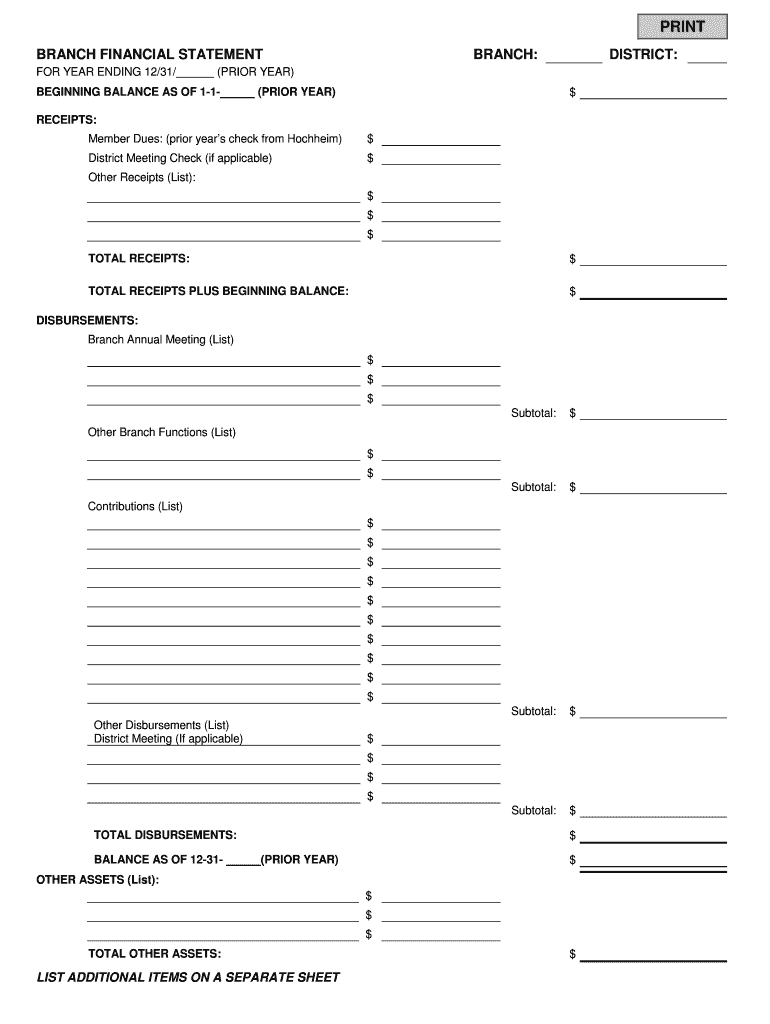

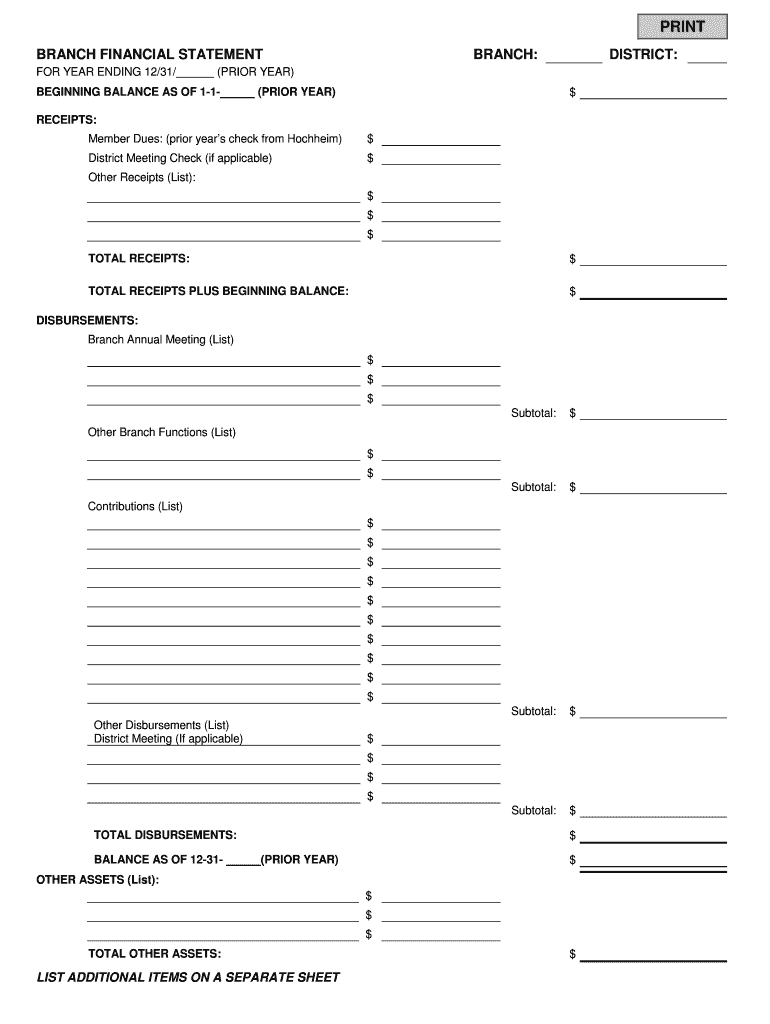

Branch financial statement branch: district: for year ending 12/31/ (prior year) beginning balance as of 11 (prior year) $

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign branch financial statement branch

Edit your branch financial statement branch form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your branch financial statement branch form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing branch financial statement branch online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit branch financial statement branch. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out branch financial statement branch

How to fill out branch financial statement branch:

01

Gather all necessary financial information: Start by collecting all relevant financial data for the branch, such as income and expense records, sales reports, payroll information, and any other financial documents that are applicable.

02

Review and classify the financial data: Once you have gathered all the necessary information, carefully review and classify each item into suitable categories, such as revenue, expenses, assets, liabilities, and equity. This step is crucial for creating an organized and accurate financial statement.

03

Calculate key financial ratios: Using the classified data, calculate important financial ratios to analyze the branch's financial performance. Ratios like profitability, liquidity, and solvency indicators can provide valuable insights into the branch's financial health.

04

Prepare the income statement: Begin by preparing the income statement, also known as the profit and loss statement. This statement outlines the branch's revenues and expenses over a specific period, usually one fiscal year, and shows the resulting net income or loss.

05

Create the balance sheet: The balance sheet provides a snapshot of the branch's financial position at a specific point in time. It includes assets (such as cash, inventory, and equipment), liabilities (such as loans and accounts payable), and equity (such as retained earnings and shareholder investments).

06

Include additional financial statements if necessary: Depending on the requirements of the branch or the organization, you may need to prepare additional financial statements such as a cash flow statement or a statement of changes in equity. These statements provide more comprehensive insights into the branch's financial activities.

Who needs branch financial statement branch?

01

Branch managers: Branch financial statements are essential for branch managers as they help them evaluate the branch's performance, identify areas for improvement, and make informed decisions regarding resource allocation and budget planning.

02

Senior management: The senior management team of an organization relies on branch financial statements to assess the financial performance of individual branches and make strategic decisions regarding expansion, restructuring, or resource allocation across different branches.

03

Investors and stakeholders: Investors and stakeholders in the organization may require branch financial statements to assess the financial stability and profitability of specific branches. These statements can help them determine the viability of investing in a particular branch or support their overall investment strategies.

In summary, filling out a branch financial statement branch requires gathering and organizing financial data, classifying it into relevant categories, calculating financial ratios, preparing income and balance sheets, and potentially including additional financial statements. Branch managers, senior management, investors, and stakeholders are the key individuals who typically need branch financial statements to make informed decisions and evaluate branch performance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit branch financial statement branch from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like branch financial statement branch, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit branch financial statement branch straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing branch financial statement branch.

How do I fill out the branch financial statement branch form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign branch financial statement branch and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is branch financial statement branch?

The branch financial statement branch is a financial report that reflects the financial status of a specific branch of a company.

Who is required to file branch financial statement branch?

Companies with branches are required to file branch financial statement branch.

How to fill out branch financial statement branch?

The branch financial statement branch can be filled out by compiling financial data specific to the branch and following standard accounting practices.

What is the purpose of branch financial statement branch?

The purpose of branch financial statement branch is to provide insight into the financial performance of a particular branch within a company.

What information must be reported on branch financial statement branch?

The branch financial statement branch must include details on revenue, expenses, assets, liabilities, and other financial metrics relevant to the branch.

Fill out your branch financial statement branch online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Branch Financial Statement Branch is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.