Get the free ITEMIZED INCOMEEXPENSE REPORT - maderacap

Show details

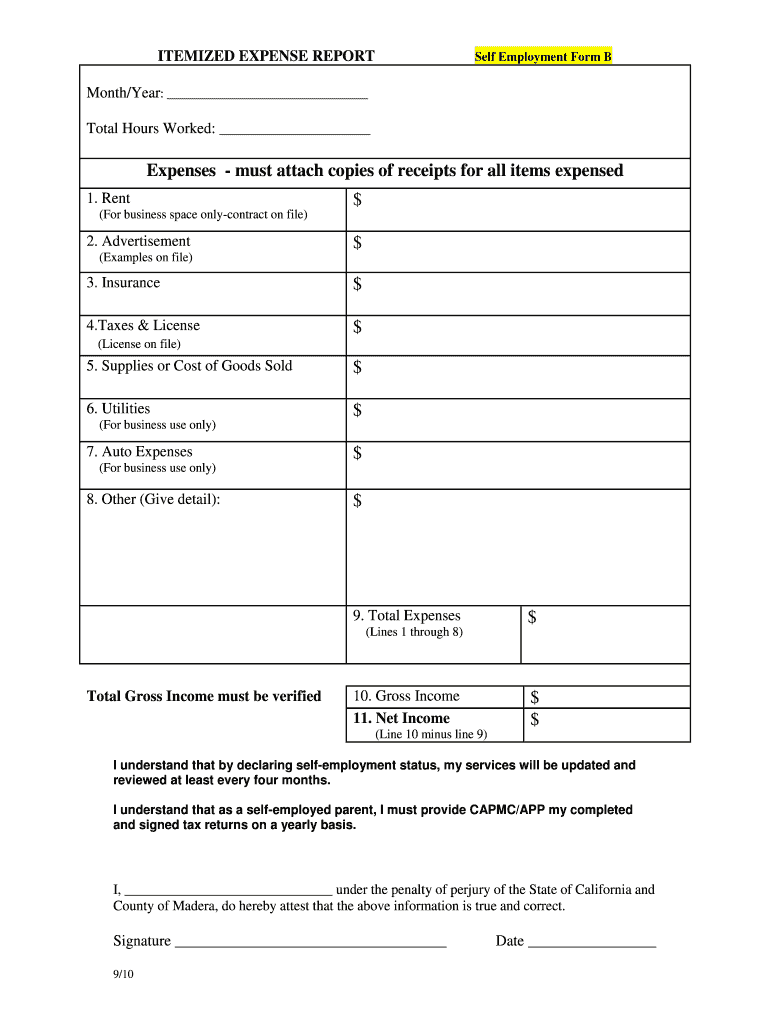

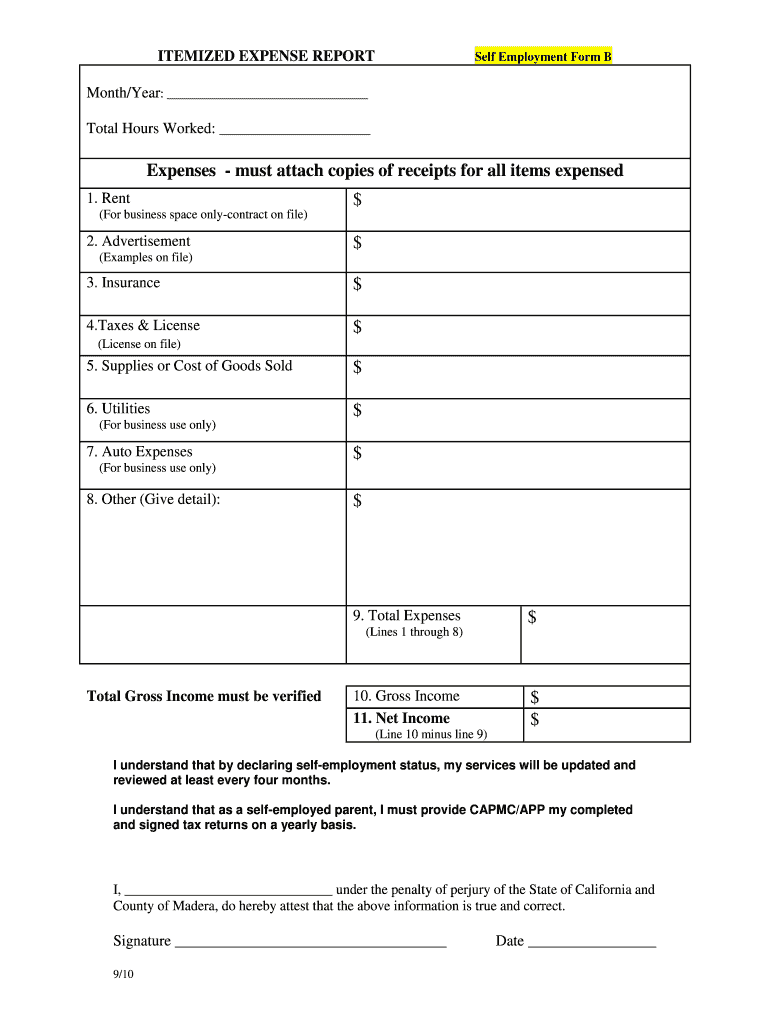

ITEMIZED EXPENSE REPORT Self Employment Form B Month/Year: Total Hours Worked: Expenses must attach copies of receipts for all items expensed 1. Rent $ (For business space only contract on file) 2.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign itemized incomeexpense report

Edit your itemized incomeexpense report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your itemized incomeexpense report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit itemized incomeexpense report online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit itemized incomeexpense report. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out itemized incomeexpense report

How to fill out an itemized income/expense report:

01

Start by gathering all relevant financial documents such as receipts, invoices, and bank statements.

02

Create separate sections or categories for income and expenses. Divide them into specific subcategories if necessary, such as "salary," "rent," "utilities," "transportation," etc.

03

Begin with recording your income sources. Include details like the date, source name, description, and amount received.

04

Move on to documenting your expenses. Start with fixed expenses like rent, utilities, and loan payments. Include the same details as mentioned above.

05

Next, list variable expenses such as groceries, transportation costs, entertainment, etc. Make sure to note the date and description for each expense.

06

If there are any personal expenses mixed with business expenses, be sure to separate them and clearly indicate which category they fall under.

07

Once you have listed all your income and expenses, calculate the total for each category.

08

Sum up the total income and total expenses. Subtract the expenses from the income to determine your net income.

09

Include any additional notes or explanations that may be necessary to provide clarity for each category or transaction.

10

Review your itemized income/expense report for accuracy and completeness before finalizing it.

Who needs an itemized income/expense report:

01

Self-employed individuals who need to monitor their business finances and report them accurately for taxation purposes.

02

Small business owners who need to track their income and expenses to maintain an overview of their financial performance.

03

Employees who receive reimbursement for work-related expenses and need to provide detailed documentation to their employer.

04

Non-profit organizations or charitable institutions that must demonstrate the allocation of funds for transparency and accountability.

05

Anyone who wants to gain a clear understanding of their financial situation by tracking and analyzing their income and expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify itemized incomeexpense report without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including itemized incomeexpense report. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I edit itemized incomeexpense report on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing itemized incomeexpense report, you can start right away.

How do I edit itemized incomeexpense report on an iOS device?

Create, edit, and share itemized incomeexpense report from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is itemized incomeexpense report?

An itemized income/expense report is a detailed breakdown of all income and expenses incurred within a specific period of time.

Who is required to file itemized incomeexpense report?

Anyone who has income and expenses to report for tax purposes is required to file an itemized income/expense report.

How to fill out itemized incomeexpense report?

To fill out an itemized income/expense report, you will need to list all income sources and expenses separately, providing detailed information for each transaction.

What is the purpose of itemized incomeexpense report?

The purpose of an itemized income/expense report is to provide a clear and accurate picture of an individual or business's financial transactions for tax or accounting purposes.

What information must be reported on itemized incomeexpense report?

The information that must be reported on an itemized income/expense report includes all sources of income and detailed descriptions of each expense incurred.

Fill out your itemized incomeexpense report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Itemized Incomeexpense Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.