Get the free COUNCIL TAX AGRICULTURAL EXEMPTION - cne-siar gov

Show details

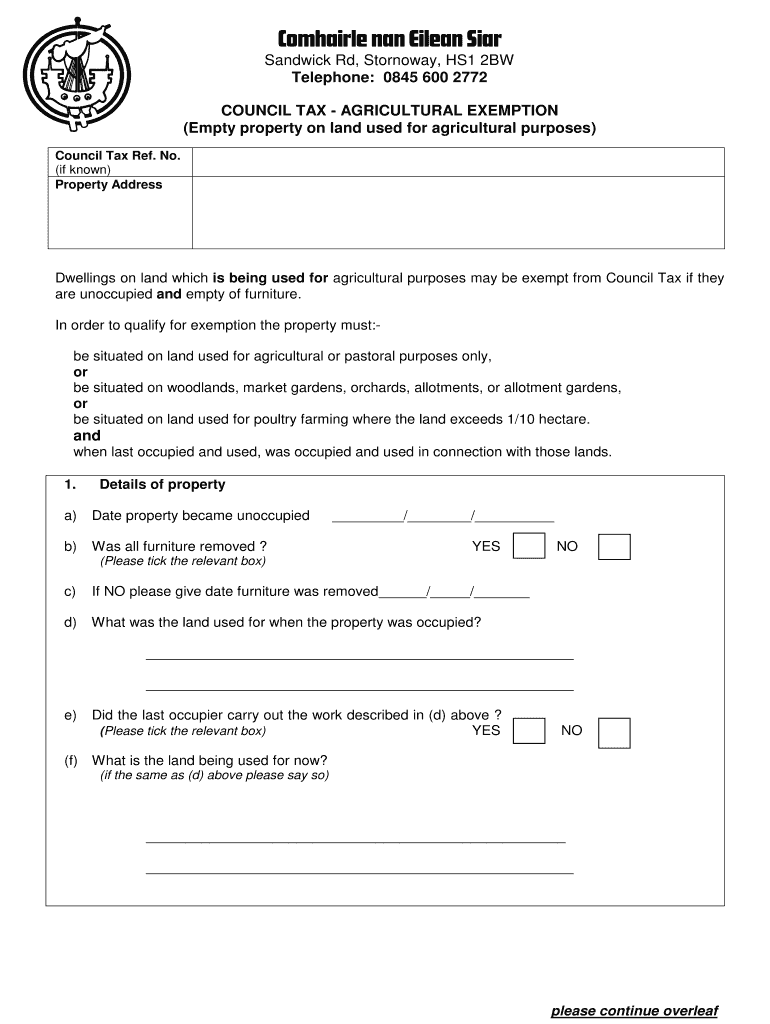

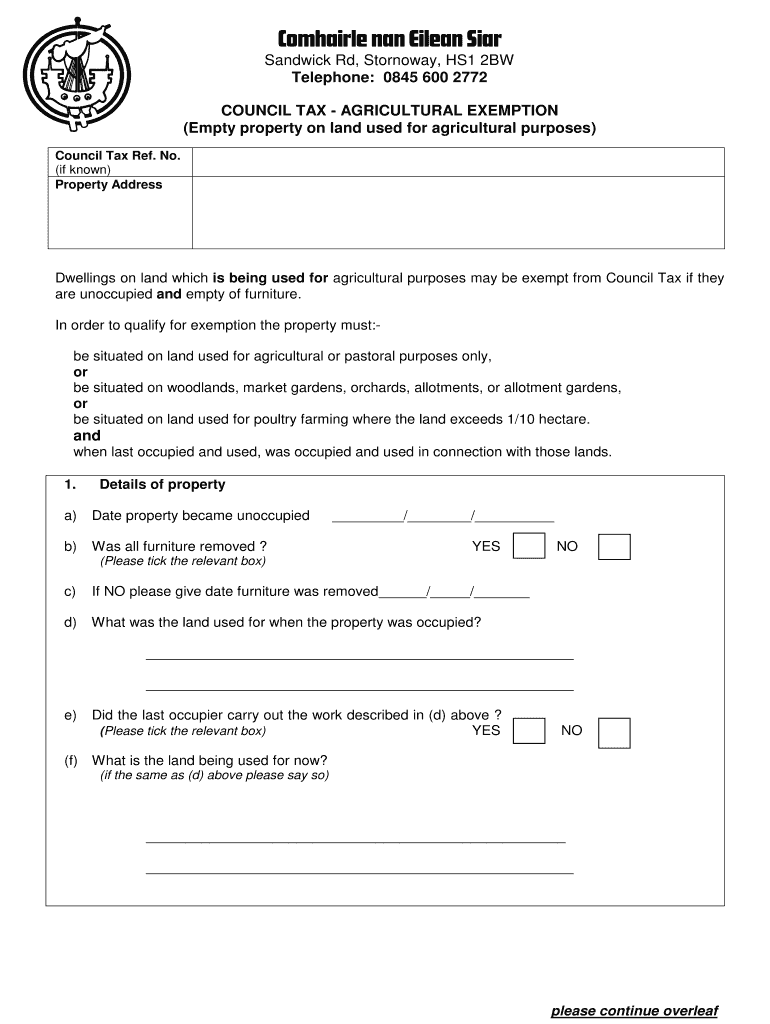

Sandwich Rd, Steinway, HS1 2BW Telephone: 0845 600 2772 COUNCIL TAX AGRICULTURAL EXEMPTION (Empty property on land used for agricultural purposes) Council Tax Ref. No. (if known) Property Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign council tax agricultural exemption

Edit your council tax agricultural exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your council tax agricultural exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing council tax agricultural exemption online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit council tax agricultural exemption. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out council tax agricultural exemption

How to fill out council tax agricultural exemption?

01

Gather all necessary documents: Before filling out the council tax agricultural exemption application, make sure you have all the required documents handy. This may include proof of ownership or tenancy of agricultural land, evidence of agricultural activity, and any other supporting documents required by your local council.

02

Complete the application form: Locate the council tax agricultural exemption application form provided by your local council. Fill out the form accurately and provide all the requested information. Be sure to double-check your answers for any errors or missing details.

03

Attach supporting documents: Along with the completed application form, attach all the required supporting documents. This may include property deeds, agricultural business certificates, agricultural activity evidence such as invoices, receipts, or photographs, and any other relevant paperwork specified by your local council.

04

Submit the application: Once the form is complete and all supporting documents are attached, submit the application to your local council. Ensure that you have followed the guidelines provided by the council for submission. This may involve sending the application by mail, submitting it online, or delivering it in person to the council's office.

05

Follow up: After submitting the application, it is a good idea to follow up with your local council to ensure they have received it and to verify the status of your application. This may involve contacting the council's designated department or checking the progress online, if available.

Who needs council tax agricultural exemption?

01

Owners or tenants of agricultural land: Individuals who own or rent agricultural land may be eligible for council tax agricultural exemption. This exemption is designed to provide relief to those engaging in agricultural activities on their land.

02

Farmers and agricultural businesses: Council tax agricultural exemption is particularly relevant for farmers and agricultural businesses that use the land for farming purposes. It recognizes the unique financial challenges faced by the agricultural industry and aims to support them by reducing their council tax liability.

03

Individuals meeting specific criteria: Each local council may have its own set of criteria to determine eligibility for council tax agricultural exemption. Typically, individuals or businesses have to demonstrate that the land is being actively used for agricultural purposes and meets certain criteria set by the council.

Overall, council tax agricultural exemption is aimed at individuals or businesses engaged in agricultural activities and provides a means to reduce their council tax burden. By following the necessary steps to fill out the application and providing the required documents, eligible individuals can seek this exemption and potentially lower their council tax payments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in council tax agricultural exemption?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your council tax agricultural exemption to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the council tax agricultural exemption in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your council tax agricultural exemption in minutes.

How do I fill out council tax agricultural exemption using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign council tax agricultural exemption. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is council tax agricultural exemption?

Council tax agricultural exemption is a relief scheme for agricultural land and buildings, allowing them to be exempt from paying council tax.

Who is required to file council tax agricultural exemption?

Individuals or businesses who own or occupy agricultural land or buildings may be required to file for the council tax agricultural exemption.

How to fill out council tax agricultural exemption?

To fill out the council tax agricultural exemption, individuals or businesses need to provide information about the agricultural land or buildings they own or occupy, including details about its use and purpose.

What is the purpose of council tax agricultural exemption?

The purpose of council tax agricultural exemption is to provide relief for agricultural land and buildings, recognizing their importance to the agricultural industry.

What information must be reported on council tax agricultural exemption?

Information such as details of the agricultural land or buildings, their use, and any relevant agricultural activities must be reported on the council tax agricultural exemption form.

Fill out your council tax agricultural exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Council Tax Agricultural Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.