Get the free Opening a Fund - Seattle Foundation - new seattlefoundation

Show details

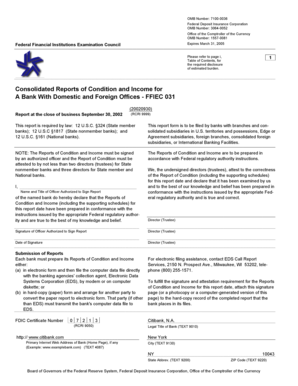

Opening a Fund Opening a Fund SECTION 1: Donor Information Please list your information below and indicate which donor should be the primary contact. DONOR 1 Name Mailing Address City State Zip Phone

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign opening a fund

Edit your opening a fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your opening a fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit opening a fund online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit opening a fund. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out opening a fund

01

To fill out opening a fund, you will first need to gather all the necessary paperwork and documents. This typically includes personal identification, proof of address, and financial statements.

02

Next, it is important to carefully research and select the type of fund you want to open. Determine the investment strategy and goals of the fund, whether it be a mutual fund, hedge fund, or private equity fund.

03

Once you have chosen the type of fund, you will need to draft a comprehensive business plan. This should outline the fund's objectives, investment strategy, target market, and expected returns.

04

It is crucial to consult with legal and financial professionals during this process. They will assist you in understanding the legal requirements, regulations, and securities laws that govern the opening and operation of a fund.

05

After completing the necessary paperwork, you will need to establish a legal entity for the fund, such as a limited liability company (LLC) or a limited partnership (LP). This step provides liability protection and ensures the fund operates within the legal framework.

06

Alongside establishing the legal entity, you will also need to set up a bank account specifically for the fund. This account will handle all the financial transactions, such as subscriptions and redemptions from investors.

07

Finally, you need to market your fund to potential investors. Develop a marketing strategy, including creating a pitch deck and reaching out to potential investors through networking, presentations, and conferences.

Who needs opening a fund?

01

Individuals who have a substantial amount of capital and wish to invest it in a professionally managed portfolio.

02

Institutional investors, such as pension funds, endowments, and insurance companies, that want to diversify their investment holdings.

03

High-net-worth individuals who seek access to alternative investment opportunities and the potential for higher returns.

04

Entrepreneurs or asset managers who want to start their own investment management firm and offer financial products to clients.

05

Corporations or businesses looking to establish a corporate fund for employee benefit programs, charitable foundations, or pension schemes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my opening a fund in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign opening a fund and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I modify opening a fund without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your opening a fund into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I get opening a fund?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the opening a fund. Open it immediately and start altering it with sophisticated capabilities.

What is opening a fund?

Opening a fund is the process of establishing a financial account or pool of assets for a specific purpose, such as investing or fundraising.

Who is required to file opening a fund?

Individuals or entities looking to establish a fund for investment or fundraising purposes are required to file opening a fund.

How to fill out opening a fund?

To fill out opening a fund, individuals or entities need to provide information about the purpose of the fund, the assets being allocated, the beneficiaries, and any rules or restrictions.

What is the purpose of opening a fund?

The purpose of opening a fund is to allocate assets for a specific purpose, such as investing in securities, raising money for a charitable cause, or providing financial support for a specific project.

What information must be reported on opening a fund?

Information that must be reported on opening a fund includes the purpose of the fund, the assets being allocated, the beneficiaries, any rules or restrictions, and the expected outcomes.

Fill out your opening a fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Opening A Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.