Get the free Firefighters’ Pension Scheme 1992 Commutation on Retirement

Show details

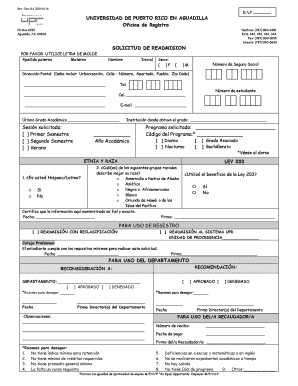

This document provides guidance on the commutation of pensions for members of the Firefighters’ Pension Scheme in England, Wales, Scotland, and Northern Ireland, detailing the rules, calculations,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign firefighters pension scheme 1992

Edit your firefighters pension scheme 1992 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your firefighters pension scheme 1992 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing firefighters pension scheme 1992 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit firefighters pension scheme 1992. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out firefighters pension scheme 1992

How to fill out Firefighters’ Pension Scheme 1992 Commutation on Retirement

01

Obtain the Firefighters' Pension Scheme 1992 Commutation on Retirement form from your local pension authority.

02

Carefully read the accompanying documentation to understand the terms and conditions.

03

Fill out your personal information, including your name, address, and pension details.

04

Indicate the amount of pension you wish to commute by following the guidelines provided.

05

Provide any necessary supporting documents, such as proof of service and identification.

06

Review the filled form for accuracy and completeness before submission.

07

Submit the completed form to your pension authority by the specified deadline.

Who needs Firefighters’ Pension Scheme 1992 Commutation on Retirement?

01

Firefighters who are nearing retirement and wish to access a lump sum payment by commuting a portion of their annual pension.

02

Individuals looking for financial flexibility upon retirement from their service in the fire brigade.

03

Retired firefighters aiming to optimize their pension benefits based on their personal financial circumstances.

Fill

form

: Try Risk Free

People Also Ask about

What is the retirement age for FPS 2015?

However, the minimum retirement age of the 2015 scheme is age 55, so if you retire before age 55 your 2015 pension entitlement is deferred until state pension age, or can be paid early from age 55 with appropriate early retirement reductions.

What is the retirement age for the 2015 scheme?

When can you retire from the NHS? NHS Pension scheme sectionNormal Pension AgeMinimum Pension Age 1995 section 60 (unless you have Special Class (SC) or Mental Health Office (MHO) status)* 55 (but some members can leave at 50)** 2008 section 65 55 2015 scheme 65 or state pension age, whichever is higher 55

What was the age of retirement in 2016?

Changes under the Pensions Act 2011 Under the Pensions Act 2011, women's State Pension age will increase more quickly to 65 between April 2016 and November 2018. From December 2018 the State Pension age for both men and women will start to increase to reach 66 by October 2020.

What is a pension commutation rate?

When the time has come to retire, you can choose to give up part of your annual entitlement to pension to receive a one-off lump sum payment in return. This is called commutation. However, there are limits on the amount that can be commuted.

Can you retire at 55?

Retiring at age 55 is possible for individuals who plan diligently. Success hinges on factors like accumulating substantial savings, managing investments effectively and defining a realistic retirement lifestyle.

What is the maximum commutation of a pension?

You can commute up to 25% of your pension, but it shouldn't exceed certain tax limits; otherwise, you could be charged. It's worth talking to your pension provider to see if you can use commutation for your specific pension and get expert advice from a financial adviser beforehand.

What is a commutation in retirement?

Commuted pension refers to the one-time lump sum payment you receive from your pension plan instead of receiving smaller amounts regularly. In simple terms, opting for commuted pension helps you receive an immediate one-time payout. Let's say, you accumulate a retirement corpus of ₹ 10 lakh through your pension plan.

What was the original full retirement age?

When the Social Security program was established, benefits were made available to men and women at age 65. The Social Security Amendments of 1956 had provided benefits for women as early as age 62. Benefits received prior to age 65 were reduced to take account of the longer period over which they would be received.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Firefighters’ Pension Scheme 1992 Commutation on Retirement?

The Firefighters' Pension Scheme 1992 Commutation on Retirement refers to the option for retirement members of the scheme to exchange a portion of their annual pension for a lump sum payment upon retirement.

Who is required to file Firefighters’ Pension Scheme 1992 Commutation on Retirement?

Members of the Firefighters' Pension Scheme 1992 who are retiring and wish to opt for commutation must file this form as part of their retirement process.

How to fill out Firefighters’ Pension Scheme 1992 Commutation on Retirement?

To fill out the commutation form, a member should provide details such as personal information, details of service, the amount of pension being commuted, and any other specified information required by the administration.

What is the purpose of Firefighters’ Pension Scheme 1992 Commutation on Retirement?

The purpose of commutation is to give retiring firefighters the financial flexibility to receive a lump sum payment, which can be used for immediate expenses, while receiving a smaller annual pension thereafter.

What information must be reported on Firefighters’ Pension Scheme 1992 Commutation on Retirement?

The form must include the member's name, pension details, amount being commuted, date of retirement, and any other relevant information as per the pension scheme's requirements.

Fill out your firefighters pension scheme 1992 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Firefighters Pension Scheme 1992 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.