Get the free Registration Form/Tax Invoice

Show details

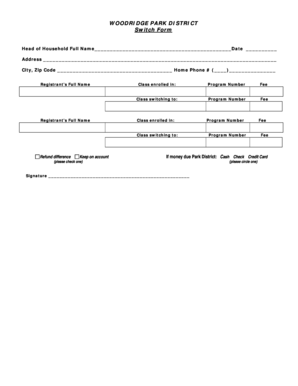

This document serves as a registration form and tax invoice for participants attending a seminar and AGM focused on eliminating family violence within culturally and linguistically diverse communities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign registration formtax invoice

Edit your registration formtax invoice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your registration formtax invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing registration formtax invoice online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit registration formtax invoice. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out registration formtax invoice

How to fill out Registration Form/Tax Invoice

01

Start with your personal information: Enter your full name, address, and contact details.

02

Provide your tax identification number or Social Security number, if applicable.

03

Indicate the purpose of the registration: Specify whether it is for a business or personal use.

04

Fill in the required financial details: Include your bank account information or any payment details.

05

Review the terms and conditions: Read through the policies before proceeding.

06

Sign and date the form: Ensure your signature is clear and matches the name provided.

07

Submit the form: Either electronically or by mailing it to the designated address.

Who needs Registration Form/Tax Invoice?

01

Individuals starting a business who need to register for tax purposes.

02

Freelancers who need to document their services for tax filings.

03

Organizations that need to issue invoices for transactions.

04

Anyone applying for government grants or funding requiring proof of registration.

Fill

form

: Try Risk Free

People Also Ask about

How to create a tax invoice?

If you need to write an invoice that shows all taxes on a purchase, there are certain pieces of information to include, such as: The words “tax invoice” Invoice date and number. Customer name. Billing and shipping address. Seller business number and identity.

What is the difference between a VAT invoice and a tax invoice?

Put very simply, an invoice is a document issued by a business that is not a vendor for VAT and a Tax Invoice is a document issued by a business that is a vendor for VAT. Tax Invoice – Abridged of Full? Where the value of the invoice is below R5000.

How can I get a VAT invoice?

How to use the E-VAT system Log into the E-VAT platform on either Google Chrome version 6.1 or higher or Firefox version 5.6 of higher. Wait for system to request a SIGNATURE KEY from the GRA. Enter SIGNATURE KEY. Generate electronic receipts both online or offline up until 24 hours.

What is a tax invoice in English?

A tax invoice is a document issued by a supplier of goods or services to their customers, which provides a detailed breakdown of the transaction and the applicable taxes.

What is the difference between a VAT invoice and a regular invoice?

This means that VAT invoices should only be issued by VAT-registered businesses, and they should only be issued for goods or services that are subject to sales tax. If your business isn't registered for VAT, you shouldn't charge sales tax, and you should always issue standard invoices instead of VAT invoices.

How do I write out a tax invoice?

The seven tax invoice requirements are: the name of the business. the seller's ABN. a clear statement that the document is a tax invoice. the date the invoice was issued. an itemised list of goods and services provided by the seller. the total price including GST.

What is a VAT invoice in English?

A Value-Added Tax (VAT) invoice is a document issued by an accountable person. A VAT invoice sets out the details of a taxable supply and all related information as prescribed by VAT law.

What does VAT invoice mean?

A value-added tax (VAT) invoice is a specific type of invoice which includes sales tax on it. It outlines details of the goods and services provided, the price, whether a client has a credit account, billing information, what your payment terms are and how they can pay.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Registration Form/Tax Invoice?

A Registration Form/Tax Invoice is a document that serves as proof of a transaction between a buyer and seller, detailing the sale of goods or services and including necessary tax information.

Who is required to file Registration Form/Tax Invoice?

Typically, businesses or individuals engaged in the sale of goods and services that are subject to tax are required to file a Registration Form/Tax Invoice.

How to fill out Registration Form/Tax Invoice?

To fill out a Registration Form/Tax Invoice, one should enter details such as the seller's information, buyer's information, description of goods or services, price, and applicable taxes.

What is the purpose of Registration Form/Tax Invoice?

The purpose of the Registration Form/Tax Invoice is to document sales transactions for accounting and tax purposes, ensuring compliance with tax regulations.

What information must be reported on Registration Form/Tax Invoice?

The information that must be reported includes the seller's name and address, buyer's name and address, date of transaction, description of the goods or services, total amount, and tax details.

Fill out your registration formtax invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Registration Formtax Invoice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.