Get the free MORTGAGE PROTECTION INSURANCE LOSS NOTICE

Show details

MORTGAGE PROTECTION INSURANCE LOSS NOTICE 9515 Deere co Road, Suite 1000 Titanium, Maryland 21093 Phone: 4438732070 / 8006387634 Claims Fax: 4438732086 www.matterhornfinancial.com Named Insured Policy

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage protection insurance loss

Edit your mortgage protection insurance loss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage protection insurance loss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

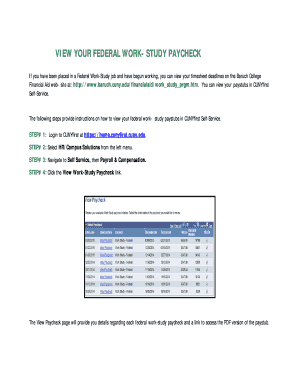

Editing mortgage protection insurance loss online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mortgage protection insurance loss. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage protection insurance loss

How to Fill Out Mortgage Protection Insurance Loss:

01

Gather all necessary documents: Before starting the process, make sure you have all the required documents such as the insurance policy, mortgage agreement, proof of loss, and any supporting documentation.

02

Contact your insurance provider: Notify your insurance provider as soon as possible about the loss you've experienced. They will guide you through the claims process and provide you with the necessary forms to fill out.

03

Fill out the claim form accurately: Carefully fill out the claim form provided by your insurance provider. Make sure to include all relevant information such as your policy number, personal details, and a detailed description of the loss or damage incurred.

04

Provide supporting documentation: Include any supporting documentation required by your insurance provider to validate your claim. This may include receipts, invoices, photographs, or any other evidence that substantiates your loss.

05

Provide details of the loss: Clearly explain the circumstances of the loss, including when and where it occurred, and any relevant details about the incident. Be truthful and provide as much detail as possible to avoid any delays or issues with your claim.

06

Follow submission instructions: Pay close attention to any specific submission instructions provided by your insurance provider. This may include submitting the claim form and supporting documentation electronically or via mail. Ensure all documents are submitted within the specified timeframe.

Who Needs Mortgage Protection Insurance Loss?

01

Homeowners with a mortgage: If you have a mortgage on your property, having mortgage protection insurance loss can provide financial protection in the event of unexpected circumstances that could cause damage or loss to your property.

02

Individuals concerned about mortgage repayments: Mortgage protection insurance loss is beneficial for individuals who are concerned about their ability to make mortgage repayments in the event of a loss or damage to their property. It can provide coverage to help cover mortgage payments, giving peace of mind during challenging times.

03

Property investors: Property investors with multiple properties and mortgages can also benefit from mortgage protection insurance loss. It can provide protection against loss or damage to their investment properties, ensuring they have a safety net to cover unexpected expenses without compromising their financial stability.

In conclusion, filling out a mortgage protection insurance loss claim requires careful attention to detail and providing accurate information. It is beneficial for homeowners, individuals concerned about mortgage repayments, and property investors to consider having mortgage protection insurance loss to safeguard against unexpected events.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mortgage protection insurance loss?

Mortgage protection insurance loss refers to the coverage that helps repay the remaining mortgage balance if the insured passes away or becomes disabled.

Who is required to file mortgage protection insurance loss?

The policyholder or their beneficiaries are required to file mortgage protection insurance loss claims.

How to fill out mortgage protection insurance loss?

To fill out mortgage protection insurance loss, the policyholder or beneficiary must contact the insurance provider and submit the necessary documentation.

What is the purpose of mortgage protection insurance loss?

The purpose of mortgage protection insurance loss is to ensure that the remaining mortgage balance is paid off in the event of the policyholder's death or disability.

What information must be reported on mortgage protection insurance loss?

The information required on mortgage protection insurance loss includes the policyholder's details, cause of loss, and any relevant documentation.

How can I send mortgage protection insurance loss for eSignature?

When your mortgage protection insurance loss is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the mortgage protection insurance loss electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your mortgage protection insurance loss.

How do I edit mortgage protection insurance loss on an Android device?

The pdfFiller app for Android allows you to edit PDF files like mortgage protection insurance loss. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your mortgage protection insurance loss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Protection Insurance Loss is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.