UK HMRC C1202 2014-2025 free printable template

Show details

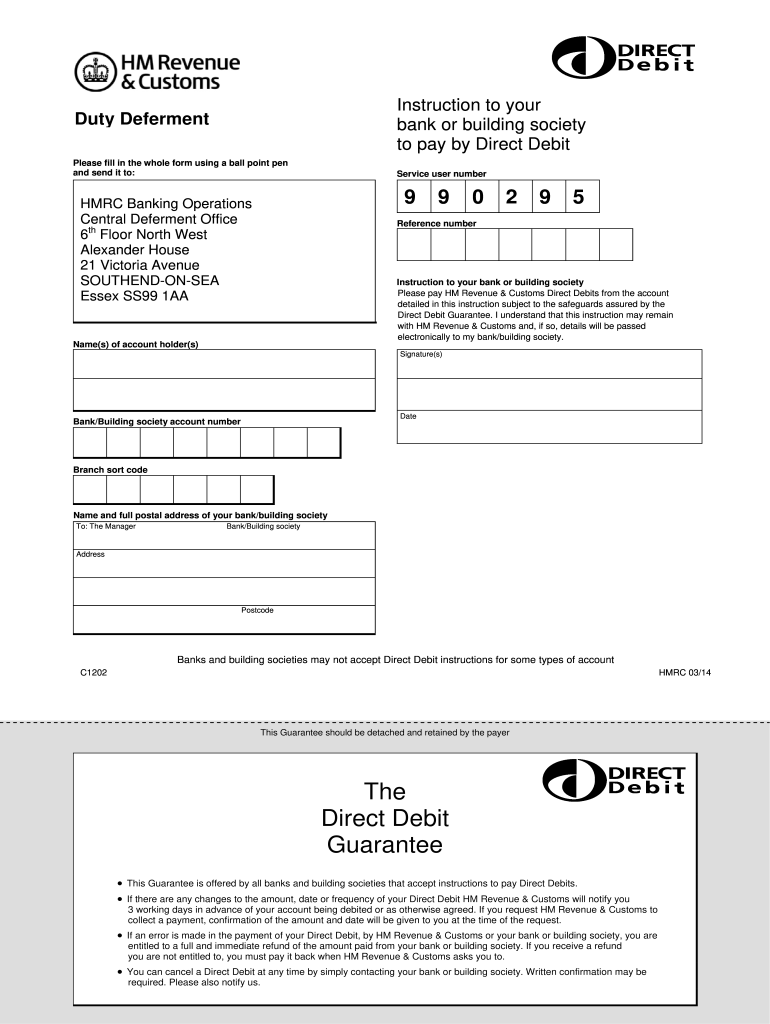

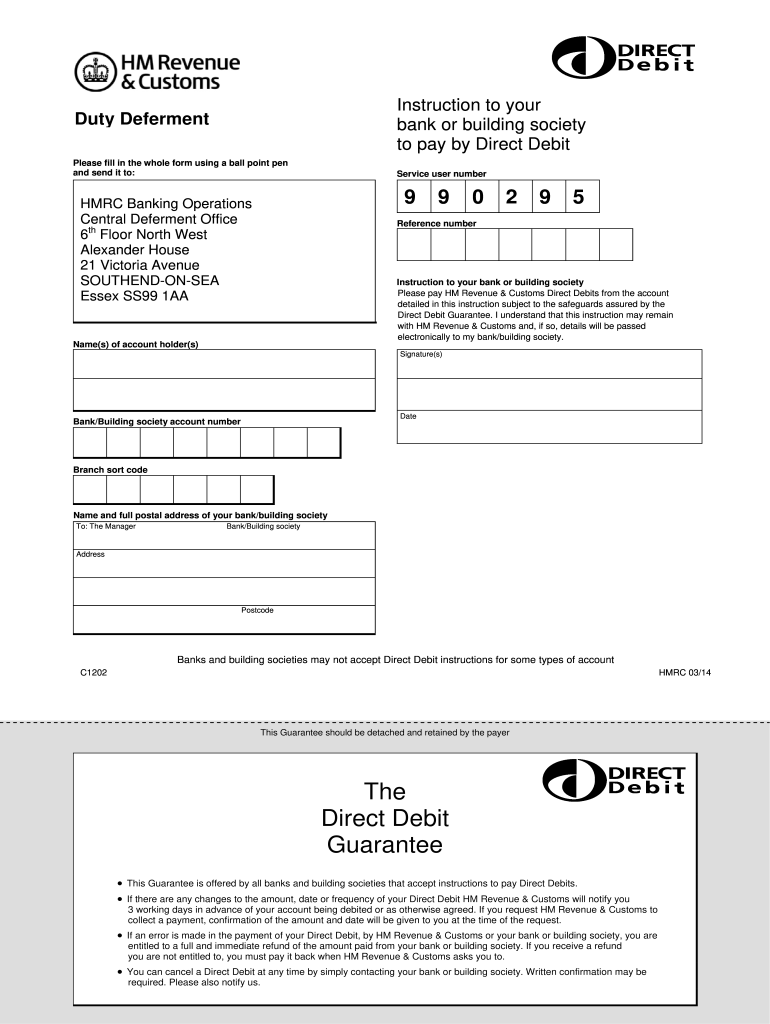

Instruction to your bank or building society to pay by Direct Debit Duty Deferment Please fill in the whole form using a ball point pen and send it to: Service user number 9 HMRC Banking Operations

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HMRC C1202

Edit your UK HMRC C1202 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC C1202 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK HMRC C1202 online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UK HMRC C1202. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out UK HMRC C1202

How to fill out UK HMRC C1202

01

Obtain the UK HMRC C1202 form from the official HMRC website or through your local tax office.

02

Fill in your personal details, including your name, address, National Insurance number, and contact information.

03

Provide details about your tax situation, such as income sources and any relevant deductions.

04

Ensure you accurately report any foreign income or tax credits.

05

Review the completed form for any errors or omissions.

06

Submit the form to HMRC either online or by mailing a printed copy, ensuring you keep a copy for your records.

Who needs UK HMRC C1202?

01

Individuals who need to claim a refund of tax paid on savings interest.

02

People seeking to reclaim extra taxes due to changes in their residency status.

03

Anyone who has overpaid tax during the tax year.

Fill

form

: Try Risk Free

People Also Ask about

What is a C1202?

Using the Customs Handling of Import and Export Freight system ( CHIEF ) You must print and post your Direct Debit Instruction (C1202). You should send it to the address on the form.

What is a LC form HMRC?

As a new employee your employer needs the information on this form before your first payday to tell HMRC about you and help them use the correct tax code. Fill in this form then you can print it and send it or give it to your employer.

What does LC mean in agreement?

An LC contract is an instruction wherein a customer requests the bank to issue, advise or confirm a letter of credit, for a trade transaction. An LC substitutes a bank's name and credit for that of the parties involved. The bank thus undertakes to pay the seller/beneficiary even if the remitter fails to pay.

What is an LC document?

What is a Letter of Credit? A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.

What is an LC form?

A letter of credit is a document sent from a bank or financial institute that guarantees that a seller will receive a buyer's payment on time and for the full amount. Letters of credit are often used within the international trade industry.

What is LC forms?

Use this form to tell HM Revenue and Customs (HMRC) how you have disposed of goods entered into the UK under the following customs procedures: • End-Use Relief using an authorisation by declaration. If you do not complete this form and send it to HMRC you'll have to pay any duty and import VAT due on the goods.

What is C1200 form?

Use form C1200 to apply to defer payment on duties, taxes and charges on certain goods removed from an excise warehouse. Email HMRC to ask for this form in Welsh (Cymraeg).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute UK HMRC C1202 online?

Filling out and eSigning UK HMRC C1202 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my UK HMRC C1202 in Gmail?

Create your eSignature using pdfFiller and then eSign your UK HMRC C1202 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit UK HMRC C1202 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute UK HMRC C1202 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is UK HMRC C1202?

UK HMRC C1202 is a tax form used to report specific income or gains to HM Revenue and Customs (HMRC) for tax purposes. It is often associated with the reporting of income from personal services or other specified activities.

Who is required to file UK HMRC C1202?

Individuals or businesses that have received specific types of income or gains that need to be reported to HMRC are required to file UK HMRC C1202. This typically includes self-employed individuals and those receiving income from certain services.

How to fill out UK HMRC C1202?

To fill out UK HMRC C1202, you need to provide details such as your personal information, the type and amount of income or gains being reported, and any applicable deductions. It's advisable to follow the guidelines provided by HMRC or consult with a tax professional.

What is the purpose of UK HMRC C1202?

The purpose of UK HMRC C1202 is to ensure that individuals and businesses report their income and gains accurately to HMRC for tax assessment and compliance. This helps maintain transparency in the tax system.

What information must be reported on UK HMRC C1202?

UK HMRC C1202 requires reporting of personal information of the filer, details of the income or gains received, any relevant deductions, and other specific information as required by HMRC guidelines.

Fill out your UK HMRC C1202 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC c1202 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.