Get the free Central Excise Duty in Rs Total price per Piece - gujagro

Show details

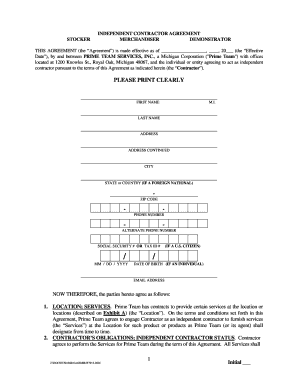

Page 1 NAME OF PRODUCT Packing PERIOD ANNEXUREII PVC SHRINKABLE SLEEVE for Aluminum BOTTLE 50 ml,100 ml,250 ml,500 ml,1000 ml 1/4/2011 to 31/3/2012 (One year) (Price bid to be sent in a separate sealed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign central excise duty in

Edit your central excise duty in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your central excise duty in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit central excise duty in online

To use the professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit central excise duty in. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out central excise duty in

How to fill out central excise duty in:

01

Gather all relevant information: Before filling out the central excise duty form, make sure you have all the necessary information regarding the goods or products involved, including their classification, quantity, and value.

02

Understand the applicable laws and regulations: Familiarize yourself with the central excise duty regulations and guidelines in your particular jurisdiction. This will help you accurately complete the form and avoid any potential errors or penalties.

03

Complete the central excise duty form: Fill out the form provided by the tax authority or customs office. Provide accurate information about the goods, such as their description, value, and classification code. Fill in all the required fields and double-check for any mistakes or omissions.

04

Calculate the central excise duty: Determine the correct amount of central excise duty payable based on the applicable tax rate and the value or quantity of the goods. Ensure that you have correctly applied any exemptions, discounts, or allowances that may be applicable.

05

Submit the form and pay the duty: Once you have completed the form and calculated the duty, submit it to the relevant tax authority or customs office. Pay the central excise duty amount owed, following the prescribed payment method and deadlines provided.

Who needs central excise duty in:

01

Manufacturers: Any person or entity involved in the manufacturing or production of goods may be required to pay central excise duty on the goods produced. This duty is levied to generate revenue for the government and control the production and consumption of certain goods.

02

Importers: Individuals or businesses involved in the importation of goods may be subject to central excise duty as well. This duty is imposed on specific imported goods to protect domestic industries and prevent unfair competition.

03

Traders or wholesalers: In some cases, traders or wholesalers who deal with excisable goods may also be liable to pay central excise duty. This typically occurs when these intermediaries are involved in activities such as repackaging or relabeling the goods.

Overall, anyone engaged in the manufacturing, importation, or trade of excisable goods needs to be aware of and comply with the central excise duty regulations in order to fulfill their tax obligations and avoid any legal consequences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the central excise duty in form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign central excise duty in. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit central excise duty in on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign central excise duty in on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How can I fill out central excise duty in on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your central excise duty in. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is central excise duty in?

Central excise duty is a tax levied on goods manufactured or produced in India.

Who is required to file central excise duty in?

Any manufacturer or producer of goods in India is required to file central excise duty.

How to fill out central excise duty in?

Central excise duty can be filled out using the ACES portal provided by the Central Board of Indirect Taxes and Customs.

What is the purpose of central excise duty in?

The purpose of central excise duty is to generate revenue for the government and to regulate the production and sale of goods.

What information must be reported on central excise duty in?

Information such as details of goods manufactured, quantity produced, and duty payable must be reported on central excise duty.

Fill out your central excise duty in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Central Excise Duty In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.