Get the free Maximising Capital Allowance

Show details

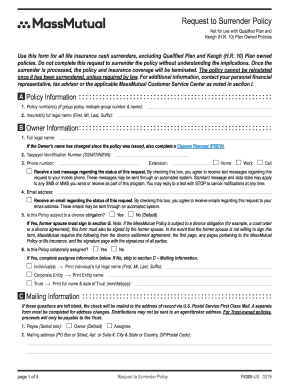

Registration Form Fax your reply to 603 2026 7003 WORKSHOP DETAILS REGISTRATION DETAILS Maximizing Capital Allowance Please register me for the workshop Effective tax planning to maximize the tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign maximising capital allowance

Edit your maximising capital allowance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maximising capital allowance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing maximising capital allowance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit maximising capital allowance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out maximising capital allowance

How to fill out maximising capital allowance:

01

Start by understanding the concept of capital allowance. Capital allowance refers to the tax relief given to businesses on their capital expenditure. It allows businesses to deduct a percentage of their qualifying capital expenditure from their taxable profits, reducing their overall tax liability.

02

Identify the assets that qualify for capital allowances. This includes tangible assets such as machinery, equipment, vehicles, and buildings. It also includes certain intangible assets like patents and copyrights. Make sure to consult the tax regulations of your specific jurisdiction to determine what assets qualify for capital allowances.

03

Keep track of your capital expenditure. Maintain accurate records of your purchases and expenditures on qualifying assets. This will help you calculate the amount of capital allowances you are eligible to claim.

04

Calculate the amount of capital allowances you can claim. Different assets have different rates of capital allowances. Consult the applicable tax regulations to determine the rate applicable to each asset category, and calculate the amount accordingly.

05

Claim your capital allowance on your tax return. Make sure to accurately complete the relevant sections of your tax return form to claim the capital allowances. Provide the necessary details and include the calculated amounts for each asset category.

Who needs maximising capital allowances?

01

Small businesses: Capital allowances can be particularly beneficial for small businesses with limited financial resources. Maximizing their capital allowances can help reduce their overall tax liability and improve their cash flow.

02

Startups: New businesses often have high capital expenditure as they invest in infrastructure, equipment, and technology. Maximizing capital allowances can help startups reduce their tax burden during their initial years of operation.

03

Businesses with significant capital expenditure: Any business that has significant capital expenditure on qualifying assets can benefit from maximizing their capital allowances. This includes industries such as manufacturing, construction, and transportation that rely heavily on machinery and equipment.

04

Property owners: Property owners, including landlords, can also benefit from maximizing capital allowances. They can claim allowances on certain capital expenditure related to their properties, such as renovations, improvements, and fixtures.

05

Businesses in countries with favorable tax incentives: Some countries offer enhanced capital allowances as a way to attract investment and stimulate economic growth. Businesses operating in these jurisdictions can take advantage of maximising their capital allowances to optimize their tax savings.

Remember, it is important to consult with a tax advisor or specialist to ensure compliance with the specific regulations and requirements related to maximising capital allowances in your jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is maximising capital allowance?

Maximising capital allowance is the process of maximizing tax deductions on eligible capital expenditures.

Who is required to file maximising capital allowance?

Businesses and individuals who have incurred capital expenditures are required to file for maximising capital allowance.

How to fill out maximising capital allowance?

To fill out maximising capital allowance, one must accurately report all eligible capital expenditures and claim the appropriate allowances.

What is the purpose of maximising capital allowance?

The purpose of maximising capital allowance is to reduce taxable income by claiming deductions on capital expenditures, ultimately lowering tax liability.

What information must be reported on maximising capital allowance?

Information such as details of capital expenditures, dates of purchases, depreciation rates, and applicable tax laws must be reported on maximising capital allowance.

How do I modify my maximising capital allowance in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your maximising capital allowance and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit maximising capital allowance from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your maximising capital allowance into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send maximising capital allowance to be eSigned by others?

Once your maximising capital allowance is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Fill out your maximising capital allowance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maximising Capital Allowance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.