Get the free Correspondent Lending Underwriting Review Policy

Show details

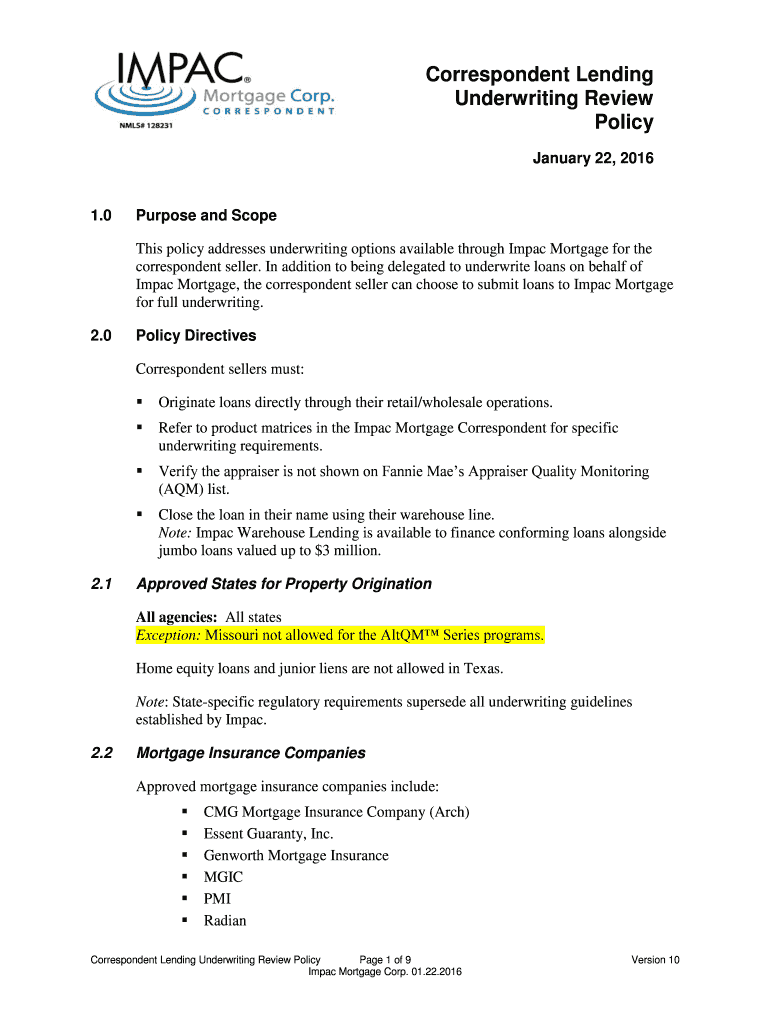

Correspondent Lending Underwriting Review Policy January 22, 2016 1.0 Purpose and Scope This policy addresses underwriting options available through Impact Mortgage for the correspondent seller. In

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign correspondent lending underwriting review

Edit your correspondent lending underwriting review form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your correspondent lending underwriting review form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit correspondent lending underwriting review online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit correspondent lending underwriting review. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out correspondent lending underwriting review

How to fill out a correspondent lending underwriting review:

01

Start by gathering all the necessary documents and information needed for the review process. This may include loan applications, financial statements, credit reports, and any supporting documentation.

02

Review the loan file thoroughly, paying attention to important details such as the borrower's credit history, income verification, and collateral value. This step helps in identifying potential risks and determining if the loan meets the lender's underwriting guidelines and criteria.

03

Assess the borrower's ability to repay the loan by analyzing various factors like income stability, employment history, and debt-to-income ratio. This helps in determining the borrower's creditworthiness and the likelihood of loan default.

04

Evaluate the property's value and ensure that it meets the lender's collateral requirements. This includes ordering and reviewing property appraisals, verifying the property's title, and assessing any potential risks associated with the property.

05

Verify the accuracy of all information provided in the loan file and ensure compliance with relevant federal, state, and local regulations. This includes reviewing the loan disclosures, compliance documents, and verifying the borrower's identification and legal documents.

06

Create a comprehensive underwriting analysis or summary report, highlighting the key findings, risks, and recommendations. This report serves as a basis for making an informed lending decision and providing appropriate loan terms and conditions.

07

Communicate with relevant parties involved in the lending process, such as loan officers, processors, and underwriting managers. This ensures that all necessary information is obtained and any clarifications or issues are addressed promptly.

08

Make a final underwriting decision based on the review findings, lender's underwriting guidelines, and risk tolerance. This decision may include approving the loan, denying it, or attaching conditions for approval.

Who needs correspondent lending underwriting review?

01

Mortgage lenders or financial institutions that engage in correspondent lending transactions usually require correspondent lending underwriting reviews. These reviews are performed to assess the quality and suitability of loans originating from third-party correspondents before committing to purchasing or funding them.

02

Mortgage investors, such as government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac, also conduct correspondent lending underwriting reviews to ensure that the loans they purchase or securitize meet their underwriting standards and guidelines.

03

Borrowers indirectly benefit from correspondent lending underwriting reviews as it helps ensure that the loans they receive are of high quality, properly underwritten, and comply with relevant regulations. This ultimately reduces the risk of loan default and promotes a healthy mortgage market.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my correspondent lending underwriting review in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your correspondent lending underwriting review as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I fill out correspondent lending underwriting review using my mobile device?

Use the pdfFiller mobile app to complete and sign correspondent lending underwriting review on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit correspondent lending underwriting review on an iOS device?

Use the pdfFiller mobile app to create, edit, and share correspondent lending underwriting review from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is correspondent lending underwriting review?

Correspondent lending underwriting review is the process of evaluating and verifying the underwriting decisions made by correspondent lenders for mortgage loans.

Who is required to file correspondent lending underwriting review?

Correspondent lenders are required to file correspondent lending underwriting review.

How to fill out correspondent lending underwriting review?

Correspondent lenders must provide detailed information about the underwriting process, loan documentation, and decision-making criteria.

What is the purpose of correspondent lending underwriting review?

The purpose of correspondent lending underwriting review is to ensure that the underwriting decisions made by correspondent lenders are in compliance with regulations and guidelines.

What information must be reported on correspondent lending underwriting review?

Correspondent lenders must report information such as loan-to-value ratios, credit scores, income verification, and property valuation.

Fill out your correspondent lending underwriting review online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Correspondent Lending Underwriting Review is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.