DoL 5500 - Schedule I 2014 free printable template

Show details

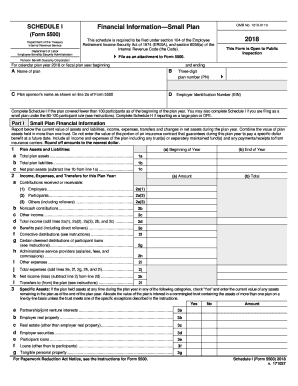

SCHEDULE I OMB No. 1210-0110 Financial Information Small Plan (Form 5500) Department of the Treasury Internal Revenue Service Department of Labor Employee Benefits Security Administration This schedule

pdfFiller is not affiliated with any government organization

Instructions and Help about DoL 5500 - Schedule I

How to edit DoL 5500 - Schedule I

How to fill out DoL 5500 - Schedule I

Instructions and Help about DoL 5500 - Schedule I

How to edit DoL 5500 - Schedule I

To edit the DoL 5500 - Schedule I form, access a digital copy of the form using pdfFiller's editing tools. Start by uploading the form to your pdfFiller account. Use the editing options available to make necessary changes, ensuring that all information remains accurate and up-to-date before saving your changes.

How to fill out DoL 5500 - Schedule I

Filling out the DoL 5500 - Schedule I involves several steps. Follow these general guidelines:

01

Begin by entering your organization's name and identifying number.

02

Complete the financial information section, providing accurate figures related to plan income and expenses.

03

Sign the form to confirm accuracy, and prepare for submission.

Ensure all details are thoroughly checked to avoid delays in processing or potential penalties.

About DoL 5500 - Schedule I 2014 previous version

What is DoL 5500 - Schedule I?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About DoL 5500 - Schedule I 2014 previous version

What is DoL 5500 - Schedule I?

The DoL 5500 - Schedule I is a supplementary form used for reporting information about employee benefit plans. Specifically, it provides detailed tax and financial data related to the operations of these plans, ensuring compliance with federal regulations.

What is the purpose of this form?

The primary purpose of the DoL 5500 - Schedule I is to collect data on the financial condition of employee benefit plans. This form helps the U.S. Department of Labor (DoL) and the Internal Revenue Service (IRS) monitor compliance with ERISA (Employee Retirement Income Security Act) requirements and tax laws. Accurate reporting through this form is vital for regulatory oversight.

Who needs the form?

The DoL 5500 - Schedule I must be completed by employee benefit plans that fall under the coverage of ERISA, typically including pension plans and welfare benefit plans. Organizations that maintain such plans, regardless of their size, are generally required to file this form annually to remain compliant with federal regulations.

When am I exempt from filling out this form?

Exemptions from filing the DoL 5500 - Schedule I may apply under certain conditions. For instance, plans with fewer than 100 participants at the beginning of the plan year may qualify for a simplified filing process, potentially negating the need to file this particular form. Additionally, some governmental plans and church plans may also be exempt.

Components of the form

The DoL 5500 - Schedule I includes various components, including sections for plan identification, financial information, and participant data. Each section is designed to capture specific aspects of the plan’s operations and finances, ensuring a comprehensive overview that meets regulatory demands.

What are the penalties for not issuing the form?

Failing to issue the DoL 5500 - Schedule I can result in significant penalties, including monetary fines. The IRS may impose a penalty of $250 per day for each day the form is late, with a maximum penalty of $150,000. This underscores the importance of timely and accurate reporting.

What information do you need when you file the form?

When filing the DoL 5500 - Schedule I, gather comprehensive information about the employee benefit plan, including:

01

Plan name and type.

02

Employer identification number.

03

Financial statements showing income and expenses.

04

Historical data about plan participants.

Having this information readily available will facilitate the filing process and enhance accuracy.

Is the form accompanied by other forms?

The DoL 5500 - Schedule I can be submitted alongside other related forms as part of the Annual Return/Report of Employee Benefit Plan. In many cases, it complements other schedules that may be necessary based on the specifics of the benefit plan being reported.

Where do I send the form?

The completed DoL 5500 - Schedule I must be submitted electronically to the Department of Labor. Utilize the DOL's EFAST2 system for submission, ensuring that all parts of the form are correctly filled out to avoid issues with processing. Refer to the DOL's official guidelines for details on acceptable submission formats.

See what our users say