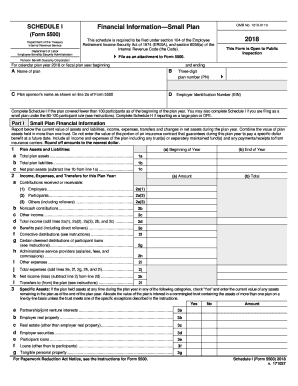

DoL 5500 - Schedule I 2014 free printable template

Instructions and Help about DoL 5500 - Schedule I

How to edit DoL 5500 - Schedule I

How to fill out DoL 5500 - Schedule I

About DoL 5500 - Schedule I 2014 previous version

What is DoL 5500 - Schedule I?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about DoL 5500 - Schedule I

What should I do if I realize I've made a mistake after submitting my DoL 5500 - Schedule I?

If you've made a mistake on your DoL 5500 - Schedule I after filing, it's important to submit an amended return. Clearly indicate the corrections and provide any necessary explanations. It's advisable to keep a copy of the original submission for your records to support any changes made during the amendment process.

How can I verify the status of my DoL 5500 - Schedule I submission?

To verify the status of your DoL 5500 - Schedule I submission, you can check the filing history through the e-filing platform you used. Look for confirmation emails or notifications indicating the filing status. If you encounter e-file rejection codes, the platform usually provides guidance on how to resolve those specific issues.

What are some common errors in filing the DoL 5500 - Schedule I, and how can I avoid them?

Common errors in filing the DoL 5500 - Schedule I include incorrect identification numbers and failing to report all necessary transactions. To avoid these, double-check the accuracy of all information before submission. Utilize reliable software that ensures compliance and accuracy, and consider a pre-filing checklist to capture all requirements.

Can I file the DoL 5500 - Schedule I on behalf of someone else, and what should I know?

Yes, you can file the DoL 5500 - Schedule I on behalf of another individual if you have the legal authority, such as a Power of Attorney (POA). Make sure all necessary documentation is in place, and clearly indicate the relationship and authority in the filing to avoid complications during processing.

What are the data security measures I need to consider when e-filing the DoL 5500 - Schedule I?

When e-filing the DoL 5500 - Schedule I, it is crucial to use secure platforms that comply with data privacy regulations. Ensure that your internet connection is secure and consider using encrypted email services when transmitting sensitive information. Familiarize yourself with the software's security features to protect your data.