Get the free Types of Retirement Plans - isitelpsorg - isite lps

Show details

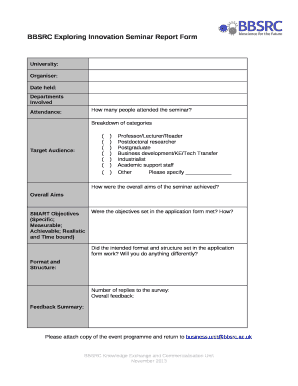

Chapter 6, Section 3 : Special Savings Plans and Goals Name Date Period Investing for Retirement Types of Retirement Plans 401(k) Keogh IRA *Company Plan Roth IRA *Individual/married couples plan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign types of retirement plans

Edit your types of retirement plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your types of retirement plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit types of retirement plans online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit types of retirement plans. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out types of retirement plans

How to fill out types of retirement plans?

01

Start by researching different types of retirement plans available. This can include 401(k) plans, individual retirement accounts (IRAs), Roth IRAs, and pension plans. Understand the features and benefits of each plan to make an informed decision.

02

Assess your financial situation and long-term goals. Consider factors such as your age, income, desired retirement age, risk tolerance, and investment knowledge. This will help you determine the type of retirement plan that best suits your needs.

03

Consult with a financial advisor or retirement planning professional. Seek expert advice to understand the nuances of each retirement plan option and how they can align with your goals. They can help you navigate through the complexities and provide personalized recommendations.

04

Review and compare different retirement plans offered by employers, if applicable. Some companies provide retirement benefits to their employees, such as a 401(k) plan with employer matching contributions. Understand the eligibility criteria, contribution limits, and investment options offered by your employer's retirement plan.

05

Complete the necessary paperwork to enroll in the chosen retirement plan. This may include filling out forms provided by your employer or financial institution offering the retirement plan. Provide accurate and up-to-date information to ensure a smooth enrollment process.

06

Determine your contribution amount. Decide how much you are willing and able to contribute to your retirement plan regularly. Be aware of any contribution limits set by the Internal Revenue Service (IRS) for each type of retirement plan.

07

Choose your investment options. Once enrolled, you will have the opportunity to select how your retirement funds are invested. Consider your risk tolerance and investment objectives when making these decisions. Seek professional advice if needed.

Who needs types of retirement plans?

01

Employees: Individuals who are employed should consider retirement plans offered by their employers. These plans often provide an opportunity for employees to save for retirement through pre-tax contributions, employer matching contributions, and potential tax advantages.

02

Self-employed individuals: Freelancers, entrepreneurs, and self-employed individuals should explore retirement plan options specifically designed for them, such as Simplified Employee Pension (SEP) IRAs or solo 401(k) plans. These plans offer flexibility and tax advantages for those with variable incomes.

03

Individuals without employer-sponsored plans: People who don't have access to employer-sponsored retirement plans can still save for the future through IRAs, Roth IRAs, or other individual retirement options. These plans offer a range of investment choices and potential tax advantages.

04

Individuals looking to supplement existing retirement savings: Retirement plans can be a valuable addition to existing retirement savings. Whether you have a pension, social security, or personal savings, a retirement plan can provide an extra layer of financial security during retirement.

In conclusion, understanding how to fill out different types of retirement plans involves research, assessment of personal goals, consulting with professionals, completing necessary paperwork, making investment decisions, and considering individual financial situations. Retirement plans are beneficial for employees, the self-employed, individuals without employer-sponsored plans, and those looking to supplement existing retirement savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is types of retirement plans?

There are various types of retirement plans such as 401(k), IRA, pension plans, and profit-sharing plans.

Who is required to file types of retirement plans?

Employers who offer retirement plans to their employees are required to file types of retirement plans.

How to fill out types of retirement plans?

Types of retirement plans can be filled out by completing the necessary forms provided by the plan administrator or financial institution.

What is the purpose of types of retirement plans?

The purpose of types of retirement plans is to help individuals save for retirement and ensure financial security in their later years.

What information must be reported on types of retirement plans?

Types of retirement plans must report details such as employee contributions, employer contributions, investment options, and plan performance.

How do I modify my types of retirement plans in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your types of retirement plans and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send types of retirement plans for eSignature?

To distribute your types of retirement plans, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit types of retirement plans on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign types of retirement plans on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your types of retirement plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Types Of Retirement Plans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.