Get the free CORPORATION PARTNERSHIP OR LIMITED LIABILITY COMPANY

Show details

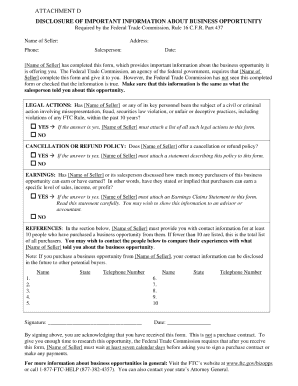

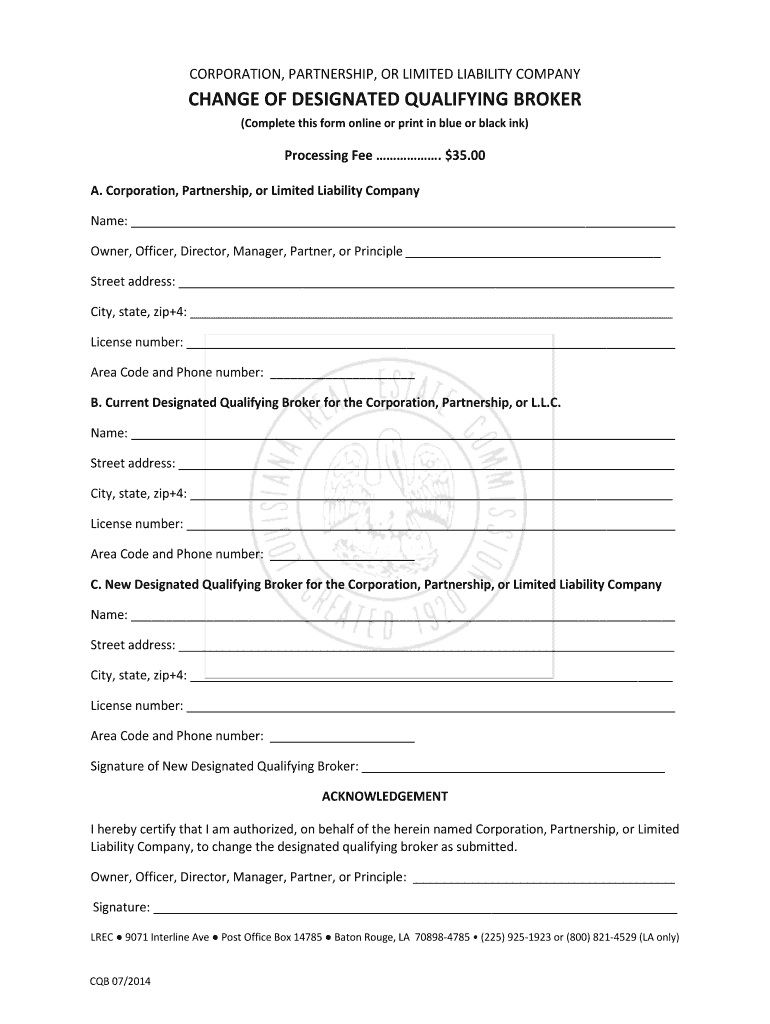

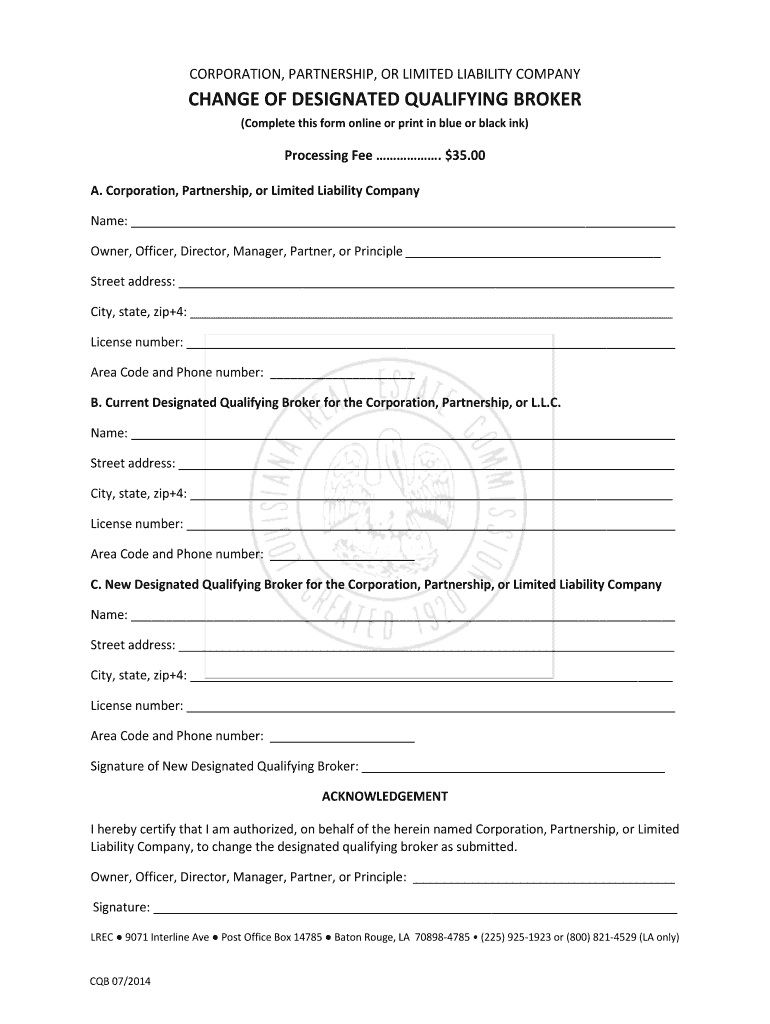

CLEAR FORM CORPORATION, PARTNERSHIP, OR LIMITED LIABILITY COMPANY CHANGE OF DESIGNATED QUALIFYING BROKER (Complete this form online or print in blue or black ink) Processing Fee. $35.00 A. Corporation,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporation partnership or limited

Edit your corporation partnership or limited form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporation partnership or limited form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporation partnership or limited online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit corporation partnership or limited. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporation partnership or limited

How to fill out corporation partnership or limited?

01

Start by choosing the type of entity you want to form - corporation, partnership, or limited liability company (LLC). Each has its own benefits and requirements, so it is important to carefully consider your specific needs and consult with legal and tax professionals.

02

Research and choose a suitable business name for your entity. Make sure it complies with all legal requirements and is not already in use by another business. You can check with your state's secretary of state office or online business name databases.

03

Prepare and file the necessary formation documents with the appropriate state agency. This typically involves completing a formation application, paying the required fees, and submitting any additional required information or documents.

04

Determine the structure and ownership of the entity. For corporations, this involves issuing shares of stock to shareholders and appointing directors and officers. For partnerships, you need to define the roles and responsibilities of each partner and establish a partnership agreement. LLCs require the creation of operating agreements and the allocation of membership interests.

05

Obtain any necessary licenses or permits required for your specific industry or location. This may include business licenses, professional licenses, or permits related to specific activities.

06

Obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This unique number is used for tax purposes and is typically required for most businesses, even if you don't have employees.

07

Register for state and local taxes as required by your jurisdiction. This may include sales tax, payroll tax, or other types of taxes based on the nature of your business.

Who needs corporation partnership or limited?

01

Entrepreneurs looking to protect their personal assets and limit liability for business debts and obligations may choose to form a corporation, partnership, or limited liability company.

02

Businesses planning to raise capital by selling shares to investors often opt for a corporation structure. This allows for the issuance of stock and helps attract potential investors.

03

Partnerships are commonly formed by individuals or businesses working together and pooling resources, expertise, or capital for a common purpose. Partnerships offer flexibility and shared decision-making.

04

Limited liability companies (LLCs) are popular among small business owners as they provide liability protection, tax flexibility, and reduced administrative requirements compared to corporations.

05

Individuals looking to engage in a business venture with other parties and share profits, losses, and management responsibilities might consider forming a partnership or limited liability company.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the corporation partnership or limited electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your corporation partnership or limited in seconds.

Can I create an electronic signature for signing my corporation partnership or limited in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your corporation partnership or limited right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I complete corporation partnership or limited on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your corporation partnership or limited. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is corporation partnership or limited?

A corporation partnership or limited refers to a business entity formed by two or more individuals or entities for the purpose of conducting business.

Who is required to file corporation partnership or limited?

All corporations, partnerships, and limited liability companies are required to file corporation partnership or limited.

How to fill out corporation partnership or limited?

To fill out corporation partnership or limited, you will need to provide information about the business entity, its owners, and financial activities.

What is the purpose of corporation partnership or limited?

The purpose of corporation partnership or limited is to ensure transparency and accountability in business activities.

What information must be reported on corporation partnership or limited?

Information such as financial statements, ownership details, and business activities must be reported on corporation partnership or limited.

Fill out your corporation partnership or limited online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporation Partnership Or Limited is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.