Get the free Changes to US Taxation

Show details

Seminar Edmonton Branch Presents: Changes to US Taxation Thursday, January 30, 2014, Registration: 3:30 pm Seminar: 4:00 pm 6:00 pm Speaker: Roy A. Berg, JD, ELM, TEP, Moody's Gartner Tax Law LLP

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign changes to us taxation

Edit your changes to us taxation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your changes to us taxation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

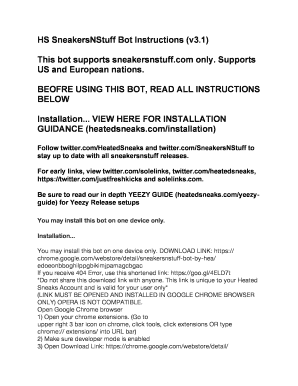

Editing changes to us taxation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit changes to us taxation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out changes to us taxation

01

To fill out changes to US taxation, gather all the necessary documents and forms required by the Internal Revenue Service (IRS). These documents may include W-2 forms, 1099 forms, and any other relevant tax documents.

02

Ensure that you have the latest tax forms and publications, which can be obtained from the IRS website or local IRS offices. These forms may vary depending on the specific changes to US taxation that have been implemented.

03

Review the instructions provided with each form carefully. This will help you understand the specific requirements for reporting and filling out the changes to US taxation correctly. Ensure that you follow all the guidelines and provide accurate information.

04

Calculate your taxable income and deductions according to the new changes in US taxation laws. It is essential to stay updated on any changes to tax rates, deductions, or credits that may impact your tax liability. Consult IRS publications or professional tax advisors if needed.

05

Make sure to keep detailed records of any supporting documentation or evidence for your tax claims, such as receipts, invoices, and financial statements. This will help substantiate your deductions or avoid any discrepancies during an audit.

06

If you are unsure about any specific changes or have complex tax situations, consider seeking assistance from a professional tax preparer or accountant. They can provide expert guidance tailored to your individual needs and ensure accurate completion of your tax return.

Who needs changes to US taxation?

01

Individuals: Any individual who must file an annual tax return in the United States is subject to changes in US taxation. This includes both US citizens and resident aliens, as well as certain non-resident aliens who earn income within the US.

02

Businesses: Any business entity operating in the US, including corporations, partnerships, sole proprietorships, and limited liability companies, must comply with changes to US taxation laws. They are required to file various types of tax returns, such as income tax returns, payroll tax returns, and sales tax returns, depending on their specific circumstances.

03

Investors: Investors who earn income from capital gains, dividends, or interest are also affected by changes in US taxation. These individuals must report their investment earnings and follow the appropriate tax rules and regulations.

04

Retirees: Retirees receiving retirement benefits, such as Social Security, pensions, or distributions from retirement accounts, need to understand and adhere to changes in US taxation. They must accurately report their retirement income and claim any applicable deductions or credits.

In conclusion, anyone who is subject to US taxation, including individuals, businesses, investors, and retirees, needs to stay informed about and fill out any changes to US taxationaccording to the guidelines and instructions provided by the IRS. It is crucial to provide accurate and complete information to ensure compliance with tax laws and avoid any penalties or legal issues.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is changes to us taxation?

Changes to US taxation refer to any adjustments, modifications, or updates made to the tax laws and regulations in the United States.

Who is required to file changes to us taxation?

Anyone who is subject to US taxation, including individuals, businesses, and other entities, may be required to file changes to US taxation.

How to fill out changes to us taxation?

Changes to US taxation can be filled out by following the specific instructions provided by the Internal Revenue Service (IRS) on the appropriate forms or online platforms.

What is the purpose of changes to us taxation?

The purpose of changes to US taxation is to ensure compliance with tax laws, collect revenue for government programs, and promote fairness in taxation.

What information must be reported on changes to us taxation?

The information that must be reported on changes to US taxation varies depending on the specific changes being made, but typically includes income, deductions, credits, and other financial data.

How can I modify changes to us taxation without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your changes to us taxation into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make edits in changes to us taxation without leaving Chrome?

changes to us taxation can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit changes to us taxation on an Android device?

You can make any changes to PDF files, such as changes to us taxation, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your changes to us taxation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Changes To Us Taxation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.