Get the free Meals Tax Registration - town hamilton va

Show details

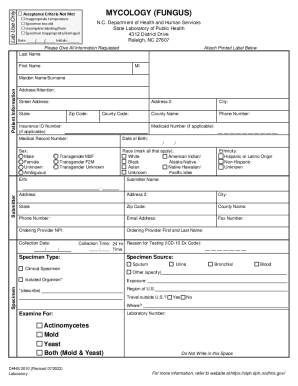

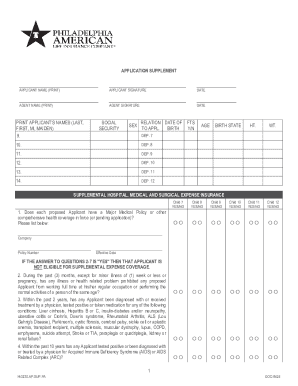

This document serves as a registration form for the Meals Tax in the Town of Hamilton, requiring owner and business information along with various identification numbers and a declaration of business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign meals tax registration

Edit your meals tax registration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your meals tax registration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing meals tax registration online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit meals tax registration. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out meals tax registration

How to fill out Meals Tax Registration

01

Gather necessary information about your business, including the business name, address, and contact details.

02

Determine the type of meals you will be selling (e.g., dine-in, take-out, or catering).

03

Fill out the Meals Tax Registration form provided by your local tax authority.

04

Provide details on estimated revenue from meals sales to help calculate potential tax obligations.

05

Include your tax ID number if applicable, and any other required identification numbers.

06

Sign and date the form to certify the information provided is accurate.

07

Submit the completed registration form to your local tax office, either in person or via the specified online portal.

Who needs Meals Tax Registration?

01

Any business that sells prepared meals or beverages, including restaurants, cafes, food trucks, and catering services.

02

Food vendors that offer meals for consumption on or off the premises.

03

Anyone operating a business with a kitchen or food service that involves charging for meals.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax on food in the US?

State laws vary widely as to what goods are subject to tax. Food for preparation and consumption in the home is often not taxable, nor are prescription medications. By contrast, restaurant meals are often taxed. Many states provide exemptions for some specific types of goods and not for other types.

What is MA meals tax?

Introduction. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. The tax is 6.25% of the sales price of the meal.

What is US food tax?

The “grocery tax” is a sales tax applied to food items purchased for home consumption. While many US states have made groceries exempt from sales tax to reduce the burden on lower-income households, some states tax groceries either at a standard or reduced sales tax rate.

What is a local meal tax?

Additionally, 13 of the 50 largest cities impose extra meals taxes — i.e., special taxes that apply to purchases of prepared foods for immediate consumption — while 37 do not charge a higher tax on meals than on other goods.

What counts as local tax?

A local tax is an assessment by a state, county, or municipality to fund public services ranging from schools and highways to garbage collection and sewer maintenance. Local taxes come in many forms, from property taxes and payroll taxes to sales taxes and licensing fees.

What is NH rooms and meals tax?

The M&R Tax is paid by the consumer and is collected and remitted to the State on the 15th of each month by operators of hotels, restaurants, or other businesses providing taxable meals, room rentals, and motor vehicle rentals. The tax rate is 8.5% for taxable periods beginning October 1, 2021.

What is the local meal tax in Massachusetts?

Massachusetts meals tax vendors are responsible for: Registering with DOR to collect the sales tax on meals. Collecting a 6.25% sales tax (and, where applicable, a 0.75% local option meals excise) on all taxable sales of meals.

What is a local meals tax?

Meals taxes are special taxes that apply to purchases of prepared foods for immediate consumption, and not just to meals eaten in a restaurant. They do not, however, apply to groceries or other non-prepared foods.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Meals Tax Registration?

Meals Tax Registration is the process through which businesses that sell prepared food and drinks are registered for collecting and remitting meals tax to the appropriate taxing authority.

Who is required to file Meals Tax Registration?

Any business that sells prepared food or drinks for consumption, such as restaurants, cafes, and catering services, is required to file for Meals Tax Registration.

How to fill out Meals Tax Registration?

To fill out Meals Tax Registration, a business typically needs to provide details such as the business name, address, type of food service, and any existing tax identification numbers on the designated form provided by the taxing authority.

What is the purpose of Meals Tax Registration?

The purpose of Meals Tax Registration is to ensure that businesses are compliant with local tax laws regarding the sale of prepared meals and beverages, thereby facilitating the collection of taxes that fund local services and infrastructure.

What information must be reported on Meals Tax Registration?

The information that must be reported typically includes the business name, address, owner's contact information, type of food sold, tax identification number, and any applicable licenses or permits.

Fill out your meals tax registration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Meals Tax Registration is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.