Get the free Trust Based or Will Based Estate Plan.pub

Show details

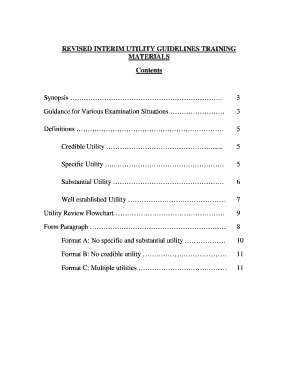

Lunch and Learn Bring your lunch to class! Trust Based or Will Based Estate Plan & Win Loyalty and Close More Transactions How to build loyalty, referrals and clients by presenting yourself as a professional

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trust based or will

Edit your trust based or will form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trust based or will form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trust based or will online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit trust based or will. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trust based or will

How to Fill Out a Trust-Based or Will?

01

Gather essential information: Start by collecting all the necessary information about your assets, beneficiaries, and any specific instructions or wishes you have for the distribution of your estate.

02

Decide on the type of document: Determine whether you want to create a trust-based estate plan or a will. Trust-based estate plans offer more flexibility and privacy but may require additional steps, while wills are simpler and more commonly used.

03

Consult an attorney or use an online resource: Seek professional guidance from an attorney who specializes in estate planning or utilize reputable online platforms that offer easy-to-use templates and guided instructions to ensure accuracy.

04

Draft the document: Whether you choose to work with an attorney or use an online resource, follow the provided guidelines to draft your trust-based estate plan or will. Make sure to include all necessary provisions such as the appointment of a trustee, guardian for minor children, and specific bequests.

05

Review and make revisions: Carefully review the drafted document for accuracy and completeness. Consider seeking feedback from family members or trusted advisors to ensure that your intentions are properly reflected.

06

Sign and execute the document: Follow the legal requirements to properly sign and execute your trust-based estate plan or will. This often includes signing in the presence of witnesses or a notary public, depending on local laws.

Who Needs a Trust-Based or Will?

01

Individuals with significant assets: Trust-based estate plans are particularly beneficial for individuals with substantial wealth as they provide more options for tax planning, asset protection, and efficient asset distribution.

02

Parents with minor children: Creating a trust-based estate plan or will is crucial for parents with minor children as it allows them to appoint a guardian for their children's care and determine how their assets will be managed for the children's benefit until they reach adulthood.

03

Those with specific wishes for asset distribution: If you have specific instructions or conditions for the distribution of your assets, such as donating to charities or providing for certain family members, a trust-based estate plan or will ensures that your wishes are carried out accordingly.

04

Individuals seeking privacy: Trust-based estate plans provide a higher level of privacy compared to wills since trust administration generally occurs outside of public probate proceedings. If you prefer to keep your financial affairs confidential, a trust-based plan might be more suitable.

Remember, every individual's situation is unique, so it's advisable to consult with an estate planning attorney or professional to assess your specific needs and preferences when deciding between a trust-based estate plan or a will.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send trust based or will for eSignature?

When you're ready to share your trust based or will, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for signing my trust based or will in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your trust based or will and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out trust based or will on an Android device?

Use the pdfFiller app for Android to finish your trust based or will. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is trust based or will?

Trust based or will is a legal document that specifies how a person's assets should be managed and distributed after their death.

Who is required to file trust based or will?

The person who creates the trust or will is required to file it.

How to fill out trust based or will?

Trust based or will can be filled out with the assistance of a lawyer specializing in estate planning.

What is the purpose of trust based or will?

The purpose of trust based or will is to ensure that a person's assets are distributed according to their wishes after their death.

What information must be reported on trust based or will?

Trust based or will must include details of the assets owned by the person, the beneficiaries, and how the assets should be distributed.

Fill out your trust based or will online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trust Based Or Will is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.