Get the free Credit Card Loss Protection Offers:

Show details

FTC Consumer Alert Federal Trade Commission Bureau of Consumer Protection Office of Consumer and Business EducationCredit Card Loss Protection Offers: They're the Real Steal I got a call from a woman

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card loss protection

Edit your credit card loss protection form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card loss protection form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit card loss protection online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit card loss protection. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card loss protection

How to fill out credit card loss protection:

01

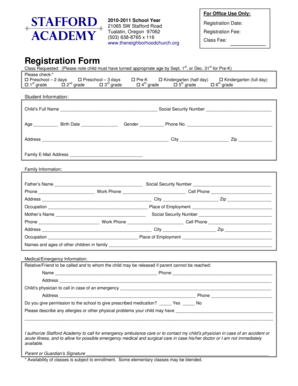

Contact your credit card issuer: To apply for credit card loss protection, you need to reach out to your credit card issuer. They will provide you with the necessary forms or guide you through the application process.

02

Complete the application form: Fill out the application form provided by your credit card issuer. This form will require your personal information, such as your name, address, contact information, and credit card details.

03

Provide necessary documentation: Along with the application form, you may need to submit certain documentation to authenticate your identity and verify your credit card ownership. This could include a copy of your identification documents, such as a driver's license or passport, as well as any additional information required by your credit card issuer.

04

Review and understand the terms and conditions: Before submitting your application, carefully review the terms and conditions of the credit card loss protection program. Take note of the coverage, limitations, and any associated costs or fees. Make sure you fully understand what is included and excluded from the protection.

05

Submit the application: Once you have completed the application form and gathered the necessary documentation, submit your application to your credit card issuer. Be sure to follow any specific instructions provided by them.

Who needs credit card loss protection?

01

Individuals who frequently use credit cards: If you regularly use credit cards for your purchases, having credit card loss protection can provide an additional layer of security in case your card is lost, stolen, or misused.

02

Travelers: Those who frequently travel, especially internationally, may benefit from credit card loss protection. It can offer financial protection if your credit card is lost or stolen while you are away from home.

03

Individuals concerned about fraud: If you are worried about unauthorized transactions or identity theft, having credit card loss protection can help alleviate some of those concerns. It may cover you for fraudulent charges made on your credit card.

04

People who want peace of mind: Credit card loss protection can provide peace of mind knowing that you have added protection in the event of a loss or theft. It offers an extra level of security and financial assistance if any unforeseen circumstances occur.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit card loss protection from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your credit card loss protection into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete credit card loss protection online?

pdfFiller has made it easy to fill out and sign credit card loss protection. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in credit card loss protection?

With pdfFiller, the editing process is straightforward. Open your credit card loss protection in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is credit card loss protection?

Credit card loss protection is a service provided by credit card companies that helps protect cardholders if their card is lost or stolen.

Who is required to file credit card loss protection?

Cardholders who have experienced a loss or theft of their credit card are required to file credit card loss protection.

How to fill out credit card loss protection?

To fill out credit card loss protection, cardholders typically need to contact their credit card company directly and provide details about the loss or theft.

What is the purpose of credit card loss protection?

The purpose of credit card loss protection is to help reduce the financial liability of cardholders in case their credit card is lost or stolen.

What information must be reported on credit card loss protection?

Cardholders must report details such as the date and time of the loss or theft, locations where the card was last used, and any unauthorized transactions.

Fill out your credit card loss protection online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Loss Protection is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.