LA DoR R-1009 2016-2026 free printable template

Show details

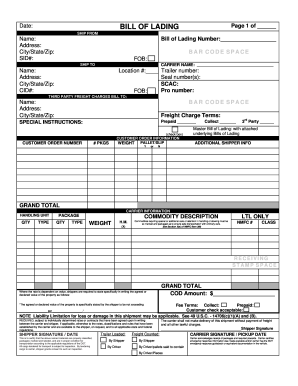

LGST 51-A R-1009 1/16 Shipbuilders of Vessels Over 50 Tons Load Displacement Louisiana Department of Revenue P. O. Box 201 Baton Rouge LA 70821-0201 Telephone 855 307-3893 Sales Tax Exemption Certificate Louisiana R*S* 47 305. 1 A Date mm/dd/yyyy Physical Address City State ZIP Mailing Address if different from physical address The above named purchaser hereby certifies that all materials equipment and machinery purchased from the vendor named below will enter into and become a component part...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign LA DoR R-1009

Edit your LA DoR R-1009 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your LA DoR R-1009 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit LA DoR R-1009 online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit LA DoR R-1009. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA DoR R-1009 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out LA DoR R-1009

How to fill out LA DoR R-1009

01

Obtain the LA DoR R-1009 form from the Louisiana Department of Revenue website or office.

02

Ensure you have all necessary information such as your business details, tax identification number, and relevant financial data.

03

Fill in the personal and business information sections accurately.

04

Complete any specific sections relevant to your reporting requirements, such as income, expenses, and deductions.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form.

07

Submit the completed form by the deadline either electronically or via mail as instructed.

Who needs LA DoR R-1009?

01

Businesses operating in Louisiana that need to report sales tax information.

02

Tax professionals or accountants managing tax filings for clients based in Louisiana.

03

Individuals or partnerships that have business operations impacting their tax responsibilities.

Fill

form

: Try Risk Free

People Also Ask about

What is a form 540 Louisiana?

If you need to change or amend an accepted Louisiana State Income Tax Return for the current or previous Tax Year, you need to complete Form IT-540 (residents) or Form IT-540B (nonresidents and part-year residents). Forms IT-540 and IT-540B are Forms used for the Tax Amendment.

Do I need to file form 540?

If you have a tax liability for 2022 or owe any of the following taxes for 2022, you must file Form 540. Tax on a lump-sum distribution. Tax on a qualified retirement plan including an Individual Retirement Arrangement (IRA) or an Archer Medical Savings Account (MSA).

Where can I get Louisiana state tax forms?

The Louisiana Department of Revenue, opens a new window (LDR) provides free digital copies, opens a new window of tax forms. You can also get tax forms mailed to you at no cost by ordering forms online, opens a new window or calling the LDR at 888.829. 3071 and selecting option 6.

What is form 540 used for?

The most common California income tax form is the CA 540. This form is used by California residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

When can I expect my Louisiana state tax refund?

For returns submitted electronically, taxpayers due refunds can expect them within 45 days of the filing date. For paper returns, the refund processing time is up to 14 weeks. Taxpayers can minimize delays in receiving their refunds by updating their contact information with LDR.

What is a power of attorney for the Louisiana Department of Revenue?

A Louisiana tax power of attorney (Form R-7006) is a form that allows a person to appoint a representative or representatives to make filings, obtain information, and otherwise act on their behalf in front of the Louisiana Department of Revenue.

What is Louisiana's highest tax?

The 2023 Tax Foundation rankings list Louisiana at the top in combined state and local sales taxes at 9.55%, five times higher than Alaska at 1.76%, the state with the lowest sales tax, USA Today Network reports.

What is the highest tax rate in Louisiana?

1, Louisiana's state sales tax of 4.45% ranks 38th from the top. But when that figure is added to the average local tax rate of 5.10%, the state's 9.55% combined rate becomes the highest among 50 states and the District of Columbia.

Which parish in Louisiana has the highest property taxes?

Who pays the most in property taxes? St. Tammany Parish (Covington, Sidell, Lewisburg) Orleans Parish (New Orleans) St. Charles Parish (St. Rose, Hahnville, Paradis) Jefferson Parish (New Orleans, Grand Isle, Metairie)

Who must file a Louisiana tax return?

Who must file. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return must file a Louisiana Individual Income Tax Return.

How to fill out Louisiana state tax form?

0:13 2:17 Form IT 540 Individual Income Return Resident - YouTube YouTube Start of suggested clip End of suggested clip Step 6 enter your federal itemized deductions on line 8a. Your federal standard deductions on lineMoreStep 6 enter your federal itemized deductions on line 8a. Your federal standard deductions on line 8b. Then subtract the ladder from the former enter the difference on line 8c.

How is Louisiana state income tax calculated?

Like the federal income tax, the Louisiana state income tax is based on income brackets, with marginal rates increasing as incomes increase. In total, there are three income brackets.Income Tax Brackets. Single FilersLouisiana Taxable IncomeRate$0 - $12,5001.85%$12,500 - $50,0003.50%$50,000+4.25% Jan 1, 2023

What is the format for Louisiana Revenue account Number?

The LA Department of Revenue Account Number for the Business can be found on the first page of your Louisiana income tax return, Louisiana sales tax return, or Louisiana employer withholding form. The format for the account # is #######-001 for Partnerships, LLCs, and Corporations.

How do I contact the Louisiana Department of Revenue sales tax?

Step 5: Determine if you will be liable for Louisiana Department of Revenue taxes. Contact the Taxpayer Services Division at (225) 219-7318 for information and an application. Additional information may also be obtained from any of the regional or district offices listed on the back of this brochure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send LA DoR R-1009 for eSignature?

To distribute your LA DoR R-1009, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I execute LA DoR R-1009 online?

Completing and signing LA DoR R-1009 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I edit LA DoR R-1009 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share LA DoR R-1009 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is LA DoR R-1009?

LA DoR R-1009 is a tax form used for reporting certain business income to the Louisiana Department of Revenue.

Who is required to file LA DoR R-1009?

Businesses operating in Louisiana that meet specific income thresholds or are subject to certain tax obligations are required to file LA DoR R-1009.

How to fill out LA DoR R-1009?

To fill out LA DoR R-1009, gather your business income information, complete the form by entering the required financial data, and ensure all sections are accurately filled out before submitting it to the Louisiana Department of Revenue.

What is the purpose of LA DoR R-1009?

The purpose of LA DoR R-1009 is to provide the Louisiana Department of Revenue with an official record of business income for accurate tax assessment and compliance.

What information must be reported on LA DoR R-1009?

LA DoR R-1009 requires reporting various details including gross income, expenses, taxable income, and other relevant financial information regarding the business's operations.

Fill out your LA DoR R-1009 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

LA DoR R-1009 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.