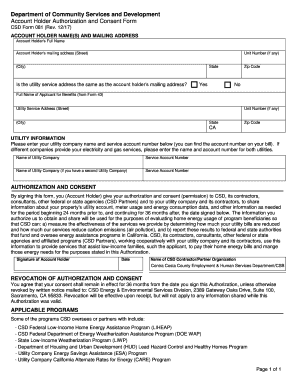

Get the free 2013 form 4797 - irs

Instructions and Help about IRS 4797

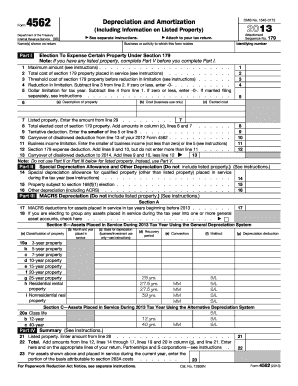

How to edit IRS 4797

How to fill out IRS 4797

About IRS 4 previous version

What is IRS 4797?

Who needs the form?

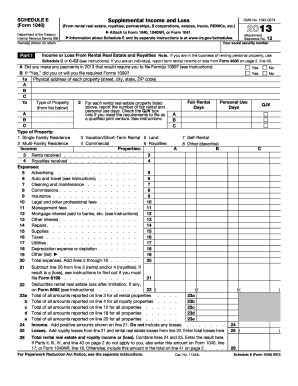

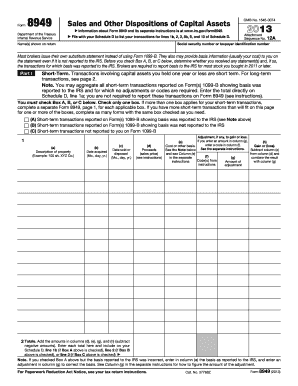

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about 2013 form 4797

How do I modify my [SKS] in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your [SKS] along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit [SKS] online?

With pdfFiller, the editing process is straightforward. Open your [SKS] in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out [SKS] on an Android device?

Use the pdfFiller Android app to finish your [SKS] and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is IRS 4797?

IRS Form 4797 is used to report the sale of business property, including the sale of depreciable assets, like a building or equipment.

Who is required to file IRS 4797?

Taxpayers who sell business property or certain depreciable property need to file IRS Form 4797.

How to fill out IRS 4797?

To fill out IRS Form 4797, report details of the property sold, including the sale price, cost basis, and any depreciation recaptured. Follow the instructions provided by the IRS.

What is the purpose of IRS 4797?

The purpose of IRS Form 4797 is to report gains and losses from the sale of business property and to determine the tax implications of those transactions.

What information must be reported on IRS 4797?

Information that must be reported on IRS Form 4797 includes the description of the property, date of sale, amount received, cost or other basis, and accumulated depreciation.