Get the free Conventional Loans With DTI Up To 58 - Integrity Credit Corporation

Show details

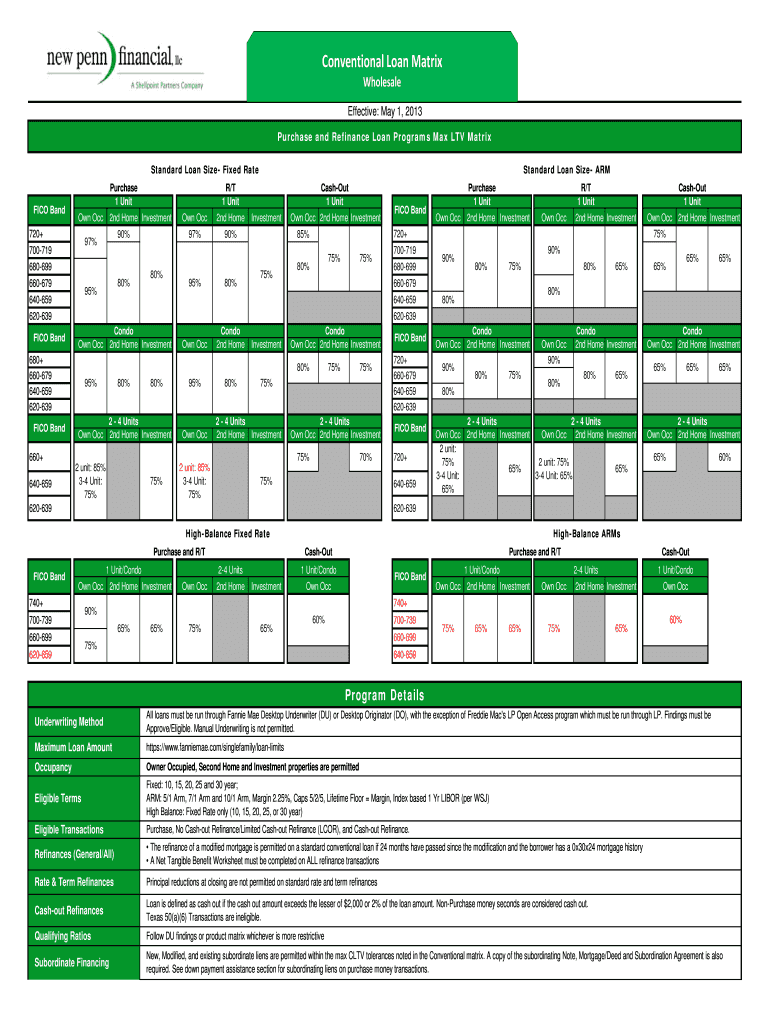

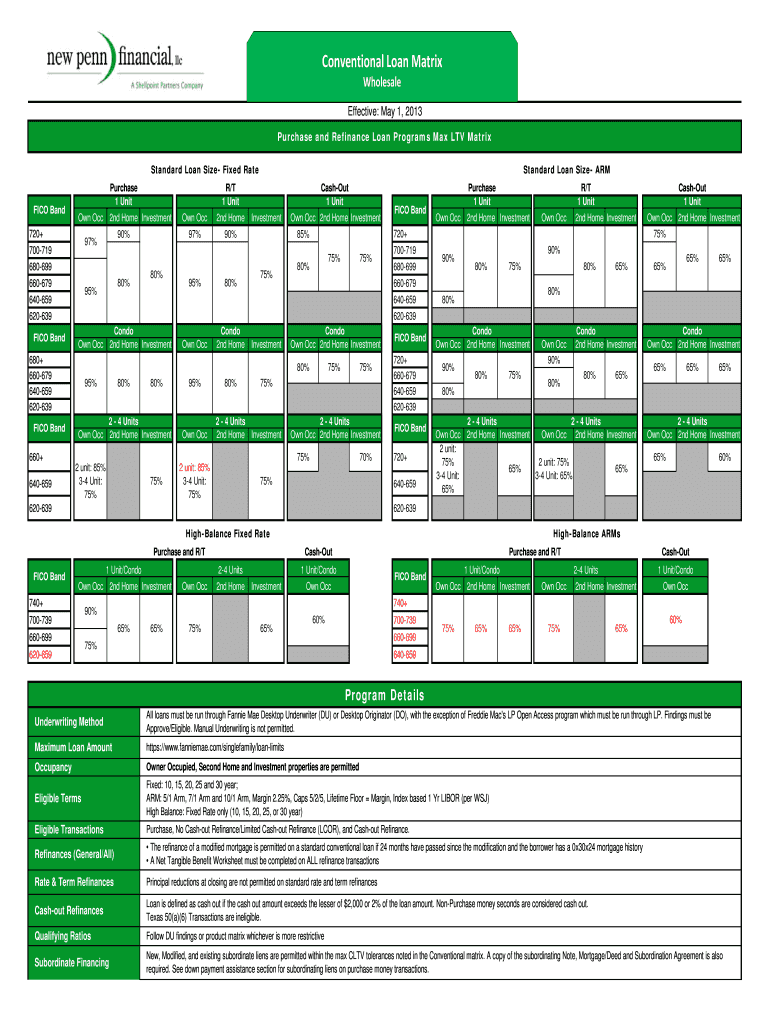

ConventionalLoanMatrix Wholesale Effective: May 1, 2013, Purchase and Refinance Loan Programs Max LTV Matrix Standard Loan Size Fixed Rate FICO Band Purchase 1 Unit Own OCC 720+ 2nd Home Investment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign conventional loans with dti

Edit your conventional loans with dti form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your conventional loans with dti form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing conventional loans with dti online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit conventional loans with dti. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out conventional loans with dti

How to fill out conventional loans with DTI:

01

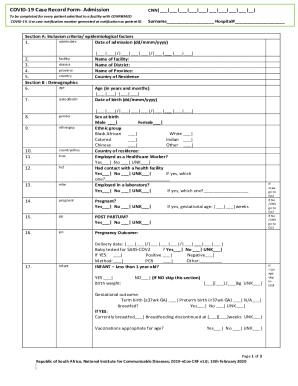

Gather your financial documents: To fill out conventional loans with DTI, you will need to provide documentation such as pay stubs, bank statements, tax returns, and any other evidence of your income and assets. Make sure you have these documents organized and readily available.

02

Calculate your debt-to-income ratio (DTI): The DTI is a crucial factor in determining your eligibility for a conventional loan. It is calculated by dividing your total monthly debt payments by your gross monthly income. Aim for a DTI ratio of 43% or lower to increase your chances of loan approval.

03

Complete the loan application: Fill out the loan application form accurately and completely. You will need to provide personal information, employment history, income details, and other relevant information. Make sure to double-check all the information before submitting the application.

04

Submit supporting documentation: Along with the loan application, you will need to submit the required supporting documentation. This may include your W-2 forms, tax returns, bank statements, and proof of other assets. Provide all the requested information to ensure a smooth loan processing.

05

Review and sign disclosure documents: Before your conventional loan can be approved, you will need to review and sign various disclosure documents. These documents outline the terms and conditions of the loan, including interest rates, repayment terms, and any additional fees or charges. Take the time to thoroughly read and understand these documents before signing them.

Who needs conventional loans with DTI?

01

Homebuyers: Individuals or families looking to purchase a home often need conventional loans with DTI. These loans can provide more favorable terms and interest rates compared to other types of loans. Meeting the required DTI ratio is essential to qualify for these loans.

02

Homeowners refinancing their mortgages: Homeowners who wish to refinance their existing mortgages may also require conventional loans with DTI. By refinancing, homeowners can potentially benefit from lower interest rates and reduce their monthly mortgage payments.

03

Real estate investors: Real estate investors who are interested in purchasing investment properties can also utilize conventional loans with DTI. These loans can help finance the purchase of rental properties, allowing investors to generate income from rental payments.

In summary, filling out conventional loans with DTI requires gathering necessary financial documents, calculating your DTI ratio, completing the loan application accurately, and submitting the required supporting documentation. Homebuyers, homeowners refinancing their mortgages, and real estate investors are some of the individuals who may need conventional loans with DTI.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find conventional loans with dti?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific conventional loans with dti and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit conventional loans with dti straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing conventional loans with dti right away.

Can I edit conventional loans with dti on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share conventional loans with dti from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is conventional loans with dti?

Conventional loans with dti refer to conventional loans that take into consideration the borrower's debt-to-income ratio.

Who is required to file conventional loans with dti?

Lenders are required to file conventional loans with dti.

How to fill out conventional loans with dti?

Conventional loans with dti can be filled out by providing information on the borrower's income, debt obligations, and other financial details.

What is the purpose of conventional loans with dti?

The purpose of conventional loans with dti is to assess the borrower's ability to repay the loan based on their income and existing debts.

What information must be reported on conventional loans with dti?

Information such as income, debts, and other financial obligations of the borrower must be reported on conventional loans with dti.

Fill out your conventional loans with dti online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Conventional Loans With Dti is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.