Canada Alberta AEHB 2939 2012 free printable template

Show details

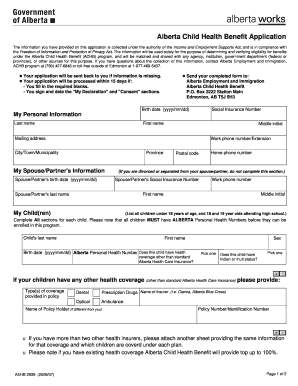

Alberta Child Health Benefit Application

The information you have provided on this application is collected under the authority of the Income and Employment Supports Act, and is managed in

accordance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada Alberta AEHB 2939

Edit your Canada Alberta AEHB 2939 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada Alberta AEHB 2939 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada Alberta AEHB 2939 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada Alberta AEHB 2939. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada Alberta AEHB 2939 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada Alberta AEHB 2939

How to fill out Canada Alberta AEHB 2939

01

Obtain the Canada Alberta AEHB 2939 form from the official government website or local office.

02

Fill in your personal information, including your name, address, and contact details, in the designated fields.

03

Specify the type of application or request you are making in the appropriate section.

04

Provide any supporting documentation required, such as proof of residency or identification.

05

Review your completed form for accuracy and ensure all necessary fields are filled out.

06

Sign and date the form where indicated.

07

Submit the completed form along with any supporting documents either online or by mail to the designated office.

Who needs Canada Alberta AEHB 2939?

01

Individuals or families residing in Alberta who need to apply for health benefits under the Alberta Health Care Insurance Plan.

02

Residents who are new to Alberta and need to register for health benefits.

03

Those who are looking to update their health coverage information, such as a change of address or personal details.

Fill

form

: Try Risk Free

People Also Ask about

How to apply for Alberta$ 600?

Seniors who are not receiving the Alberta Seniors Benefit and eligible parents with children under 18 can apply online through the government portal or in person at locations across the province.

Who is eligible for $600 in Canada?

Eligibility for Seniors: Age 65 or older by June 30, 2023. Adjusted household income is below $180,000 ing to your 2021 tax return. Alberta resident as of November 30, 2022, and remain so on the first day of each month between January and June to be eligible for each month's payment.

What is Alberta benefits?

The Alberta child and family benefit (ACFB) is a tax-free amount paid to families that have children under 18 years of age. For July 2022 to December 2022, you may be entitled to receive the following amounts: $1,330 ($110.83 per month) for the first child. $665 ($55.41 per month) for the second child.

How do you qualify for welfare in Alberta?

To be eligible for Income Support, you must meet a number of criteria. On this page: Age and residency.Ability to work are looking for work. are working but not earning enough. are unable to work for a short time. need help to access training to find a job. are unable to work due to chronic health problems or other concerns.

How do I claim the$ 600 Alberta affordability payments?

Apply online Once you have a 'verified' or 'pending verified' Alberta.ca Account, you can apply for your affordability payment online using the secure application portal. Applications will be accepted any time between January 18 and June 30, 2023. To complete your application online: Open the application portal.

How to apply for Alberta benefits?

From the myAlbertaSupports home page, click on the 'Apply Online' icon. Log in – Log in or create an account. You will be redirected to Alberta.ca Account. Choose applications – Choose the services and benefits you want to apply for.

How to apply for Alberta$ 600?

The only way to apply for the affordability payment or update your profile is through the secure online application portal, or in-person at an Alberta Registry or Alberta Supports Centre.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Canada Alberta AEHB 2939 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your Canada Alberta AEHB 2939 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I sign the Canada Alberta AEHB 2939 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your Canada Alberta AEHB 2939 in seconds.

How do I fill out the Canada Alberta AEHB 2939 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign Canada Alberta AEHB 2939 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is Canada Alberta AEHB 2939?

Canada Alberta AEHB 2939 is a form used in Alberta, Canada, for reporting certain tax-related information to the province's tax authority.

Who is required to file Canada Alberta AEHB 2939?

Individuals or businesses in Alberta that have specific tax obligations or transactions that must be reported to the Alberta tax authority are required to file this form.

How to fill out Canada Alberta AEHB 2939?

To fill out Canada Alberta AEHB 2939, provide accurate financial information as instructed in the form, ensuring all relevant fields are completed and any necessary documentation is attached.

What is the purpose of Canada Alberta AEHB 2939?

The purpose of Canada Alberta AEHB 2939 is to ensure compliance with provincial tax regulations and to report income, expenses, and other relevant financial data to the tax authority.

What information must be reported on Canada Alberta AEHB 2939?

Information that must be reported on Canada Alberta AEHB 2939 includes income earned, eligible expenses, tax credits, and any other details relevant to the taxpayer's financial situation.

Fill out your Canada Alberta AEHB 2939 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Alberta AEHB 2939 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.