Get the free Professional Indemnity Insurance Accountants Proposal Form - thepidesk co

Show details

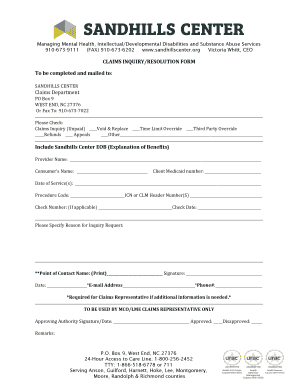

Professional Indemnity Insurance Accountants Proposal Form The PI Desk Ltd Suite B, Sheffield Business Center Europa Link, Sheffield, South Yorkshire, S9 1XZ Tel: 0114 242 1176 Fax: 0114 242 2372

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign professional indemnity insurance accountants

Edit your professional indemnity insurance accountants form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your professional indemnity insurance accountants form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing professional indemnity insurance accountants online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit professional indemnity insurance accountants. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out professional indemnity insurance accountants

How to fill out professional indemnity insurance for accountants:

01

Gather the necessary information: Before starting the application process, gather all the relevant information such as your business details, financial records, and any previous claims you've made.

02

Research insurance providers: Look for reputable insurance providers who specialize in professional indemnity insurance for accountants. Compare their coverage options, premium rates, and customer reviews to ensure you choose the best fit for your needs.

03

Start the application process: Contact the chosen insurance provider and request an application form for professional indemnity insurance. Fill out the form accurately, providing all the requested information, including your business structure, years of experience, and specific services you offer.

04

Determine the coverage amount: Assess the potential risks associated with your profession as an accountant and determine the appropriate coverage amount. This will depend on factors such as the size of your business, the types of clients you work with, and the value of the financial transactions you handle.

05

Provide details of previous claims: If you have previously made any claims on your professional indemnity insurance, disclose those details in the application. This will help the insurance provider assess your risk profile accurately.

06

Submit the application and supporting documents: Once you have completed the application form, submit it along with any supporting documents requested by the insurance provider. These may include financial statements, client contracts, or proof of qualifications.

07

Review the policy terms and conditions: After submitting the application, carefully review the policy terms and conditions provided by the insurance provider. Ensure you understand the coverage limits, exclusions, premiums, and any additional benefits or features.

08

Make any necessary adjustments: If there are any discrepancies or changes required in the policy terms, work with the insurance provider to make the necessary adjustments before finalizing the policy.

09

Pay the premium: Once you are satisfied with the policy terms and conditions, pay the premium amount as specified by the insurance provider. This typically involves either a one-time payment or monthly installments, depending on the chosen payment option.

10

Obtain your professional indemnity insurance policy: Once the premium is paid, the insurance provider will issue your professional indemnity insurance policy. Keep a copy of the policy in a secure location and ensure it is easily accessible when required.

Who needs professional indemnity insurance accountants?

01

Accountants in public practice: This includes self-employed accountants, accounting firms, auditors, and tax advisors who provide professional services to clients, such as preparing financial statements, offering tax advice, or conducting audits.

02

Financial consultants: Individuals or firms providing financial consulting services, including investment advice, retirement planning, or risk management, should consider professional indemnity insurance to protect themselves and their clients in case of professional negligence claims.

03

Bookkeepers: Bookkeepers who manage financial records and transactions for businesses should consider professional indemnity insurance as errors or omissions in their work could result in financial losses for their clients.

04

Forensic accountants: Forensic accountants who investigate financial fraud, perform business valuations, or provide expert witness testimony may also benefit from professional indemnity insurance to mitigate the risks associated with their specialized services.

It is crucial that all these professionals carefully assess their individual risks and consult with insurance professionals to determine the appropriate level of coverage for their specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is professional indemnity insurance accountants?

Professional indemnity insurance for accountants is a type of insurance coverage that protects accounting professionals against claims of professional negligence or errors and omissions.

Who is required to file professional indemnity insurance accountants?

Accountants who provide professional services to clients are typically required to have professional indemnity insurance.

How to fill out professional indemnity insurance accountants?

Professional indemnity insurance for accountants can be filled out by contacting insurance providers who offer this type of coverage.

What is the purpose of professional indemnity insurance accountants?

The purpose of professional indemnity insurance for accountants is to provide financial protection in case a client files a claim against the accountant for negligence or errors.

What information must be reported on professional indemnity insurance accountants?

Information such as the policy number, coverage dates, and details of the insured accountant's practice may need to be reported on the insurance documents.

How can I manage my professional indemnity insurance accountants directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your professional indemnity insurance accountants and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an eSignature for the professional indemnity insurance accountants in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your professional indemnity insurance accountants right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I complete professional indemnity insurance accountants on an Android device?

Complete professional indemnity insurance accountants and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your professional indemnity insurance accountants online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Professional Indemnity Insurance Accountants is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.