Get the free RE Transfer of your MRS Trust RESP Loan B2B Trust

Show details

130 Adelaide Street West Suite 200 Toronto, Ontario M5H 3P5 Toll Free 800.263.8349 b2btrust.com April 5, 2012, Recipient's name Street address City, Province Postal code RE: Transfer of your MRS Trust

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign re transfer of your

Edit your re transfer of your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your re transfer of your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit re transfer of your online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit re transfer of your. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

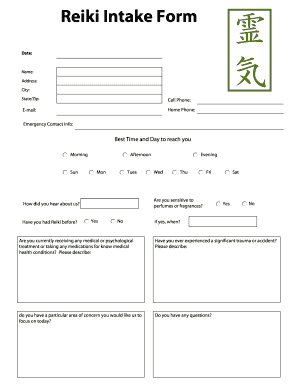

How to fill out re transfer of your

How to fill out re transfer of your:

01

Firstly, gather all the necessary information required for the re transfer, such as the recipient's name, account number, and bank details.

02

Next, carefully read the instructions provided on the re transfer form to understand the specific requirements and sections that need to be completed.

03

Begin by filling out your personal details in the designated sections, including your name, address, and contact information.

04

Moving on, enter the details of the recipient, ensuring accuracy to avoid any potential errors or delays in the re transfer process.

05

In the relevant fields, provide the recipient's bank account number alongside the name of the bank, branch, and its location.

06

If there are any additional details or special instructions that need to be mentioned, make sure to include them appropriately.

07

Double-check all the information filled in the form for any mistakes or missing details. It is crucial to ensure accuracy to prevent any complications during the re transfer process.

08

Finally, sign and date the re transfer form to indicate your authorization and completion of the document.

09

Submit the filled-out re transfer form along with any required supporting documents, such as identification or proof of relationship, as instructed by the re transfer entity.

Who needs re transfer of your:

01

Individuals who have deposited funds into the wrong bank account and need to retrieve them.

02

Those who have mistakenly sent money to an incorrect recipient and require it to be transferred back to their account.

03

Businesses or organizations that have deposited funds into the wrong employee's account and need to rectify the error.

04

Individuals who have recently closed a bank account and need to have any remaining funds transferred to their new account.

05

People who have received fraudulent or unauthorized charges in their bank account and need to reverse the transaction.

06

Individuals who have requested a refund for a purchase or service and want the funds to be transferred back to their account.

07

Beneficiaries or inheritors who need to receive funds from an estate or trust after the transfer process.

08

Students or individuals receiving scholarships or grants who need the funds to be transferred to their specific account for educational purposes.

09

People who have participated in a financial settlement or agreement and require the funds to be transferred accordingly.

Note: The specific circumstances and requirements for a re transfer may vary depending on the financial institution or organization involved, so it is important to follow their instructions and guidelines accurately.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get re transfer of your?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the re transfer of your in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit re transfer of your online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your re transfer of your to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I complete re transfer of your on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your re transfer of your. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is re transfer of your?

Re transfer of your is the process of transferring ownership of a property from one person to another, often as part of a sale or gift.

Who is required to file re transfer of your?

The person or entity who is receiving the property is typically required to file the re transfer of your form.

How to fill out re transfer of your?

To fill out a re transfer of your form, you will need to provide information about the property being transferred, the parties involved, and any relevant payment or consideration.

What is the purpose of re transfer of your?

The purpose of re transfer of your is to officially document the change of ownership of a property.

What information must be reported on re transfer of your?

Information such as the names and addresses of the parties involved, a description of the property, and the date of the transfer must be reported on the re transfer of your form.

Fill out your re transfer of your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Re Transfer Of Your is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.