Get the free Anti-Money Laundering Training is a requirement

Show details

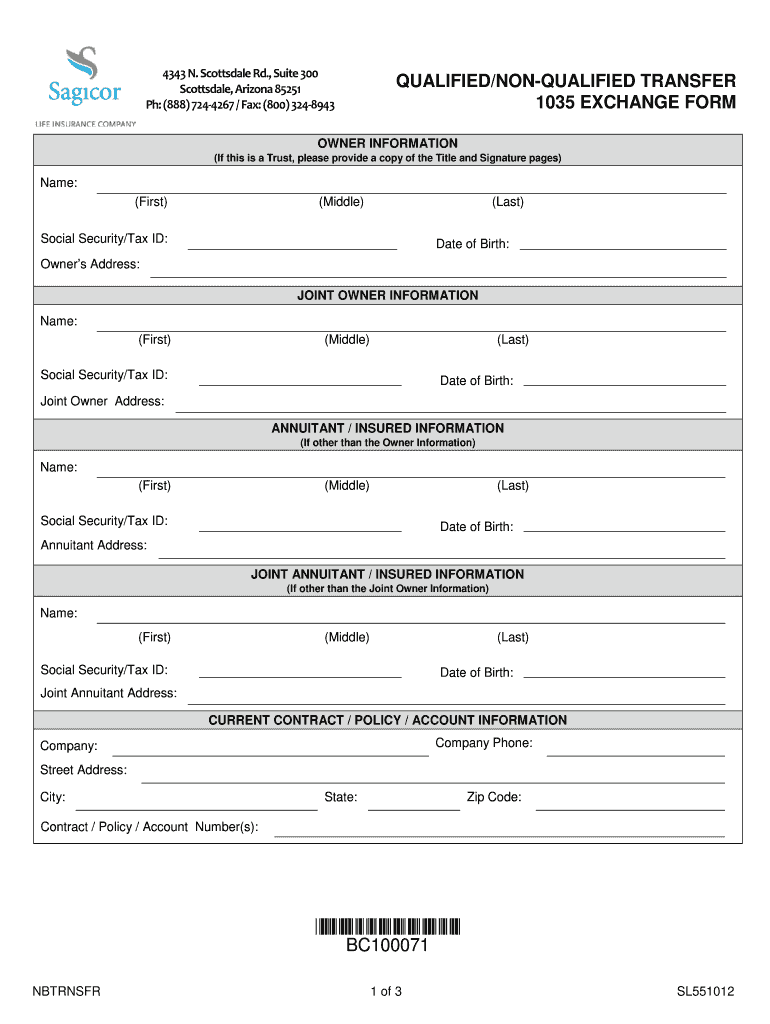

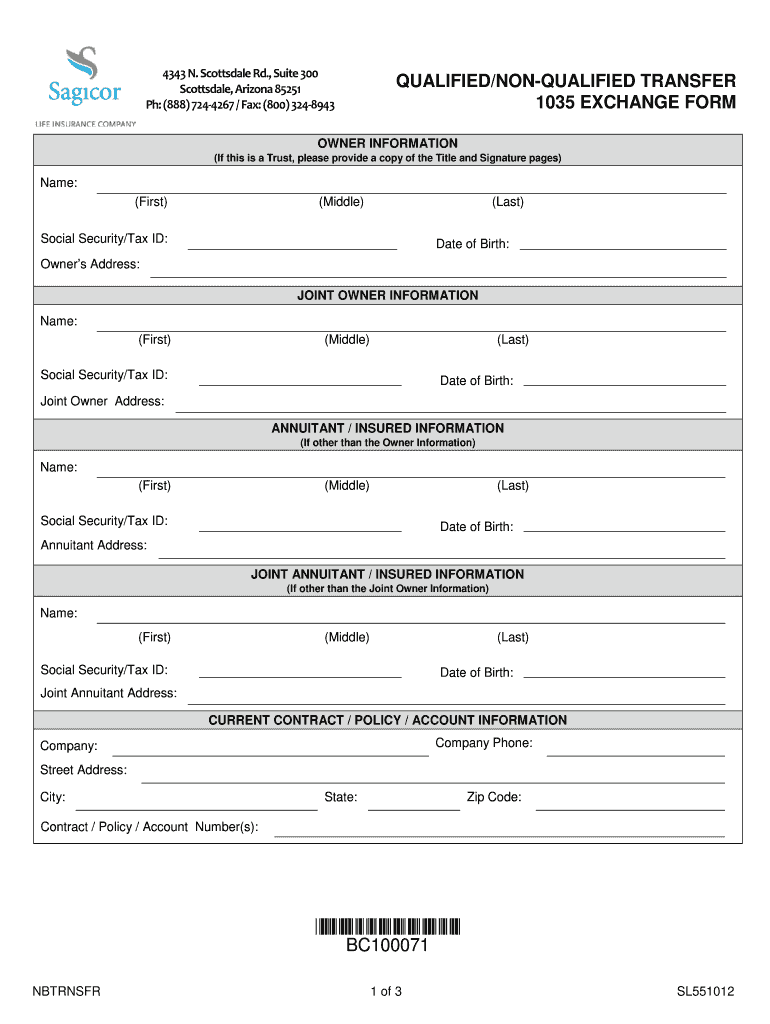

OFAC printed the day of the application OFAC signed & dated by agent. ... ANNUITY COMPANY TRANSFER FORM ... regularly for rate changes, etc. http:// www.marketingfinancial.com/gsannuities/ .... Fixed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign anti-money laundering training is

Edit your anti-money laundering training is form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your anti-money laundering training is form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing anti-money laundering training is online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit anti-money laundering training is. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out anti-money laundering training is

How to fill out anti-money laundering training:

01

Start by understanding the purpose of anti-money laundering training. Educate yourself on the various laws and regulations in place to combat money laundering activities.

02

Identify the training requirements specific to your industry or organization. Different industries may have different levels of training needed, so make sure you are aware of any specific guidelines or regulations applicable to your field.

03

Gather the necessary materials and resources for the training. This may include training manuals, online modules, or instructional videos. Ensure that you have access to all the relevant information needed to complete the training effectively.

04

Follow the training program as provided. Pay attention to the designated learning objectives and key concepts covered in the training material. Take notes if necessary to enhance your understanding and retention of the information.

05

Engage actively with the training content. Participate in any quizzes, assessments, or interactive elements included in the training program. This will help reinforce your understanding and identify areas where you may need additional clarification.

06

Seek clarification and ask questions if something is unclear. If you come across any concepts or topics that you find confusing or unclear, reach out to the appropriate training facilitators or experts for further explanation. It is essential to have a clear understanding of the content to effectively practice anti-money laundering measures.

07

Complete any required assessments or evaluations. Some training programs may require you to pass a final assessment or evaluation to ensure your comprehension and competency in anti-money laundering practices. Follow the instructions provided and complete these assessments as required.

08

Keep a record of your training completion. Many organizations require employees to maintain records of their training completion for compliance and audit purposes. Ensure that you keep a copy of your training completion certificate or any other relevant documentation.

09

Stay updated on the latest developments in anti-money laundering regulations and practices. Money laundering techniques and regulations can evolve over time, so it's crucial to stay informed and refreshed on any changes or updates. Attend refresher courses or additional training sessions as needed to maintain your knowledge in this area.

Who needs anti-money laundering training:

01

Financial institutions such as banks, credit unions, and investment firms are typically required to provide anti-money laundering training to their employees. This includes frontline staff, managers, and executives involved in financial transactions and services.

02

Non-financial businesses that deal with high-value transactions or frequently handle cash may also require anti-money laundering training. This can include real estate agents, jewelers, casinos, and car dealerships, among others. The training ensures these businesses can recognize potential money laundering activities and take appropriate action.

03

Compliance officers, risk managers, auditors, and legal professionals often receive anti-money laundering training to ensure they have a comprehensive understanding of the regulations. They play a crucial role in developing and implementing anti-money laundering policies within their respective organizations.

04

Government agencies and law enforcement personnel involved in investigating and combating money laundering activities may also undergo specialized anti-money laundering training. Understanding money laundering techniques and regulations helps them detect and prevent illicit financial activities effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my anti-money laundering training is directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your anti-money laundering training is and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit anti-money laundering training is in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing anti-money laundering training is and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out anti-money laundering training is using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign anti-money laundering training is and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is anti-money laundering training is?

Anti-money laundering training is a program designed to educate individuals on how to detect and prevent money laundering activities.

Who is required to file anti-money laundering training is?

Financial institutions and certain businesses engaged in specific activities are required to file anti-money laundering training.

How to fill out anti-money laundering training is?

Anti-money laundering training can be filled out online through the designated reporting system or platform provided by the governing authority.

What is the purpose of anti-money laundering training is?

The purpose of anti-money laundering training is to enhance awareness and compliance with laws and regulations related to preventing money laundering and terrorist financing.

What information must be reported on anti-money laundering training is?

Information such as suspicious transaction reports, customer due diligence, and record-keeping requirements must be reported on anti-money laundering training.

Fill out your anti-money laundering training is online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Anti-Money Laundering Training Is is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.