AL A-1 1998 free printable template

Show details

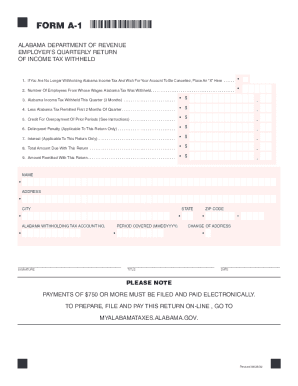

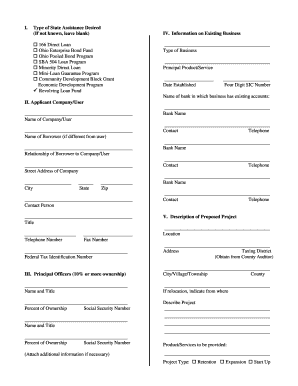

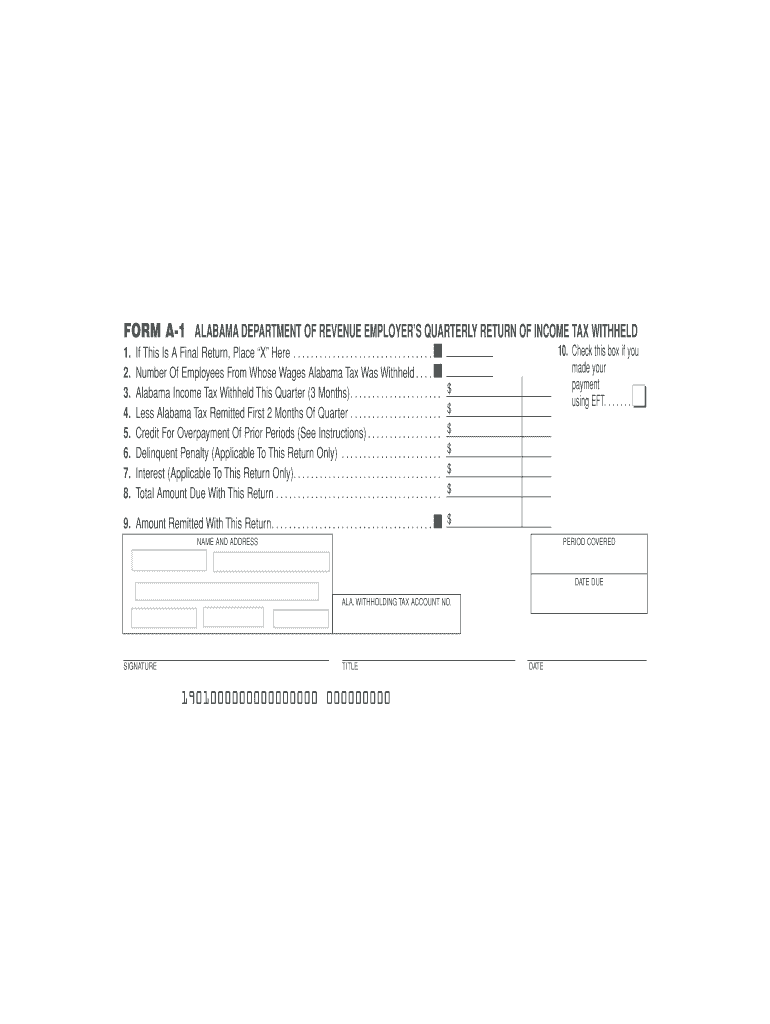

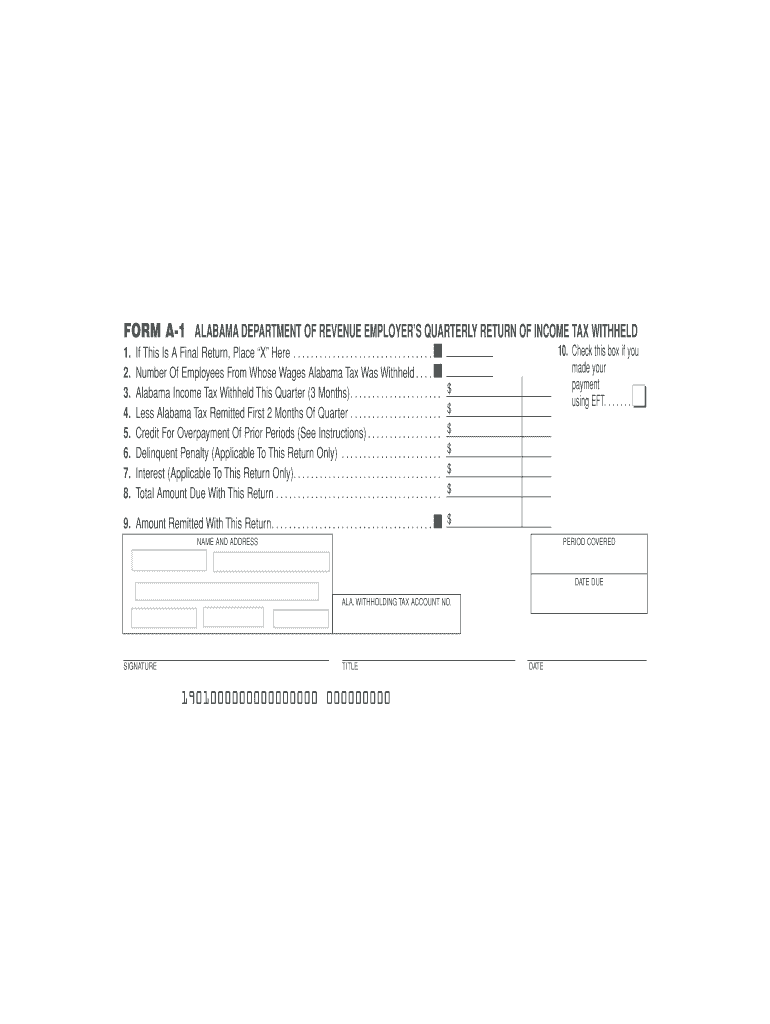

Form A-1 1/98 7/16/03 12 58 PM Page 1 FORM A-1 ALABAMA DEPARTMENT OF REVENUE EMPLOYER S QUARTERLY RETURN OF INCOME TAX WITHHELD 10. FINAL RETURN When an employer or withholding agent ceases to withhold Alabama income tax an X should be placed in the space provided in Line 1 of the return. INSTRUCTIONS FOR PREPARING FORM A-1 LINE 1 If you have discontinued withholding Alabama income tax place an X in the blank on this line to indicate a final re...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL A-1

Edit your AL A-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL A-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AL A-1 online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AL A-1. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL A-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL A-1

How to fill out AL A-1

01

Obtain the AL A-1 form from the appropriate source.

02

Read the instructions carefully before beginning.

03

Fill in your personal information in the designated fields (name, address, etc.).

04

Provide any relevant identification numbers as required.

05

Complete sections regarding the purpose of the form based on your situation.

06

Review the information for accuracy before submitting.

07

Submit the form according to the provided directions, whether online or by mail.

08

Keep a copy of the submitted form for your records.

Who needs AL A-1?

01

Individuals applying for specific permits or licenses.

02

Employees needing to provide documentation for human resources.

03

Anyone required to report information according to regulatory requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is the Alabama business privilege tax?

Minimum privilege tax is $100; plus the $10 Secretary of State annual report fee for corporations. For the taxable year beginning after December 31, 2022, taxpayers who would otherwise be subject to the minimum tax due of $100 shall pay $50 in lieu thereof.

What pensions are not taxable in Alabama?

IRA and 401(k) distributions in retirement: Taxed in Alabama Alabama does recognize Roth IRA and Roth 401(k) plan distributions as tax-free, matching the federal treatment of these retirement accounts. (For more on IRAs and how they work, head on over to our IRA Center.)

Can you file exempt on Alabama state taxes?

If you had no Alabama income tax liability last year and you anticipate no Alabama income tax liability this year, you may claim “exempt” from Alabama withholding tax. To claim exempt status, check this block, sign and date this form and file it with your employer.

How do I claim exempt on Alabama state taxes?

You must provide Form DD-2058 to your employer with Form A-4 to qualify. All wages will be reported to your state of legal residence by your employer. This exemption may also be used by individuals who 1.) filed an Ala- bama Income Tax Return last year and 2.) had a zero tax liability on that return.

Do I have to pay taxes when I sell my house in Alabama?

A. Yes. In general, income from the sale of Alabama property is required to be reported on an Alabama income tax return.

How do I file exempt on w4 in Alabama?

If you are filing EXEMPT status (which means that there will be nothing withheld from your paycheck, you must write the word EXEMPT on line 7. You cannot have something on line 5 and EXEMPT on line 7. If you are filing exempt status line 5 should be left blank.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my AL A-1 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your AL A-1 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit AL A-1 online?

With pdfFiller, the editing process is straightforward. Open your AL A-1 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I complete AL A-1 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your AL A-1 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is AL A-1?

AL A-1 is a tax form used in Alabama for reporting certain types of income and tax withheld.

Who is required to file AL A-1?

Any individual or entity that has income that is subject to withholding and meets the reporting thresholds set by the state of Alabama is required to file AL A-1.

How to fill out AL A-1?

To fill out AL A-1, start by entering your personal information, including name, address, and Social Security number. Next, report the income earned and any taxes that have been withheld. Follow the instructions provided with the form for additional details.

What is the purpose of AL A-1?

The purpose of AL A-1 is to ensure the correct reporting of income and withholding for tax purposes, helping both taxpayers and the state ensure compliance with tax laws.

What information must be reported on AL A-1?

Information that must be reported on AL A-1 includes the taxpayer's identification details, income amount, total tax withheld, and any other relevant financial information as specified in the form instructions.

Fill out your AL A-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL A-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.