AL A-1 2019 free printable template

Show details

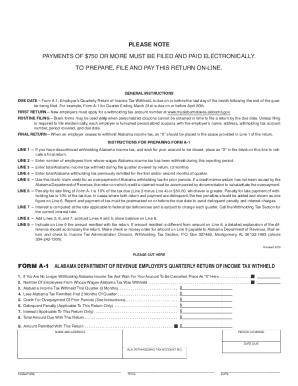

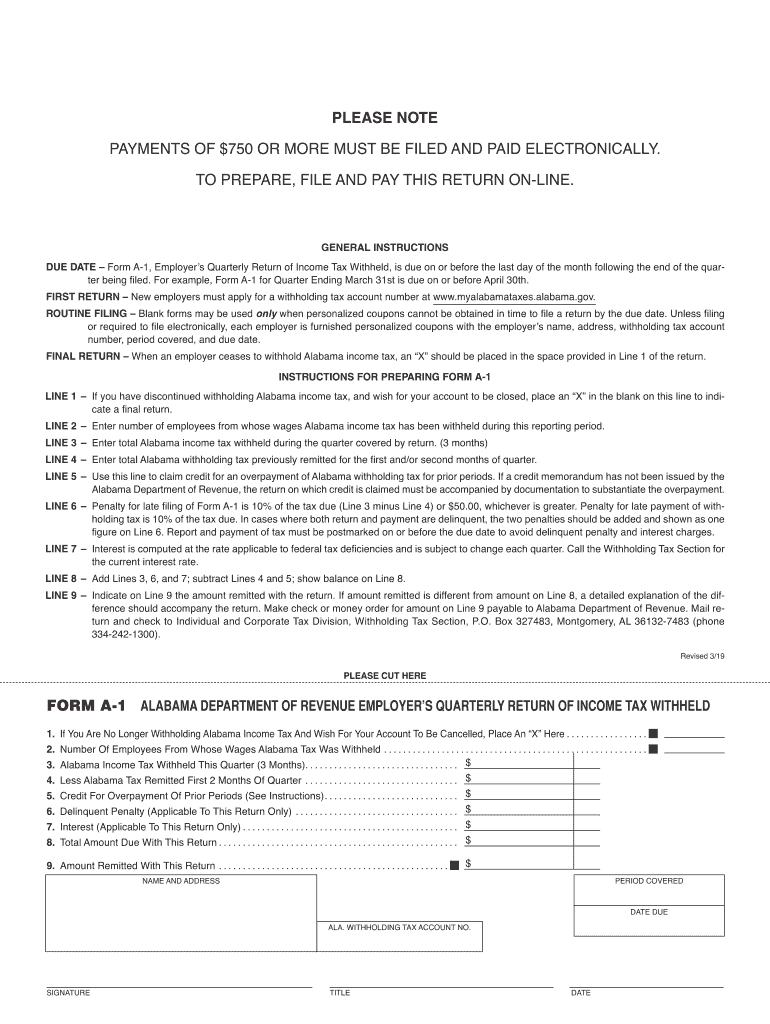

PLEASE NONPAYMENTS OF $750 OR MORE MUST BE FILED AND PAID ELECTRONICALLY. TO PREPARE, FILE AND PAY THIS RETURN ONLINE.GENERAL INSTRUCTIONS DATE Form A1, Employers Quarterly Return of Income Tax Withheld,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AL A-1

Edit your AL A-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AL A-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AL A-1 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AL A-1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AL A-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AL A-1

How to fill out AL A-1

01

Begin by gathering all necessary personal information, including full name, address, and contact details.

02

Fill in the date at the top of the form.

03

Clearly indicate your identification number or Social Security Number.

04

Provide details regarding your employment status, including job title and employer information.

05

Specify the purpose of filling out the AL A-1 form as required.

06

Sign and date the document at the bottom to confirm the information is accurate.

Who needs AL A-1?

01

Individuals applying for certain public assistance programs.

02

People seeking tax relief or financial aid from state agencies.

03

Anyone who has been instructed by an authority to complete the AL A-1 form.

Fill

form

: Try Risk Free

People Also Ask about

How much is the penalty for expired car insurance?

In case you get caught without insurance for the second time then you will be liable to pay a fine of Rs 4000, and imprisonment of up to 3 months is also possible under the discretion of law.

What happens if you get caught with no car insurance?

Penalties for driving without insurance You could receive a fixed penalty of £300 and six penalty points on your licence if you are caught driving a vehicle that you are not insured to drive. If the case goes to court you could get an unlimited fine and be disqualified from driving.

How much will it cost to register my car in Alabama?

In Alabama, registration fees start at $23, depending on your car. They could be more. You may also have to pay property tax or local issuance fees on top of the base registration fee. If your car weighs more than 8,000 lbs., you'll have to pay an extra $50.

Can you get a tag without a title in Alabama?

In order to register a vehicle subject to the Alabama title law, a title application must be completed before a registration can be processed. When a certificate of title is not required, only a registration is issued.

How much is gift tax on a car in Alabama?

A $10 tax is due on a gift of a motor vehicle to an eligible party. The gift tax is the responsibility of the eligible person receiving the motor vehicle, and the person pays the gift tax to the county tax assessor-collector (CTAC) at the time the person titles and registers the motor vehicle.

Can you register a car without a title in Alabama?

In order to register a vehicle subject to the Alabama title law, a title application must be completed before a registration can be processed. When a certificate of title is not required, only a registration is issued.

What documents do I need to register my car in Alabama?

VEHICLE REGISTRATION REQUIREMENTS Title or Manufacturer's Statement (Certificate) of Origin or Alabama Title Application. Bill of Sale. Unexpired Driver License or Non-Driver ID (for all owners) Insurance (Policy Number & NAIC Number)

Can I get a tag with a bill of sale in Alabama?

Valid proof may include a receipt of the sale, bill of sale or a registration receipt. If you do not have a receipt or bill of sale, you may be able to use a notarized statement explaining how you got the vehicle.

Does Alabama require notary for title transfer?

No, the state of Alabama does not require the assignment of an MSO or title to be notarized.

What is the Alabama law in car insurance?

What is the minimum auto insurance requirements in Alabama? A. The minimum auto insurance liability limits are commonly stated as 25/50/25. This means $25,000 bodily injury liability limit per person. $50,000 maximum for all bodily injuries to be paid for any one accident.

What year vehicle does not require a title in Alabama?

Every motor vehicle not more than 35 model years old, which is domiciled in Alabama and is required to be registered in Alabama, is required to have an Alabama certificate of title.

Is insurance required by law in Alabama?

Auto insurance requirements in Alabama. If you plan on driving in the state of Alabama, the Alabama mandatory liability law requires drivers to carry insurance. Furthermore, drivers must also carry proof of insurance while driving, which must be shown to law enforcement officials when requested.

What documents do I need to register a car in my name?

Go to your relevant motor vehicle registration authority and submit the following: your identity document (ID) proof of residential address e.g. utility account. if you stay at an informal settlement, you must bring a letter with an official date stamp from the ward councillor confirming your address.

How do I title and register a car in Alabama?

What You'll Do to Register your Vehicle in Alabama Step 1: Visit your county license plate issuing office. Step 2: Submit your documentation. Step 3: Pay an auto title transfer fee. Step 4: Submit your car for vehicle identification number inspection, if necessary. Step 5: Proceed to vehicle registration.

How do you get a title for a car that doesn't have one Alabama?

Anyone wishing to get an Alabama certificate of title must apply through a designated agent of the Alabama Department of Revenue. Licensed motor vehicle dealers are designated agents, so those buying a new or used vehicle through a dealer can also get their certificate through the dealer.

How do I register a gifted car in Alabama?

Alabama Title Transfer For Gifted Vehicles To title a gifted car, the process is the same as buying a car. The gifter will act as the seller and the receiver as the buyer. Once the certificate of title is signed, you can submit it and the fee to the MVD for your new title.

What is the penalty for not having car insurance in Alabama?

Alabama requires every driver to have car insurance — and driving without it is a misdemeanor. If caught, the state may charge a fine of $500–$1,000, suspend your driver's license and registration for 180 days, and even send you to jail for three to six months.

How much is it to transfer a car title in Alabama?

How Much Does It Cost When Transferring A Car Title In Alabama? There is a title fee of $18 plus sales tax calculated on the purchase price of the car. The current rates are 2.6% for private sales and 3.1% for dealer sales. Your local county may assess usage fees or other service fees.

What do you need to get a tag in Alabama?

VEHICLE REGISTRATION REQUIREMENTS Title or Manufacturer's Statement (Certificate) of Origin or Alabama Title Application. Bill of Sale. Unexpired Driver License or Non-Driver ID (for all owners) Insurance (Policy Number & NAIC Number)

How to gift a car in Alabama?

Yes, you can gift a car in Alabama.On the Alabama vehicle bill of sale, you must provide: Names and complete addresses of the seller and buyer (PO boxes are NOT acceptable) If the vehicle's seller is a dealer, the dealer's licensed name must be listed. Date of sale. Complete description of the vehicle, such as:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my AL A-1 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your AL A-1 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit AL A-1 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including AL A-1, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete AL A-1 online?

pdfFiller makes it easy to finish and sign AL A-1 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

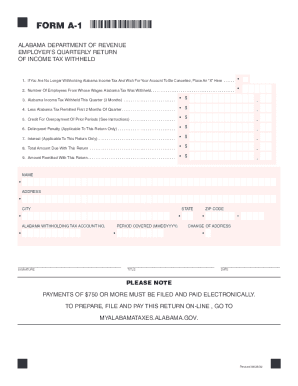

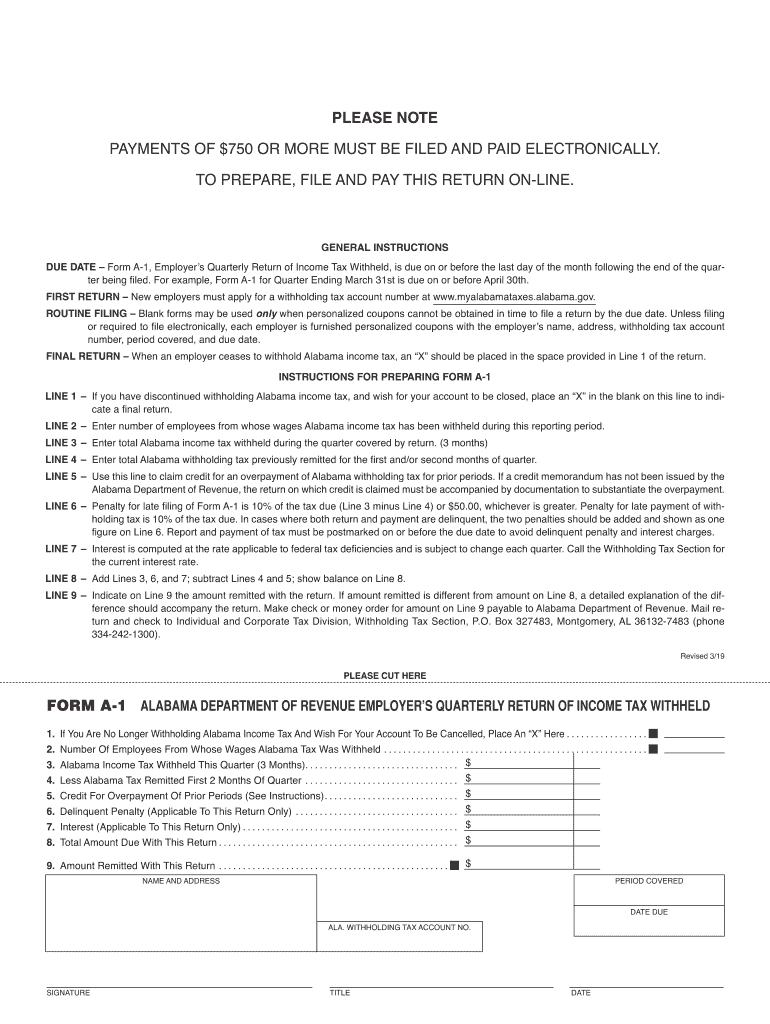

What is AL A-1?

AL A-1 is a tax form used by employers in Alabama to report certain tax information to the state.

Who is required to file AL A-1?

Employers in Alabama who withhold state income taxes from employees' wages are required to file AL A-1.

How to fill out AL A-1?

To fill out AL A-1, employers must provide details such as their business information, total wages paid, and the amount of state income tax withheld.

What is the purpose of AL A-1?

The purpose of AL A-1 is to help the Alabama Department of Revenue track tax payments and ensure compliance with state tax laws.

What information must be reported on AL A-1?

Information that must be reported on AL A-1 includes the employer's name, address, employer identification number, total wages, and total state income tax withheld.

Fill out your AL A-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AL A-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.