Get the free Annualized Income Installment Worksheet

Show details

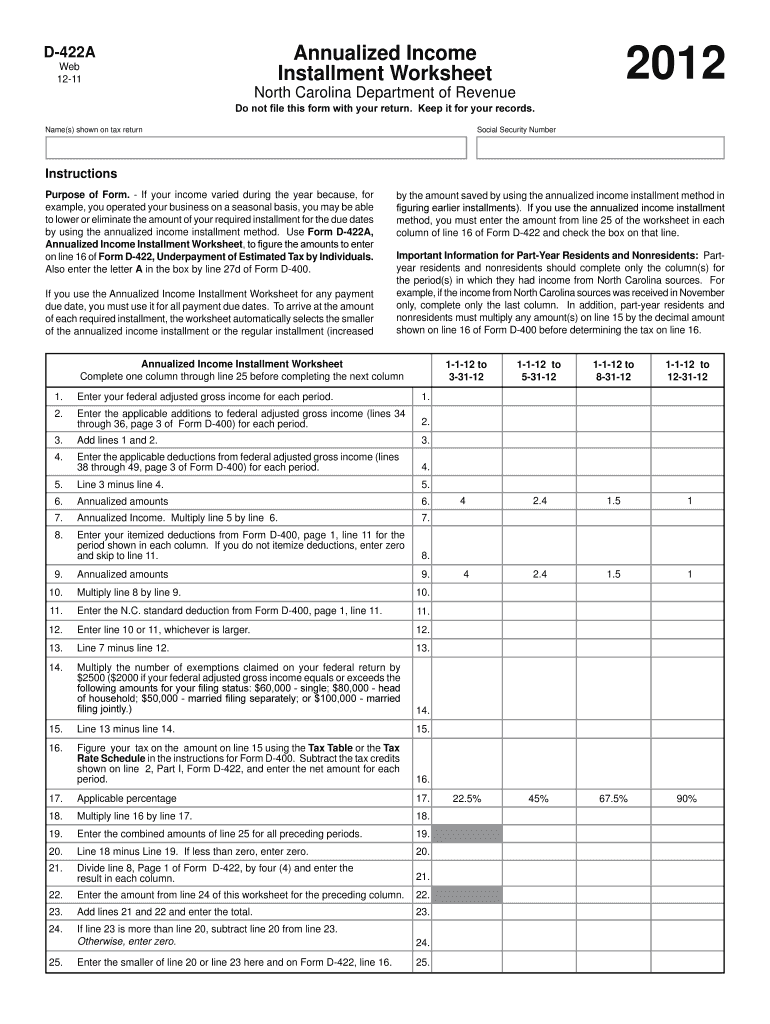

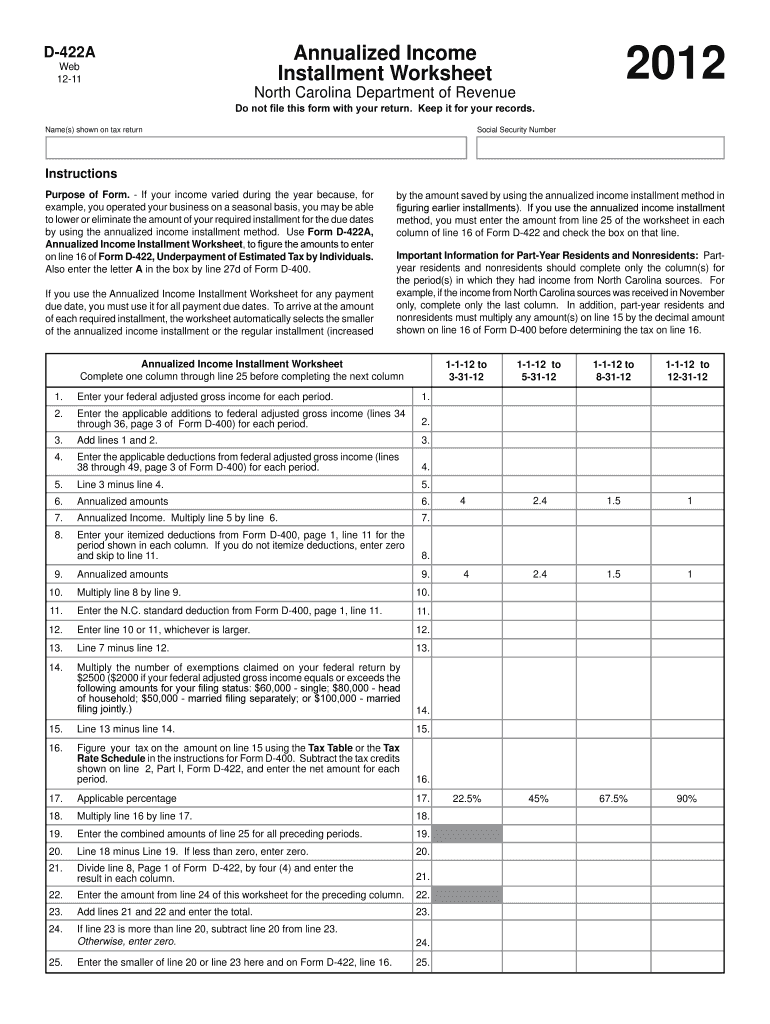

This worksheet is used to calculate the amounts to enter on line 16 of Form D-422 for those with income variations during the year, especially for part-year residents and nonresidents, to determine

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annualized income installment worksheet

Edit your annualized income installment worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annualized income installment worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annualized income installment worksheet online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit annualized income installment worksheet. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annualized income installment worksheet

How to fill out Annualized Income Installment Worksheet

01

Gather all necessary financial documents including pay stubs and tax returns.

02

Determine the total income you expect to receive for the current year.

03

Outline your expected income for each month, making adjustments for any fluctuations.

04

Calculate your projected annual income by adding up the total expected monthly income.

05

Complete the Annualized Income Installment Worksheet by entering your calculated annual income and aligning it with the appropriate sections.

06

Review your entries for accuracy before submission.

Who needs Annualized Income Installment Worksheet?

01

Individuals who receive variable income throughout the year.

02

Self-employed individuals who need to estimate their income for tax purposes.

03

Taxpayers who may not be on a regular pay schedule.

04

Anyone who is required to make estimated tax payments based on their income.

Fill

form

: Try Risk Free

People Also Ask about

How to calculate annualised income?

Calculating an annualised salary in Australia is fairly straightforward. All you need to do is multiply the number of hours you are expected to work in a week by 52, which is the number of weeks in a year. For example, if you are expected to work 40 hours per week, your annual salary will be 40 x 52 = 2080.

How do you annualize monthly income?

The formula is simple if you have 12 months of data: Add up the monthly income received during a period of 12 months. Divide by 12. There's your annualized income.

What is 2210AI?

Form 2210 is IRS form that relates to Underpayment of Estimated taxes. You are not required to complete it since the IRS will figure the penalty, if any, and let you know if you owe anything additionally .

What is annualised monthly income?

Annualised salary is the estimated payment an employee would receive over a year should they work the full year. This projected amount is based on their earnings during shorter periods, such as weekly or monthly, including bonuses, commissions, and overtime.

What is the annualized payment method?

The annualized income installment method refigures estimated tax payment installments so it correlates to when the taxpayer earned the money in the year. It is designed to limit underpayment and corresponding underpayment penalties related to uneven payments when a taxpayer's income fluctuates throughout the year.

How to annualize monthly income?

The formula is simple if you have 12 months of data: Add up the monthly income received during a period of 12 months. Divide by 12. There's your annualized income.

How do you annualize a monthly rate?

Annualizing a Monthly or Weekly Return Suppose a stock has gained 2.5% in the past month. To annualize the return: Simple annualization: 2.5% × 12 = 30% annually. Compound annualization: (1 + 0.025)^12 - 1 = 1.025^12 - 1 = 1.3449 - 1 = 0.3449 or 34.49% annually.

Should I use the annualized income method?

Benefits of the Annualized Method: It helps avoid penalties due to underpayment. Accurately reflects cash flow for more straightforward tax calculation and payment. Simplifies the tax estimation process for irregular earnings. Facilitates more predictable financial planning for significant income variations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annualized Income Installment Worksheet?

The Annualized Income Installment Worksheet is a tax form used by taxpayers to calculate estimated tax payments based on their income throughout the year. It helps them to appropriately distribute their tax liability over the periods of the year according to their actual income.

Who is required to file Annualized Income Installment Worksheet?

Taxpayers who expect to owe tax of $1,000 or more when filing their return and who have income that is not received evenly throughout the year may be required to file the Annualized Income Installment Worksheet. This typically includes self-employed individuals or those with fluctuating income.

How to fill out Annualized Income Installment Worksheet?

To fill out the Annualized Income Installment Worksheet, taxpayers must first estimate their income for each period of the year. They then calculate the tax liability for that income, apply any credits, and determine the amount owed for each installment period, following the specific instructions provided with the worksheet.

What is the purpose of Annualized Income Installment Worksheet?

The purpose of the Annualized Income Installment Worksheet is to help taxpayers accurately compute their estimated tax payments based on income received during specific periods of the year, allowing for fairer tax obligations compared to averaging income over the year.

What information must be reported on Annualized Income Installment Worksheet?

The Annualized Income Installment Worksheet requires taxpayers to report their total income for each installment period, expenses, deductions, and any credits applicable. It also requires taxpayers to indicate the estimated tax liability and the amount paid or expected to be paid in each period.

Fill out your annualized income installment worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annualized Income Installment Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.