AZ ADOR Form 200 (10180) 2011 free printable template

Show details

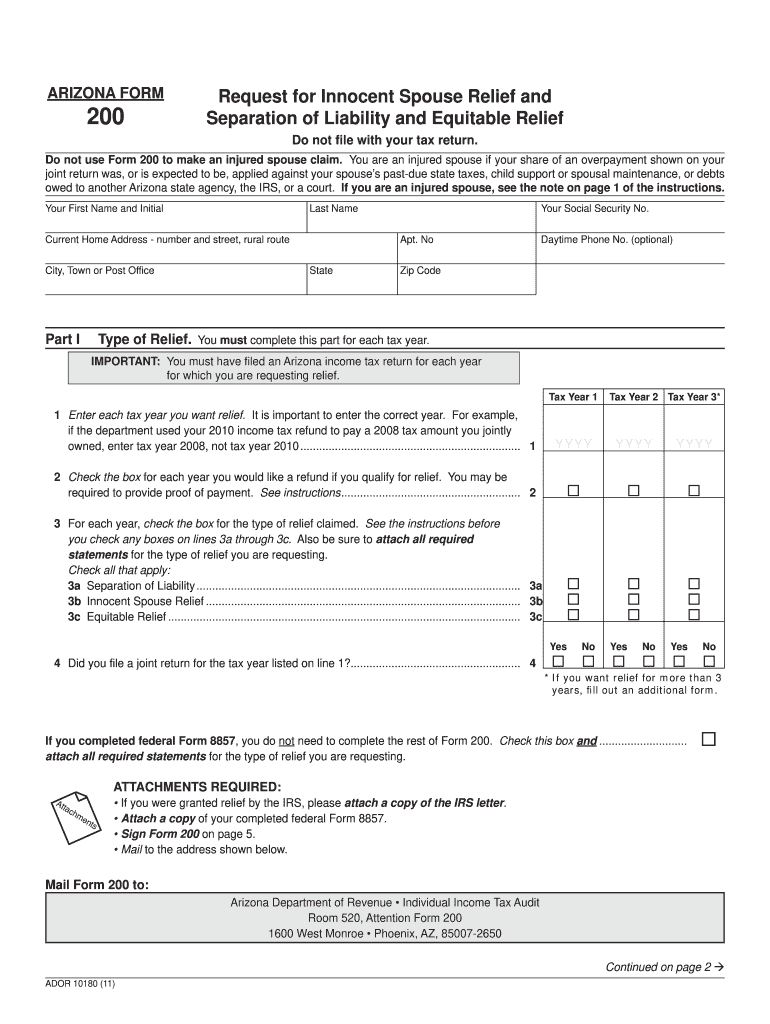

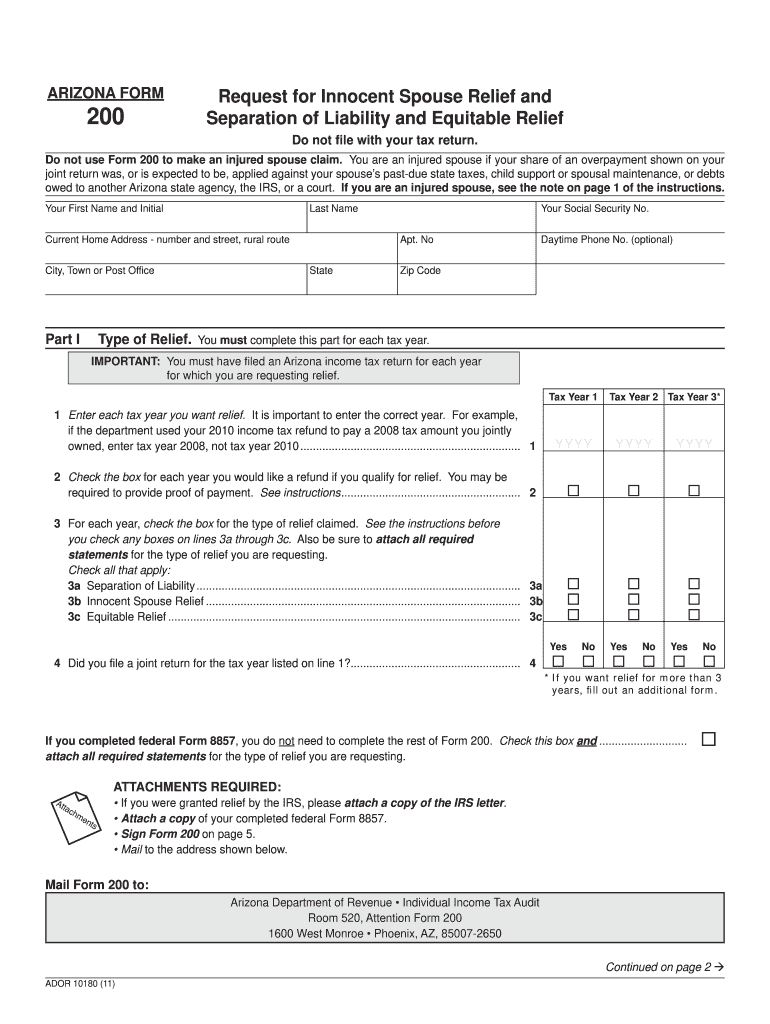

ARIZONA FORM 200 Request for Innocent Spouse Relief and Separation of Liability and Equitable Relief Do not file with your tax return. Do not use Form 200 to make an injured spouse claim. You are

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign arizona form 200

Edit your arizona form 200 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona form 200 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arizona form 200 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit arizona form 200. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ ADOR Form 200 (10180) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out arizona form 200

How to fill out AZ ADOR Form 200 (10180)

01

Download the AZ ADOR Form 200 (10180) from the Arizona Department of Revenue website.

02

Fill out your personal information at the top of the form, including your name, address, and taxpayer identification number.

03

Provide details regarding the type of income you are reporting on the form.

04

Complete the sections related to any deductions or credits you are claiming.

05

If applicable, report any additional information required based on your specific tax situation.

06

Review the form for accuracy and completeness before submitting it.

07

Submit the form via mail or electronically if applicable.

Who needs AZ ADOR Form 200 (10180)?

01

Individuals or entities who are required to report income or pay taxes in Arizona.

02

Taxpayers who need to claim deductions or credits associated with their income.

03

Those who have specific tax obligations as outlined by the Arizona Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

How to split income for married filing separately in Arizona?

Married Filing Separate Return Arizona is a community property state. If you file a separate return, you must figure how much income to report using community property laws. Under these laws, a separate return must reflect one-half of the community income from all sources plus any separate income.

Can you be legally married but file separately?

Married couples can choose to file separate tax returns. When doing so, it may result in less tax owed than filing a joint tax return.

What is considered community income in Arizona?

Community income is income earned by taxpayers who live in community property states. Community income states include Arizona, California, Idaho, Louisiana, New Mexico, Nevada, Texas, Washington and Wisconsin. Community income can include real estate and other property.

What circumstances can you file married filing separately?

Reasons to file separately can also include separation and pending divorce, and to shield one spouse from tax liability issues for questionable transactions. Filing separately does carry disadvantages, mainly relating to the loss of tax credits and limits on deductions.

What is innocent spouse relief?

Innocent spouse relief can relieve you from paying additional taxes if your spouse understated taxes due on your joint tax return and you didn't know about the errors. Innocent spouse relief is only for taxes due on your spouse's income from employment or self-employment.

Can you file separately if married in Arizona?

To fulfill the married filing separately requirements, you'll each report your own income separately. However, if you live in a community property state, you must report half of all community income and all of your separate income on your return. Community property states include: Arizona.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete arizona form 200 online?

With pdfFiller, you may easily complete and sign arizona form 200 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for the arizona form 200 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your arizona form 200 in minutes.

How do I complete arizona form 200 on an Android device?

Use the pdfFiller Android app to finish your arizona form 200 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is AZ ADOR Form 200 (10180)?

AZ ADOR Form 200 (10180) is a tax form used in Arizona for reporting certain types of income and taxes, typically related to corporate income tax.

Who is required to file AZ ADOR Form 200 (10180)?

Entities that do business in Arizona and are subject to corporate income tax requirements must file AZ ADOR Form 200 (10180). This includes corporations, partnerships, and other business entities.

How to fill out AZ ADOR Form 200 (10180)?

To fill out AZ ADOR Form 200 (10180), ensure that all necessary information, such as business name, tax identification number, and income details, is accurately entered. Follow the instructions provided with the form and include all required documentation.

What is the purpose of AZ ADOR Form 200 (10180)?

The purpose of AZ ADOR Form 200 (10180) is to accurately report corporate income and determine the amount of corporate income tax owed to the state of Arizona.

What information must be reported on AZ ADOR Form 200 (10180)?

The information that must be reported on AZ ADOR Form 200 (10180) includes the corporation's revenue, allowable deductions, tax credits, and computation of the tax owed.

Fill out your arizona form 200 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona Form 200 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.