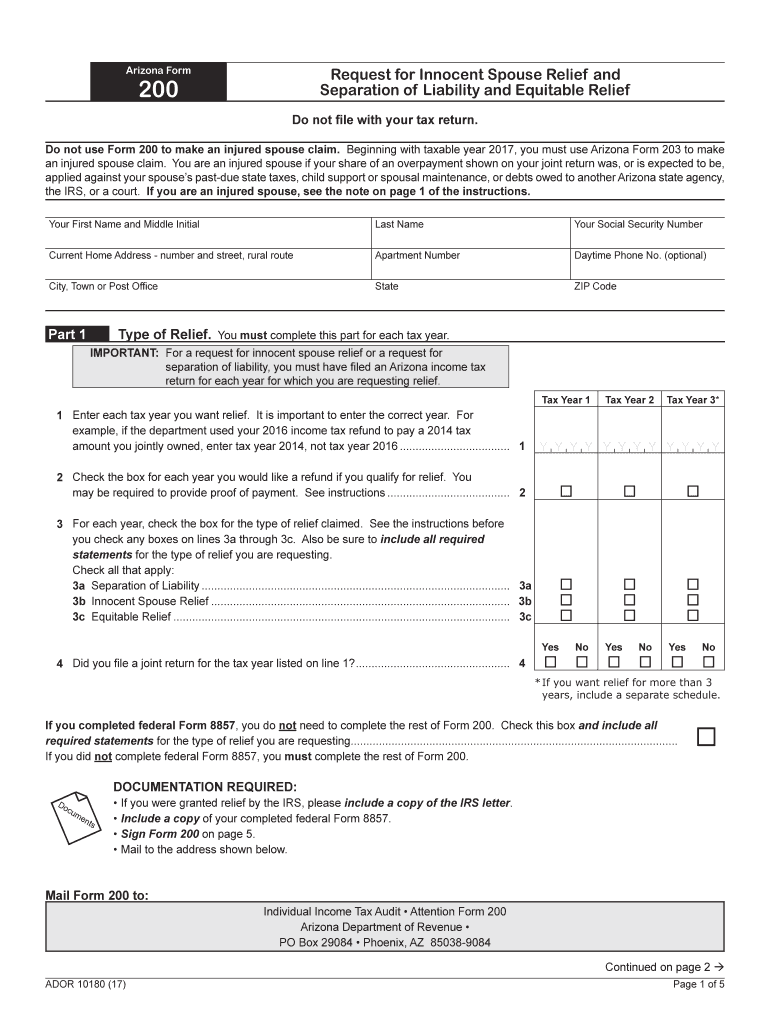

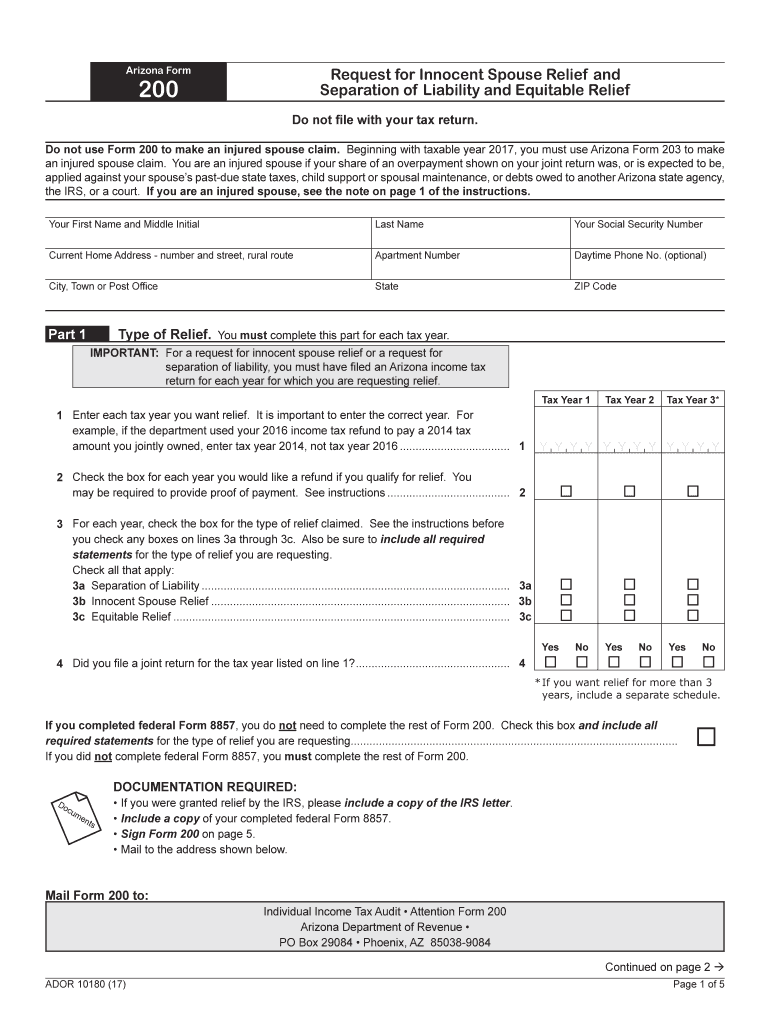

AZ ADOR Form 200 (10180) 2017 free printable template

Get, Create, Make and Sign AZ ADOR Form 200 10180

How to edit AZ ADOR Form 200 10180 online

Uncompromising security for your PDF editing and eSignature needs

AZ ADOR Form 200 (10180) Form Versions

How to fill out AZ ADOR Form 200 10180

How to fill out AZ ADOR Form 200 (10180)

Who needs AZ ADOR Form 200 (10180)?

Instructions and Help about AZ ADOR Form 200 10180

Hello today I have a different video for you, and I'm wearing a sweet ninja turtle shirt yeah it's the best, so this video is a DIY I will show you how to go from this to this yay so if you don't know these are called z palettes this is just the Sephora brand, so they put their own logo they've made it stripe like their bags and stuff, so it's really, really cute and basically what it is an empty palette that is magnetized, so you can put whatever you want in it, you customize it, so I have two of them one I have made into my everyday like Oh as I just put my finger in it doesn't do that so this I made into my everyday palette now I know this seems like a lot I'm not saying I wear all this stuff every single day it's just like I these are the powders I can do a full face with and not have to worry and I kind of grab them every single day I have a setting powder a bronzer three blushes a highlighter this is for brows this is a brow powder and then like a bunch of eyeshadows I'm going to have a blog post about exactly what's in here in detail so if you want to check that out then click the description bar below and all the information will be there, but I'm going to show you how to take a blush or eyeshadow depends on take it from here and be able to put it into there disclaimer what I'm about to do maybe a fire hazard it may be really dangerous you may hurt yourself I've already hurt myself so let's just be smart people and don't take my word for something and if you think you're going to burn the house down just trust that instinct because I don't know this is makeshift DIY let's say so also if you have Mac products that you want to deeply pot that's how we call them so take the products out of it if you have six of these containers they have a program called back to Mack and you can actually take six empty containers and get a free lipstick or lip gloss or single eyeshadow so let's just begin, so you can order the Z palette from a Z palette website or this is a 401 it comes like this empty like I said they have all different sizes I have a small little one too, and then it comes with magnets, and it comes with a little stick for prying things out so if you break your eyeshadows if you break your blushes I'm so sorry it's happened to me, I broke my favorite Mac blush called Melba and I tried to salvage it but it was so messy that I fought the bullet and got a new one, so this is a Mac blush called stay pretty what do you think well this lipstick hate it love it thumbs up thumbs down I kind of like it not just my shirt kind of this would match it's a bright pink, and it makes you look amazing um but in with the different lips, so it's called stay pretty it's a pro longhair blush let's begin take a little stick I used to use before I got this just a really thin knife again be really careful kind of focus here for a sec okay I'm going to be blurry this is going to be in focus, so there's this little ledge here okay before it clips in you can see it...

People Also Ask about

How to split income for married filing separately in Arizona?

Can you be legally married but file separately?

What is considered community income in Arizona?

What circumstances can you file married filing separately?

What is innocent spouse relief?

Can you file separately if married in Arizona?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AZ ADOR Form 200 10180 to be eSigned by others?

Can I create an electronic signature for the AZ ADOR Form 200 10180 in Chrome?

How do I fill out AZ ADOR Form 200 10180 on an Android device?

What is AZ ADOR Form 200 (10180)?

Who is required to file AZ ADOR Form 200 (10180)?

How to fill out AZ ADOR Form 200 (10180)?

What is the purpose of AZ ADOR Form 200 (10180)?

What information must be reported on AZ ADOR Form 200 (10180)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.