Get the free Oklahoma Sales Tax Report - FormSend

Show details

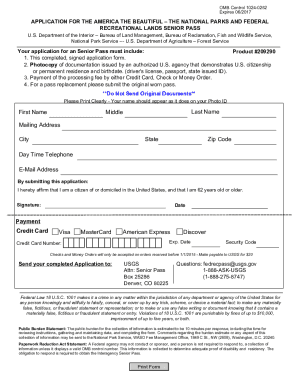

STS 4100101 STS0001-01-00-BT Oklahoma Sales Tax Report 13-14 Revised 10-2003 A. Taxpayer FEI/SSN Taxpayer Copy/Work Sheet B. Reporting Period C. Due Date Dollars 1. Total Sales (Whole dollars only)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oklahoma sales tax report

Edit your oklahoma sales tax report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma sales tax report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oklahoma sales tax report online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit oklahoma sales tax report. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oklahoma sales tax report

How to fill out Oklahoma sales tax report:

01

Gather all necessary information: Before filling out the Oklahoma sales tax report, make sure you have all the required information, such as your business details, sales and use tax permit number, and records of all taxable sales made within the reporting period.

02

Determine the reporting period: The Oklahoma sales tax report should be filed monthly, quarterly, or annually, depending on your business activity and the reporting guidelines set by the Oklahoma Tax Commission. Identify the reporting period for which you need to file the report.

03

Complete the general information section: Provide your business name, address, contact information, and sales tax permit number. This information helps the tax authorities identify your business accurately.

04

Report taxable sales: In this section, you need to provide a breakdown of your taxable sales made during the reporting period. Include information such as the date of sale, the amount of sale, and the sales tax due for each transaction. Make sure to classify sales based on different tax rates, if applicable.

05

Calculate and report sales tax due: Once you have recorded all taxable sales made during the reporting period, calculate the total sales tax due. This is done by adding up the sales tax amount due for each transaction. Be sure to apply the correct tax rate for each sale.

06

Deduct any allowable exemptions: If your business is eligible for any exemptions or deductions, such as sales made to tax-exempt entities, include them in this section. Make sure to provide the necessary documentation or proof for these deductions.

07

Review and submit the report: Before submitting your Oklahoma sales tax report, thoroughly review all the information you have entered. Ensure accuracy and double-check calculations. Once you are confident that the report is complete and accurate, submit it to the Oklahoma Tax Commission by the specified deadline.

Who needs Oklahoma sales tax report:

01

Businesses with sales tax permit: Any business in Oklahoma that holds a sales tax permit and engages in taxable sales or transactions is required to file the Oklahoma sales tax report. This includes both retail and service-oriented businesses.

02

Businesses with taxable sales: If your business makes taxable sales during the reporting period, you need to file the Oklahoma sales tax report. Taxable sales can include tangible personal property, certain services, and other specified goods.

03

Businesses operating within Oklahoma: The requirement to file the Oklahoma sales tax report applies to businesses that operate within the state's jurisdiction, regardless of their physical location. Even if your business is based outside of Oklahoma but conducts taxable sales within the state, you still need to comply with the reporting obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is Oklahoma form 200?

Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form 200-F has been filed. The report and tax will be delinquent if not paid on or before September 15.

What is form 511 Oklahoma?

More about the Oklahoma Form 511 Individual Income Tax Tax Return TY 2022. Form 511 is the general income tax return for Oklahoma residents. Form 511 can be eFiled, or a paper copy can be filed via mail.

What is the Oklahoma sales tax return STS 20002?

Oklahoma Tax Commission Form STS-20002-A Oklahoma Sales Tax Return for Filing Returns After July 1 2017. Also include amounts for purchases for which you are paying the sales tax directly to the Oklahoma Tax Commission OTC. This form is used to file Oklahoma sales tax returns AFTER July 1 2017.

What is Form 511 EIC Oklahoma?

The 2022 Oklahoma EIC is based on your earned income for either tax year 2021 or 2022. The Oklahoma EIC is refundable beginning with tax year 2022. Complete Form 511-EIC using the attached EIC Table and provide a copy of Form 511-EIC with your income tax return.

How do I report sales tax in Oklahoma?

You have three options for filing and paying your Oklahoma sales tax: File online – File online at OK Tap. You can remit your payment through their online system. File by mail – You can use form STS-20002 to file on paper and by mail. AutoFile – Let TaxJar file your sales tax for you.

Do I need to charge sales tax in Oklahoma?

ing to Oklahoma law, you must charge and collect sales tax on all transfers of possession or title of tangible personal property in the state. Additionally, sales tax is levied on certain services provided in Oklahoma, usually for services that include creating or manufacturing a product for sale.

How do I file an extension for my Oklahoma state tax?

Taxpayer files extension request via Oklahoma Form 504-I or federal Form 4868 by the original due date, April 18, 2023. (This may be accomplished via withholding, estimates, additional payments, etc.) Taxpayer files Form 511 or Form 511NR by the extended due date, October 16, 2023.

How do I report sales on my tax return?

You must report the transaction (gain on sale) on Form 8949, Sales and Other Dispositions of Capital AssetsPDF, and Form 1040, U.S. Individual Income Tax Return, Schedule D, Capital Gains and LossesPDF.

How do I claim for credit refund of sales tax in Oklahoma?

You may contact the credit/refund section at (405) 521-3270. Important: Refund claims without supporting documents cannot be approved. See the instructions on the back of this form for details regarding necessary documentation. NOTE: State law requires the State of Oklahoma to issue refunds via direct deposit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit oklahoma sales tax report from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like oklahoma sales tax report, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make changes in oklahoma sales tax report?

With pdfFiller, it's easy to make changes. Open your oklahoma sales tax report in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete oklahoma sales tax report on an Android device?

Complete oklahoma sales tax report and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is oklahoma sales tax report?

The Oklahoma sales tax report is a document that businesses in Oklahoma must file to report the sales tax they have collected from customers.

Who is required to file oklahoma sales tax report?

Any business in Oklahoma that sells taxable goods or services and has a sales tax permit is required to file the Oklahoma sales tax report.

How to fill out oklahoma sales tax report?

To fill out the Oklahoma sales tax report, businesses need to provide information such as total sales, taxable sales, sales tax collected, and any credits or deductions that apply. The report can be filed online through the Oklahoma Tax Commission's website.

What is the purpose of oklahoma sales tax report?

The purpose of the Oklahoma sales tax report is to ensure businesses are reporting and remitting the correct amount of sales tax to the state. It helps the state track sales tax revenue and enforce tax compliance.

What information must be reported on oklahoma sales tax report?

Businesses must report information such as total sales, taxable sales, sales tax collected, and any applicable credits or deductions on the Oklahoma sales tax report.

Fill out your oklahoma sales tax report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Sales Tax Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.