Get the free Chartered Professional Accountants of Ontario 25 York Street Suite 1100 Toronto, ON ...

Show details

Chartered Professional Accountants of Ontario 25 York Street Suite 1100 Toronto, ON M5J 2V5 Fax: 416 977.2128 Email: certification Ontario.ca Ontario.ca Application for Admission to Membership in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chartered professional accountants of

Edit your chartered professional accountants of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chartered professional accountants of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chartered professional accountants of online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit chartered professional accountants of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

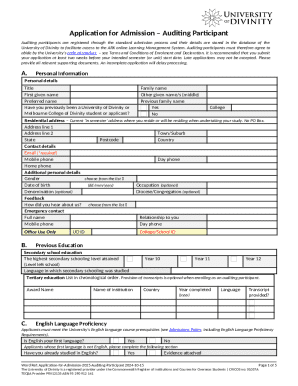

How to fill out chartered professional accountants of

How to fill out chartered professional accountants of?

01

Gather all necessary documentation such as financial statements, tax returns, and other relevant financial records.

02

Review the application form carefully, ensuring all personal and professional details are accurate and complete.

03

Fill out the sections related to educational qualifications, work experience, and professional certifications if applicable.

04

Provide a detailed account of your work experience, including the types of accounting tasks and responsibilities you have handled.

05

Clearly explain any specialized skills or areas of expertise you possess, such as auditing, taxation, or financial analysis.

06

Include any relevant professional development or continuing education courses you have completed.

07

Attach any supporting documentation that showcases your achievements, such as certificates, awards, or commendations.

08

Review the completed application thoroughly for any errors or omissions before submitting it.

Who needs chartered professional accountants of?

01

Business owners and entrepreneurs who require expert financial advice and planning to optimize their operations.

02

Individuals and families seeking assistance with tax planning, filing, and ensuring compliance with relevant regulations.

03

Non-profit organizations and charities that need professional accounting services to manage their finances and adhere to reporting standards.

04

Government entities and agencies that require reliable financial reporting and auditing for transparency and accountability.

05

Corporations and companies in need of accurate financial statements, budgeting, and financial forecasting for decision-making purposes.

06

Individuals or organizations involved in complex financial transactions such as mergers, acquisitions, or restructuring.

07

Startups and small businesses looking for guidance in setting up accounting systems, managing cash flow, and securing financing.

08

Professionals seeking career advancement in accounting or finance, aiming to enhance their credentials and job prospects.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete chartered professional accountants of online?

Easy online chartered professional accountants of completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make changes in chartered professional accountants of?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your chartered professional accountants of to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I edit chartered professional accountants of on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing chartered professional accountants of.

What is chartered professional accountants of?

Chartered Professional Accountants offer accounting and financial services.

Who is required to file chartered professional accountants of?

All licensed CPAs are required to file chartered professional accountants of.

How to fill out chartered professional accountants of?

Chartered Professional Accountants must fill out the form provided by the licensing authority.

What is the purpose of chartered professional accountants of?

The purpose of chartered professional accountants of is to report financial information and maintain compliance with regulations.

What information must be reported on chartered professional accountants of?

Information such as revenue, expenses, assets, liabilities, and profits must be reported on chartered professional accountants of.

Fill out your chartered professional accountants of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chartered Professional Accountants Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.