Get the free FORM 8453N

Show details

Este documento es una declaración para la presentación electrónica de la declaración de impuestos sobre la renta individual de Nebraska para el año fiscal 2002.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8453n

Edit your form 8453n form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8453n form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 8453n online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 8453n. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8453n

How to fill out FORM 8453N

01

Obtain FORM 8453N from the IRS website or your tax software.

02

Fill in your name and Social Security number at the top of the form.

03

Provide your spouse's name and Social Security number if you are filing jointly.

04

Enter the tax year for which you are filing.

05

Fill in the total income, tax, and any taxes paid from your electronic return.

06

Sign and date the form.

07

Submit the completed FORM 8453N along with your electronic tax return.

Who needs FORM 8453N?

01

Individuals filing their taxes electronically who do not wish to e-file due to certain reasons.

02

Taxpayers who have filed a federal return but need to submit supporting documentation via FORM 8453N.

Fill

form

: Try Risk Free

People Also Ask about

What are the three forms of taxes?

Tax systems in the U.S. fall into three categories: regressive, proportional, or progressive. Regressive and progressive taxes impact high- and low-income earners differently but proportional taxes don't. Property taxes are an example of a regressive tax. The U.S. federal income tax is progressive.

What are the 3 types of tax return forms?

There are three personal income tax forms — 1040, 1040A and 1040EZ — with each designed to get the appropriate amount of your money to the IRS. Differences in the forms, however, could cost you if you're not paying attention.

Why is TurboTax asking me to mail form 8453?

If you received a request to submit Form 8453 (US Individual Income Tax Transmittal for an IRS e-file return), you need to mail some forms to the IRS that can't be e-filed. TurboTax creates Form 8453 for you, and it serves as a cover page for your additional documentation.

What are the three ways to file a tax return?

Fill out IRS Form 1040 by hand and mail it (not recommended), File taxes online using tax software, or. Hire a human tax preparer to do the work of tax filing.

How do you write verb forms in English?

Most verbs in English are regular verbs and by adding -d or -ed to their base form, they turn into the past form. For example, walked, talked, showed, preceded, and stayed are all the past forms of the verbs walk, talk, showed, precede, and stay.

What are 3 tax preparation options to file your taxes?

Options for filing taxes include getting free help from the IRS, paying for tax software, or hiring a pro. Whether you go solo or with a tax pro, the IRS says you'll get a refund faster (if you're owed one) by filing electronically and including your direct deposit information.

What are the three forms you may use to file your federal tax return?

If you have wages, file Form 1040, U.S. Individual Income Tax Return. If you're a senior, you can file 1040-SR. If you have a business or side income, file Form 1040 with a Schedule C.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

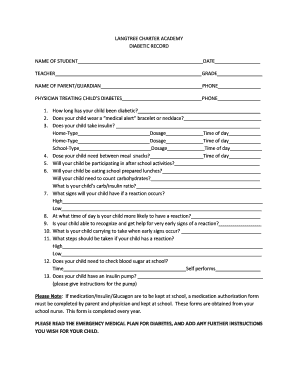

What is FORM 8453N?

FORM 8453N is a U.S. tax form used to verify the authenticity of electronically filed New York State personal income tax returns.

Who is required to file FORM 8453N?

Taxpayers who electronically file their New York State personal income tax returns and are required to submit Form 8453N to verify their identity and the accuracy of their tax return must file this form.

How to fill out FORM 8453N?

To fill out FORM 8453N, taxpayers need to provide their personal information, including name, address, Social Security Number, and specific details about their tax return. They should also sign and date the form.

What is the purpose of FORM 8453N?

The purpose of FORM 8453N is to serve as a declaration of the taxpayer's identity and to authenticate the electronic submission of their New York State personal income tax return.

What information must be reported on FORM 8453N?

FORM 8453N requires reporting information such as the taxpayer's name, address, Social Security Number, the electronic filing date, and details regarding the income tax return being filed.

Fill out your form 8453n online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8453n is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.