Get the free Liquid Fuels - Erie County - 0218b2016b - Auditor General

Show details

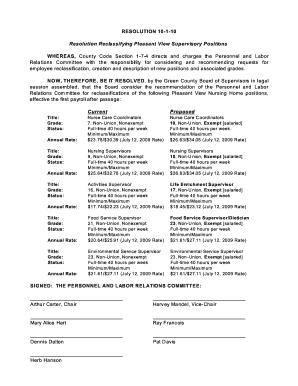

ATTESTATION ENGAGEMENT Erie County Pennsylvania 25000 Liquid Fuels Tax Fund For the Period January 1, 2012, to December 31, 2014, February 2016 Independent Auditors Report The Honorable Leslie Richards

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign liquid fuels - erie

Edit your liquid fuels - erie form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your liquid fuels - erie form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit liquid fuels - erie online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit liquid fuels - erie. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out liquid fuels - erie

How to Fill Out Liquid Fuels - Erie?

01

Determine the type and quantity of liquid fuels required - Erie. Whether you need gasoline, diesel, jet fuel, or any other type of liquid fuel, it is important to know the specific requirements and quantities needed before proceeding.

02

Find a licensed and reputable liquid fuels supplier - Erie. Look for a supplier in the Erie area who is authorized to distribute liquid fuels. Check their credentials, reputation, and customer reviews to ensure you are dealing with a reliable supplier.

03

Contact the supplier and provide necessary information - Erie. Once you have identified a suitable supplier, get in touch with them and provide the required information such as the type of fuel, quantity needed, and desired delivery date. They may also require additional details like your contact information, delivery address, and payment preferences.

04

Place an order and arrange for delivery or pickup - Erie. Confirm the order with the supplier and discuss the delivery or pickup options available. Depending on your preference, you can either choose to have the liquid fuels delivered to your desired location or arrange to pick them up from the supplier's designated facility.

05

Complete any necessary paperwork - Erie. Some liquid fuel purchases may require the completion of paperwork or documentation, such as providing tax exemption certificates, permits, or licenses. Ensure you comply with all relevant regulations and submit any required paperwork to the supplier as necessary.

06

Receive and inspect the liquid fuels - Erie. Once the delivery or pickup is scheduled, ensure that someone is available to receive the liquid fuels. Conduct a thorough inspection to verify the quantity and quality of the fuels received, checking for any leaks, damages, or discrepancies. If you notice any issues, immediately report them to the supplier.

07

Store and handle the liquid fuels safely - Erie. If you plan to store the liquid fuels, make sure you have appropriate storage facilities that meet safety regulations. Follow the recommended handling procedures and safety guidelines to prevent accidents or spills.

08

Monitor and manage your liquid fuel inventory - Erie. Keep track of your liquid fuel usage and regularly monitor your inventory levels. This will help you plan future orders and ensure you always have an adequate supply.

09

Dispose of any empty fuel containers properly - Erie. When you have emptied the liquid fuel containers, dispose of them according to local waste management regulations. Do not store or reuse empty containers that previously held volatile liquid fuels.

Who Needs Liquid Fuels - Erie?

01

Transportation industry: Liquid fuels like gasoline and diesel are essential for powering vehicles, including cars, trucks, buses, and motorcycles, used for transportation purposes.

02

Aviation sector: Liquids fuels such as jet fuel are crucial for aircraft to operate and enable air transportation.

03

Industrial sector: Many industrial processes require liquid fuels for power generation, heating, or as raw materials in various manufacturing processes.

04

Emergency services: Emergency vehicles, such as fire trucks and ambulances, depend on liquid fuels to respond quickly and efficiently during emergencies.

05

Agriculture: Farms and agricultural machinery often rely on liquid fuels for operating tractors, irrigation systems, and other equipment needed in various farming activities.

Note: The specifics of who needs liquid fuels in the Erie area may vary depending on local industries, regulations, and energy requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is liquid fuels - erie?

Liquid fuels - erie refers to the tax paid on motor fuels, including gasoline and diesel, used for transportation.

Who is required to file liquid fuels - erie?

Businesses or individuals who use motor fuels for transportation purposes are required to file liquid fuels - erie.

How to fill out liquid fuels - erie?

Liquid fuels - erie can be filled out electronically or on paper forms provided by the tax authority.

What is the purpose of liquid fuels - erie?

The purpose of liquid fuels - erie is to generate revenue for maintaining roads and transportation infrastructure.

What information must be reported on liquid fuels - erie?

Information such as the amount of motor fuels used, types of fuels, and distance traveled must be reported on liquid fuels - erie.

How can I modify liquid fuels - erie without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your liquid fuels - erie into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the liquid fuels - erie electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your liquid fuels - erie in seconds.

How do I complete liquid fuels - erie on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your liquid fuels - erie. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your liquid fuels - erie online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Liquid Fuels - Erie is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.