Get the free Forget about Unexpected Home Repair Bills - brevardschoolsfoundation

Show details

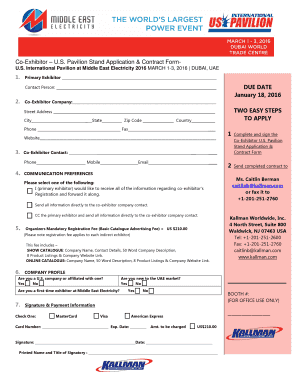

Forget about Unexpected Home Repair Bills! Exclusive Pricing En joy W Orr by y For DG EE P Pablo each win of Min GH d by o BS. hard c stick ugly ago DI rates skive, poor d excel service, high s, a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign forget about unexpected home

Edit your forget about unexpected home form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your forget about unexpected home form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit forget about unexpected home online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit forget about unexpected home. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out forget about unexpected home

How to fill out forget about unexpected home?

01

Start by assessing your current living situation and identifying potential risks that could lead to unexpected home issues. This could include factors such as the age of your home, location, and any previous incidents that you've experienced.

02

Create a proactive checklist that covers preventive measures to help you avoid unexpected home problems. This might involve regular maintenance tasks such as servicing electrical systems, checking for water leaks, updating security measures, and maintaining your heating and cooling systems.

03

Consider reviewing and upgrading your insurance coverage to ensure that you are adequately protected against unexpected home issues. This includes assessing your current policy, understanding the coverage limits, and considering additional riders or policies that may be necessary based on your specific needs.

04

Stay informed about any local regulations or requirements that may affect the safety of your home. This could include building codes, fire safety regulations, and other guidelines that help you maintain a secure and well-maintained property.

05

Be proactive in addressing any potential warning signs or red flags that may indicate impending home issues. This could involve regularly inspecting your home for structural integrity, keeping an eye out for signs of water damage, and addressing any pest control issues promptly.

06

Lastly, consider consulting professionals such as home inspectors, contractors, or insurance agents to get expert advice tailored to your specific situation. These professionals can provide valuable insights and recommendations to help you fill out forget about unexpected home.

Who needs forget about unexpected home?

01

Homeowners: Homeowners are the primary audience who need to be aware of and proactive in filling out forget about unexpected home. As they own the property, they bear the responsibility for maintaining its safety and integrity.

02

Renters: While the ultimate responsibility for the property lies with the landlord, renters also benefit from being aware of potential risks and proactive in avoiding unexpected home problems. This can help them ensure a safe living environment and potentially avoid any inconveniences caused by home issues.

03

Property Managers: Property managers who oversee multiple properties need to take into consideration the well-being of the homes they manage. By being proactive in addressing potential issues, property managers can minimize disruptions to tenants while also ensuring the long-term value and functionality of the properties they manage.

Overall, anyone who has a stake in a residential property, whether they own it, rent it, or manage it, needs to be aware of and actively take steps to fill out forget about unexpected home. This proactive approach can lead to a safer, more secure living environment and minimize any potential financial or emotional burdens caused by unexpected home issues.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify forget about unexpected home without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including forget about unexpected home. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I sign the forget about unexpected home electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your forget about unexpected home in seconds.

How do I complete forget about unexpected home on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your forget about unexpected home. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is forget about unexpected home?

Forget about unexpected home is a form used to report any unexpected events or incidents that occurred in a home.

Who is required to file forget about unexpected home?

Homeowners or tenants who have experienced unexpected events in their home are required to file forget about unexpected home.

How to fill out forget about unexpected home?

Forget about unexpected home can be filled out online or by mail with details of the unexpected event and any necessary documentation.

What is the purpose of forget about unexpected home?

The purpose of forget about unexpected home is to document and report any unforeseen incidents that have occurred in a home.

What information must be reported on forget about unexpected home?

Information such as the date and time of the unexpected event, description of what occurred, and any damages or injuries that resulted must be reported on forget about unexpected home.

Fill out your forget about unexpected home online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Forget About Unexpected Home is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.