Get the free Customer Undertaking for Switching Current Account Variant Without Change of Account...

Show details

This document serves as a formal request for switching existing current account variants with HDFC Bank without changing the account number. It outlines the requirements, terms, and potential charges

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customer undertaking for switching

Edit your customer undertaking for switching form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customer undertaking for switching form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit customer undertaking for switching online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit customer undertaking for switching. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customer undertaking for switching

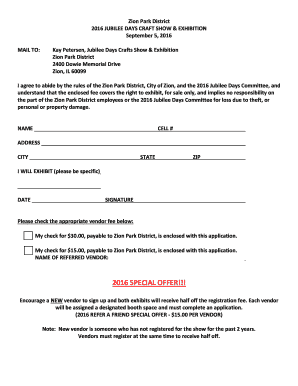

How to fill out Customer Undertaking for Switching Current Account Variant Without Change of Account Number

01

Obtain the Customer Undertaking form from your bank.

02

Fill in your personal details, including your name, address, and account number.

03

Specify the new account details to which you are switching.

04

Indicate that you want to maintain your existing account number.

05

Review the terms and conditions outlined in the form.

06

Sign and date the form to confirm your agreement.

07

Submit the completed form to your bank branch or through the designated submission method.

Who needs Customer Undertaking for Switching Current Account Variant Without Change of Account Number?

01

Customers who wish to switch their current account variant without changing their account number.

02

Individuals looking for better account features or benefits but want to retain their existing account number.

Fill

form

: Try Risk Free

People Also Ask about

What is customer signature card HDFC?

1. The document is a customer signature card for opening an account with HDFC Bank. It contains fields for the applicant's name, mobile number, account details, nomination details, and signatures.

What to do when switching current accounts?

Review your existing payments. Go through your payments – if there are any you no longer use or want, it makes sense to cancel them rather than switch them to your new bank account. Gather your documentation. Open your new account with your chosen bank. Choose your switch date. Start your switch. Know your rights.

How to add authorized signatory in HDFC Bank?

0:49 2:18 Option enter your credentials. And click verify a link will be shared with the name added via SMS toMoreOption enter your credentials. And click verify a link will be shared with the name added via SMS to finish the verification. Process and complete the steps to become the joint account holder.

What happens when I switch my current account?

Your switch is guaranteed The Account Switch Service Guarantee means your new bank will switch your payments and transfer your balance, and your old bank will take care of closing your old account.

How long does it take to switch current account?

With the Current Account Switch Service (CASS), transferring from one current account to another will take just seven working days. This means you can start the whole process again after day eight. However, there are some very good reasons why you shouldn't switch that often.

Does switching current accounts affect your credit score?

No, providing you repay any outstanding overdraft(s) on your previous account(s) as required by your old bank or building society.

How do I change my current account number?

Get a new bank account number You can do this in person at most banks, except online-only institutions. Some banks also accept digital applications. Depending on why you're changing accounts, you may open your account at the same bank or move to a new institution.

How do I change my current account from one bank to another?

7 Steps to Switch Banks Accounts in India ICICI Bank Evaluate your Reasons. Find an Alternative Bank. Compile a List of the Deposits and Payments that you make Automatically. Open a New Account with a Bank. Sign up for Mobile and Online Banking. Refresh your Automatic Deposits and Payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Customer Undertaking for Switching Current Account Variant Without Change of Account Number?

The Customer Undertaking for Switching Current Account Variant Without Change of Account Number is a formal document that allows a customer to switch their current account to a different variant while retaining the same account number.

Who is required to file Customer Undertaking for Switching Current Account Variant Without Change of Account Number?

Customers who wish to change their current account variant without altering their account number are required to file the Customer Undertaking.

How to fill out Customer Undertaking for Switching Current Account Variant Without Change of Account Number?

To fill out the Customer Undertaking, the customer must provide their account details, specify the new account variant, and sign the document to authorize the switch.

What is the purpose of Customer Undertaking for Switching Current Account Variant Without Change of Account Number?

The purpose of the Customer Undertaking is to formally authorize the bank to process the switching of current account variants while ensuring the same account number is maintained.

What information must be reported on Customer Undertaking for Switching Current Account Variant Without Change of Account Number?

The Customer Undertaking must include the customer's name, current account number, details of the desired account variant, and the customer's signature.

Fill out your customer undertaking for switching online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customer Undertaking For Switching is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.