Get the free CREDIT AND INDEMNITY AGREEMENT - Dryco - dryco

Show details

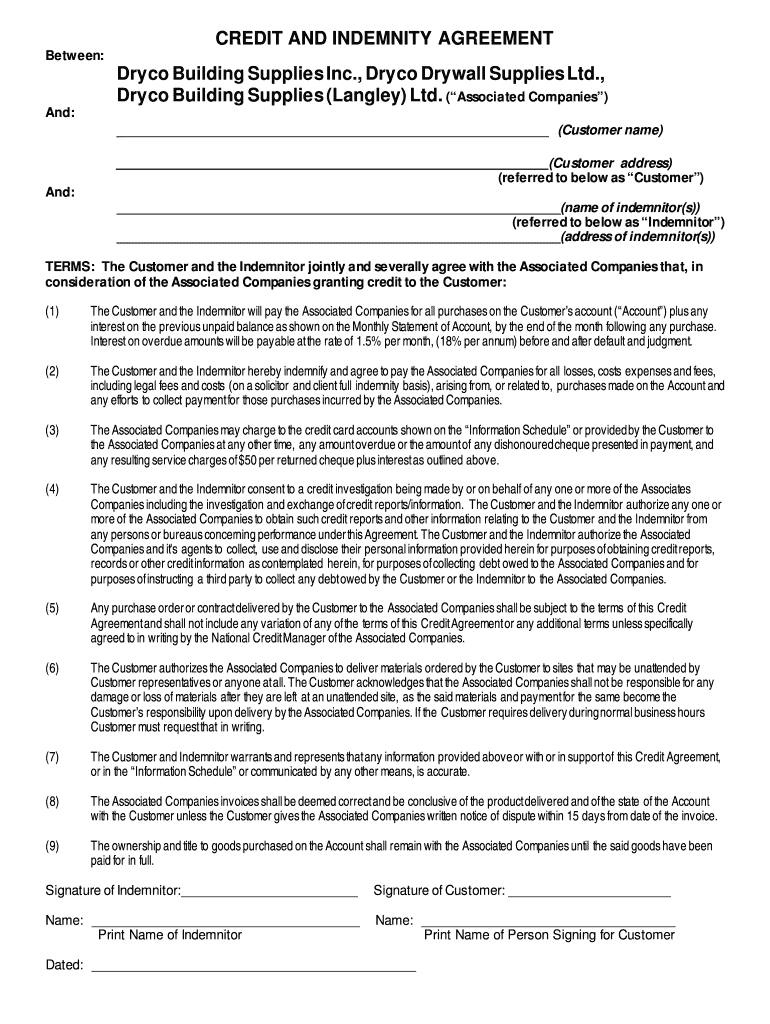

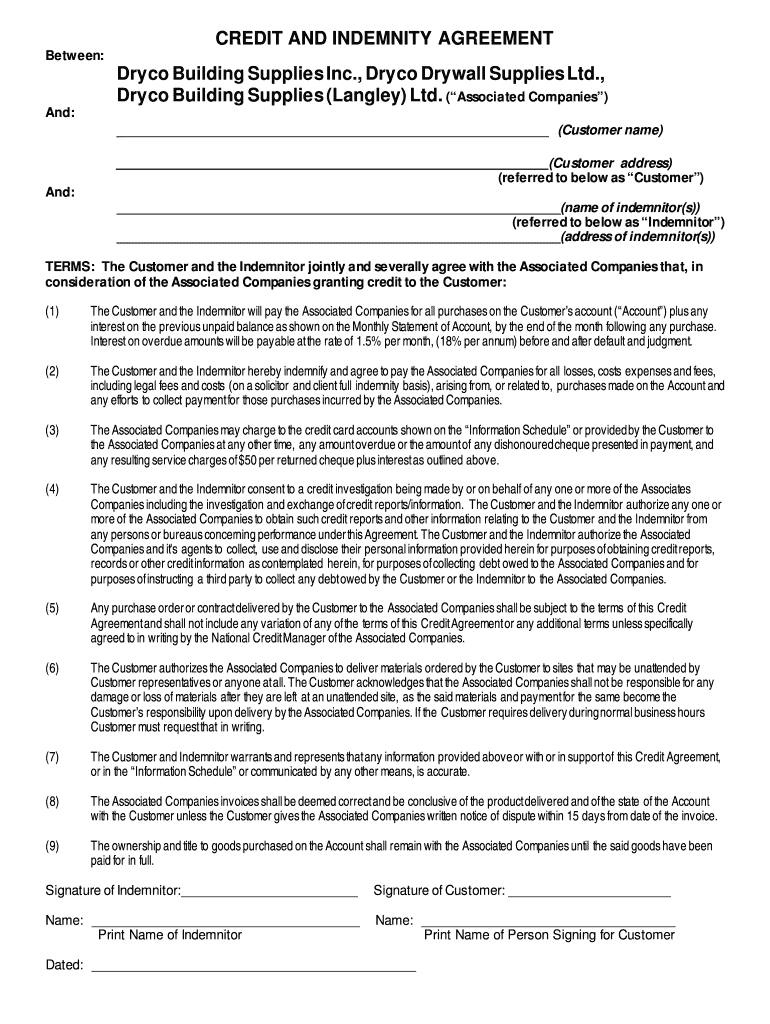

CREDIT AND INDEMNITY AGREEMENT Between: Draco Building Supplies Inc., Draco Drywall Supplies Ltd., Draco Building Supplies (Langley) Ltd. (Associated Companies) And: (Customer name) (Customer address)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit and indemnity agreement

Edit your credit and indemnity agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit and indemnity agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit and indemnity agreement online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit and indemnity agreement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit and indemnity agreement

How to fill out credit and indemnity agreement:

01

Read the agreement thoroughly: Before filling out the credit and indemnity agreement, take the time to carefully read through the document. Understand the terms and conditions, as well as the rights and responsibilities of all parties involved.

02

Provide accurate personal information: The agreement will require your personal information, such as name, address, contact details, and identification numbers. Make sure to provide accurate and up-to-date information to avoid any potential complications.

03

Include relevant financial details: The credit and indemnity agreement may require you to disclose your financial information, such as income, assets, and liabilities. Ensure that these details are accurately stated.

04

Consult with legal experts if needed: If you have any doubts or concerns regarding certain clauses or terms in the agreement, it is advisable to seek legal advice. A legal expert can provide you with the necessary guidance to ensure that you understand the agreement fully.

Who needs credit and indemnity agreement:

01

Small business owners: Credit and indemnity agreements are often required by small business owners when applying for loans or lines of credit. These agreements act as a form of security or guarantee for lenders, protecting them in the event of default or non-payment.

02

Landlords and property owners: When entering into a lease agreement, landlords and property owners may require tenants to sign a credit and indemnity agreement. This ensures that the tenant assumes responsibility for any damages to the property or unpaid rent.

03

Individuals seeking loans: Whether it's a personal loan, mortgage, or car financing, individuals who are seeking loans from financial institutions may be required to sign a credit and indemnity agreement. This agreement protects the lender and outlines the borrower's obligations and responsibilities.

04

Contractors and service providers: In certain industries, contractors and service providers may need to enter into credit and indemnity agreements with their clients. This ensures that they will be compensated for the services rendered and protects them from any potential liabilities or disputes.

In conclusion, filling out a credit and indemnity agreement involves carefully reviewing the document, providing accurate personal and financial information, and seeking legal advice if necessary. This type of agreement is commonly required by small business owners, landlords, individuals seeking loans, and contractors/service providers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit and indemnity agreement straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing credit and indemnity agreement.

How do I complete credit and indemnity agreement on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your credit and indemnity agreement. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I edit credit and indemnity agreement on an Android device?

With the pdfFiller Android app, you can edit, sign, and share credit and indemnity agreement on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is credit and indemnity agreement?

Credit and indemnity agreement is a legal document that outlines the terms and conditions of a financial arrangement between a lender and a borrower.

Who is required to file credit and indemnity agreement?

The parties involved in a financial transaction, such as a lender and borrower, are required to file a credit and indemnity agreement.

How to fill out credit and indemnity agreement?

To fill out a credit and indemnity agreement, the parties involved must provide details of the financial arrangement, including terms, conditions, and obligations.

What is the purpose of credit and indemnity agreement?

The purpose of credit and indemnity agreement is to outline the rights and responsibilities of the parties involved in a financial transaction, and to provide legal protection.

What information must be reported on credit and indemnity agreement?

The credit and indemnity agreement must include details of the financial arrangement, such as loan amount, interest rate, repayment terms, and indemnity provisions.

Fill out your credit and indemnity agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit And Indemnity Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.